By Michael J. Wiener

Special to Financial Independence Hub

I’ve heard a few times over the years that one of the disadvantages of making an extra payment against your mortgage, or any other debt, is that saving this way only earns simple interest rather than compound interest. This is nonsense, as I’ll show with an example.

Flawed Reasoning

The reasoning behind the claim that paying down a mortgage only earns simple interest goes as follows. Each month, your payment pays all of the interest plus some of the principal. Therefore, there is no interest accruing on previous interest, so there is no compounding.

This is a tidy little story, but the reasoning doesn’t hold up.

An Example

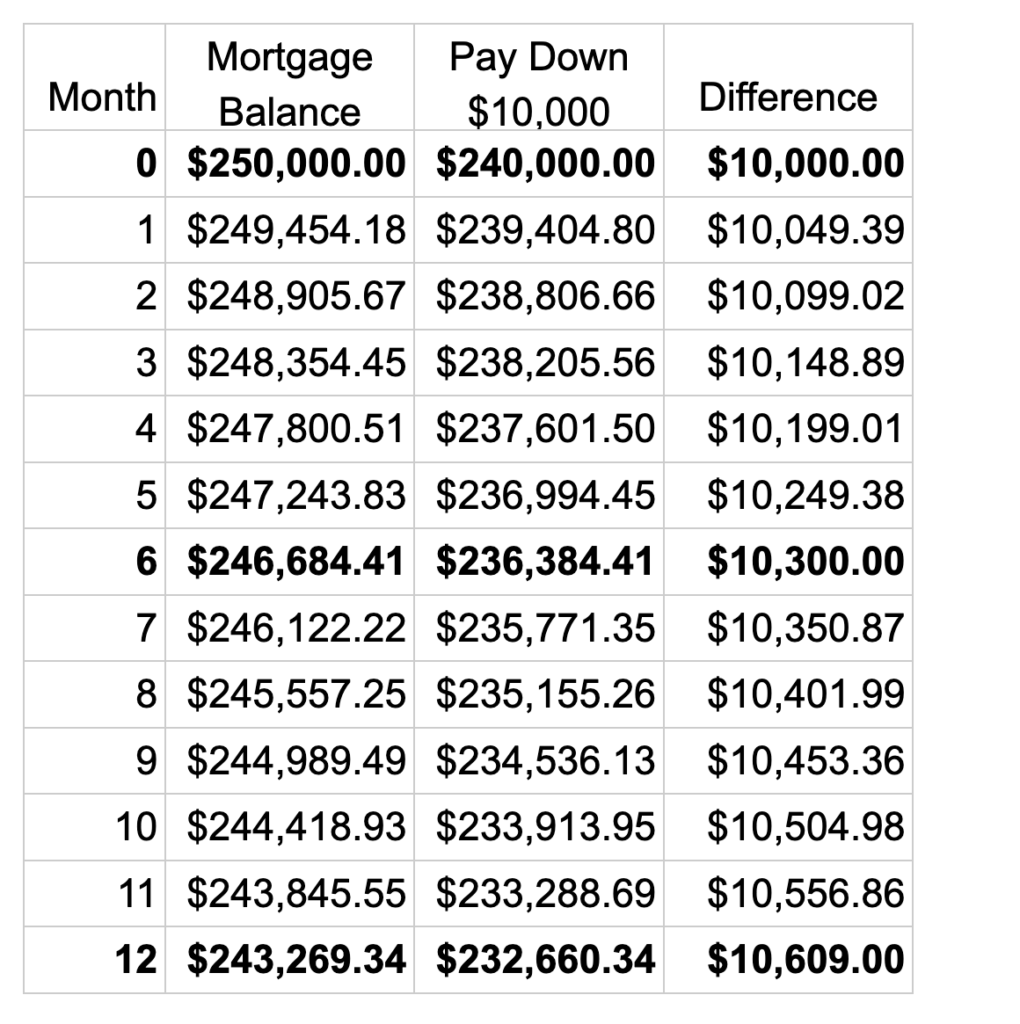

Suppose you have 20 years left on your 6% mortgage (in Canada where most mortgages use semi-annual compounding). This makes your monthly payment $1780.47. The second column of the table below shows how your mortgage balance would decline over the coming year.

