“To conquer fear is the beginning of wisdom.”

“To conquer fear is the beginning of wisdom.”

—Bertrand Russell (1872–1970), British philosopher

Investors have been enjoying the fruits of rising markets. A nine-year upside since the March 2009 lows, to be more precise. Conventional wisdom expected that stocks continue to deliver as economic conditions are likely to remain healthy.

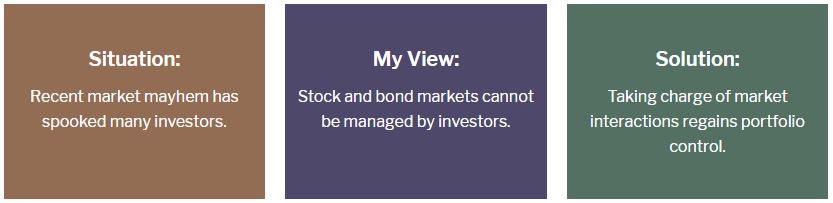

Suddenly, everyone is wallowing in fears. Worries about global economies, recurring volatility and market jitters are back on stage. Investors are wondering what to do with the nest egg amid the crazy mayhem.

“Markets can’t be managed, so focus on your interaction with the markets.”

I recommend that you act wisely. Move slowly. Don’t give up. Don’t throw in your towels. The solution is simpler than you think.

Repeat after me: “I am not in control of my nest egg – the stock and bond markets are.” This is your first and most important admission.

Expect market corrections and surprises any time. Market mayhem is a normal occurrence, in both directions. You’ll be afforded little time, if any, to react. Fretting and worrying about the volatility does not help anyone. Your task is to regain as much control as possible.

Recent market haircuts are graphic reminders of the curve balls of investing. Zeroing in on simple practices reduces the hazards of stepping in a sink hole along your investing roadway.

Adopted Wisdom

I have adopted these timeless steps. You should too:

- What matters most is how the portfolio fares, not the market outcomes.

- Markets can’t be managed, so focus on your interactions with the markets.

- Short-term trading is speculation, long-term investing is the wiser mindset.

- Resist your urges to panic or overreact to sharp market moves, both up and down.

- Invest only money you don’t need to spend for at least five years.

- Buy quality investments that have specific purposes in your game plan.

- Diversify your portfolio with fixed income and other assets, such as real estate.

- Revisit the risks in your portfolio as you get closer and into retirement.

- Add new money to your portfolio steadily over time, in rising and falling markets.

- Rebalance your nest egg periodically vis-a-vis your target mix, not market results.

These timeless tactics have delivered in times past. They rescue sufficient portfolio control from the markets back to you. Lower stock prices and choppiness can still be part of your short term. Long-term management rewards your patience and discipline.

Learn from your past portfolio bloopers. Continuing to react to every market hiccup does not work. Rather, it’s now high time for a change. Take charge of the market interactions with your portfolio.

Conquer your fears. Regain portfolio control and survive the mayhem. It becomes your lifelong wisdom for all times.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s website, where it appeared on Feb. 27.

Adrian Mastracci, Discretionary Portfolio Manager, B.E.E., MBA started in the investment and financial advisory profession in 1972. He graduated with the Bachelor of Electrical Engineering from General Motors Institute in 1971, then attended the University of British Columbia, graduating with the MBA in 1972. This blog is republished here with permission from Adrian’s website, where it appeared on Feb. 27.