The National Institute of Ageing is today releasing the next instalment [“the final Step 1”] of its series of papers on the Canada Pension Plan (CPP/QPP) and the Canadian retirement income system. The link invites readers to click on a download button for a full PDF of the report.

Recall that Findependence Hub’s introductory blog on this was published on April 11th here, and subsequently in my Retired Money column at MoneySense.ca on April 23: How to double your CPP Income. It also summarized in this second Hub blog on April 24th.

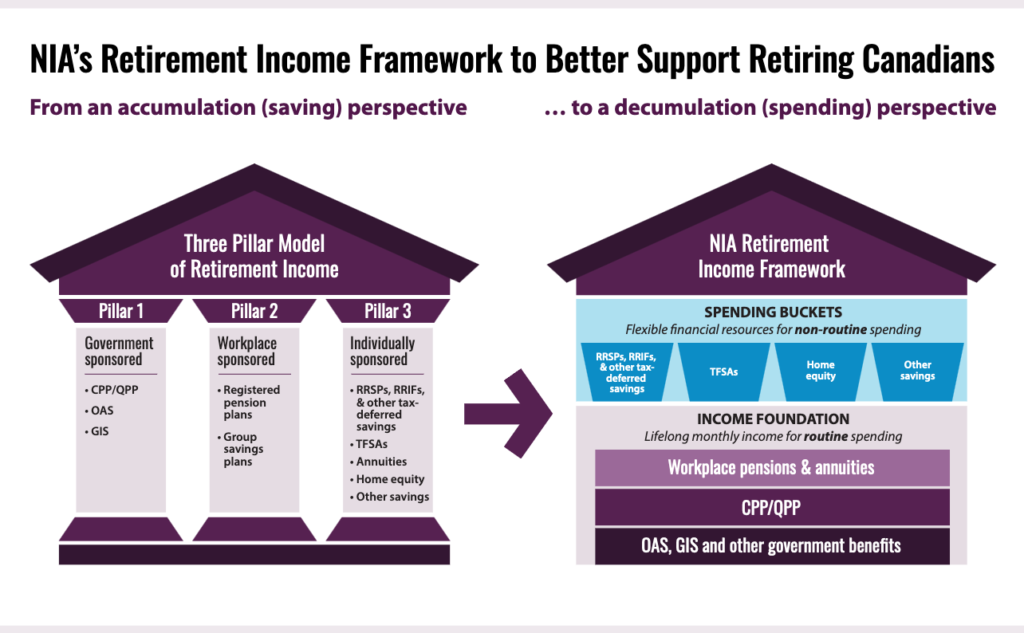

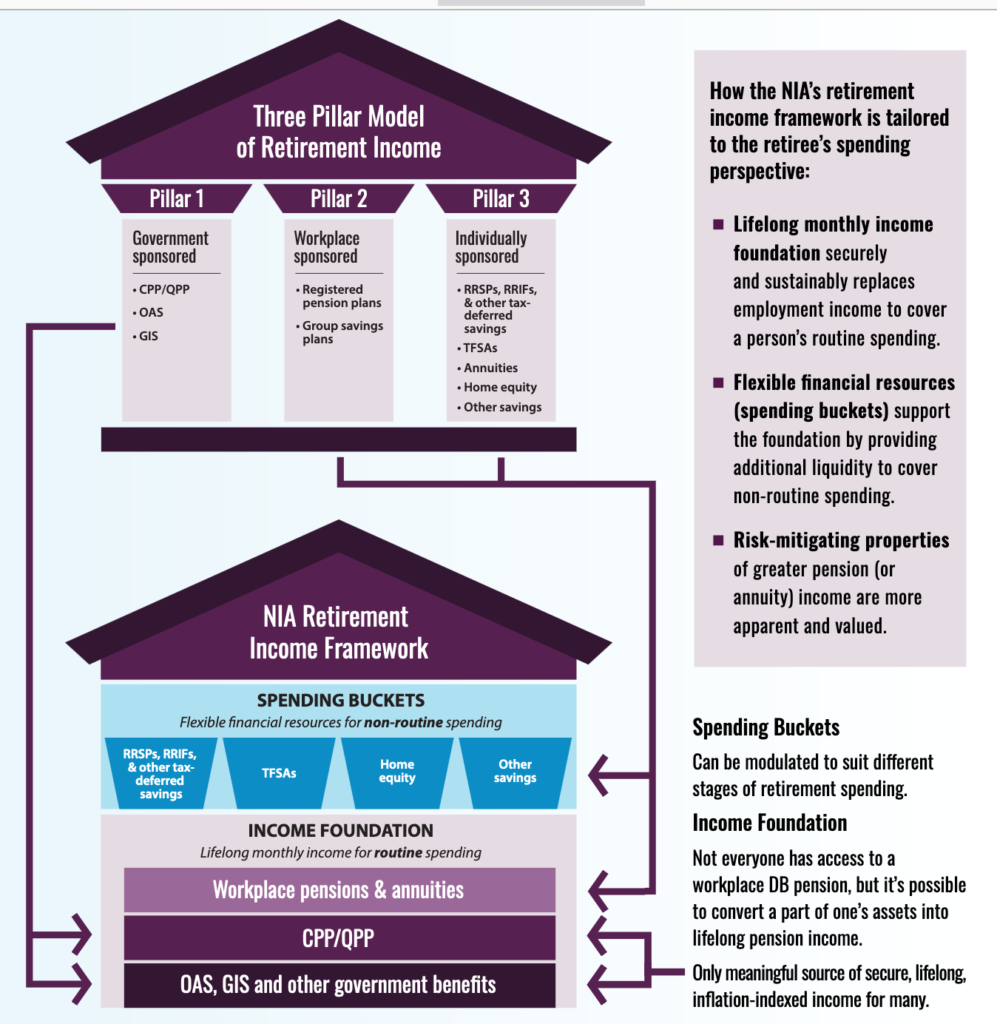

Below is a screenshot from the new paper: my comments follow below the graphic, which the NIA defines as a “redefined visual of the Canadian retirement income system.”

Recall that the entire series of papers is titled 7 Steps Toward Better CPP/QPP Claiming Decisions: Shifting the paradigm on how we help Canadians. Step #1 is titled (Re)Introducing the Retirement Income System: A New Framework Tailored to the Retiree’s Perspective.

The accompanying text includes this overview:

“Canada’s retirement income system has traditionally been presented to the public as three pillars, consisting of government-sponsored retirement income programs (CPP/ QPP, OAS and GIS), workplace pension plans and personal savings. However, this traditional framing is a missed opportunity to help workers mentally transition into retirement, encouraging them to shift their attention toward the adequacy of their financial resources to successfully and sustainably finance their entire retirement.”

The paper goes on to point out that here is some irony involved in how the traditional “three pillar” framework of the retirement income system is presented: it does so from the perspective of providers (i.e., government, employers and the financial services industry), rather than those it is intended to inform.

“When viewed from the end user’s perspective, pensions are not a financial pillar of the retirement income system. They are the income foundation on which other financial resources rest.”

By viewing pensions as “a foundation rather than a pillar,” the NIA continues, “the resulting framework provides a structure that is more focused on spending, with an ‘income’ foundation that securely and sustainably replaces employment income. Private assets accumulated on an individual or collective basis — including tax-deferred savings such as registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), and defined contribution (DC) pension plans — are ‘spending buckets’ on top of this foundation, providing flexibility to support non-routine spending throughout different retirement stages.”

The paper says the visual distinction between the lifelong monthly income and the spending buckets contrasts their different uses and risk profiles: “clearly demarcating the type of financing suited to cover routine versus non-routine expenses.”

It suggests that retiring Canadians will want to ensure their monthly retirement income (from CPP/QPP, OAS, GIS, workplace defined benefit (DB) pension plans and annuities) is “sufficient to securely cover routine expenses that last for life — such as food, utilities and other ongoing costs — enabling them to safely maintain their living standards into older age regardless of the ups and downs of the economy, inflation and financial markets. After ongoing spending needs have been addressed, there is more flexibility to focus on non-routine spending, such expensive repairs and luxuries.”