Suppose you decide to pay $10,000 down on your mortgage, but you leave the payments the same. The third column shows your declining mortgage balance for this scenario. The last column shows the difference between these scenarios. This difference shows your returns from your investment in paying down your mortgage.

If your investment earned only simple interest at 6% per year, then the difference would be $10,600 after a year, but it is $10,609. The extra $9 comes from the semi-annual compounding. This isn’t much after one year, but after ten years, simple interest gives $16,000, but the real figure if we continued this table is $18,061. The compounding effect is significant.

Where Does the Flawed Reasoning Go Wrong?

To get the correct answer to questions such as whether paying down your mortgage earns compound interest, we have to treat money as fungible. Consider what happens when your debt accrues new interest. Think of the interest blending evenly with the former debt amount. Then when your payment gets applied, it wipes out proportional amounts of the original debt and the new interest. This leaves some interest with your debt that will accrue compound interest later.

Giving the Flawed Reasoning Another Chance

Let’s consider a simpler example. You borrow $10,000 at 12% (compounded monthly), pay off just the $100 interest each month for a year, and then pay back the $10,000. So, you paid a total of $1200 in interest.

This seems like 12% simple interest. However, it isn’t. You can’t just add dollar amounts from different times like this. You didn’t have the option to pay all the $1200 interest at the end of the year. Each interest payment had a different present value; you had to forego a different amount of interest you could have earned elsewhere if you hadn’t made the debt payment. If you had waited until the end of the year to make any payments, the total debt would have been $11,268 because of the compound interest.

Advertised Rates

Presumably there are historical reasons for how interest rates are advertised, but I find it confusing and misleading. When we say that a debt is at 12% compounded monthly, we really mean 1% per month and 12.68% per year. To take the nominal annual advertised rate of 12% and divide it by 12 to get a monthly rate, we’re treating it like simple interest. But, it isn’t simple interest. Try skipping a payment. Even if no penalty is added, the interest will compound. The annual rate is really 12.68%.

In the case of most Canadian mortgages, the compounding is semi-annual (every 6 months). So, to get from a nominal 6% annual rate to a monthly rate, we first divide by 2, falsely treating it like simple interest, to get 3%. Then we use the compounding calculation (1.03)^(1/6)–1 to go from the 3% 6-month rate to the monthly rate of 0.494%.

Using the flawed simple interest reasoning, there is no compounding on mortgages, so we should multiply this monthly rate by 12 to get an annual rate of 5.93%. So, is the mortgage rate 5.93%, or the advertised 6%, or the fully compounded 6.09%?

I would prefer to see fully compounded rates advertised. This is the most honest way because simple interest doesn’t really exist in the world. It also simplifies things because it removes the need to specify the compounding frequency.

Conclusion

The returns from paying off debts earns compound interest, not simple interest. The idea of approximating interest over periods shorter than a year as simple interest may have made sense back when interest was calculated by hand, but modern computing can easily handle the calculations necessary if all advertised rates were fully compounded.

Michael J. Wiener runs the web site Michael James on Money, where he looks for the right answers to personal finance and investing questions. He’s retired from work as a “math guy in high tech” and has been running his website since 2007. He’s a former mutual fund investor, former stock picker, now index investor. This blog originally appeared on his site on May 22, 2024 and is republished here with his permission.

Michael J. Wiener runs the web site Michael James on Money, where he looks for the right answers to personal finance and investing questions. He’s retired from work as a “math guy in high tech” and has been running his website since 2007. He’s a former mutual fund investor, former stock picker, now index investor. This blog originally appeared on his site on May 22, 2024 and is republished here with his permission.