An Interac survey being released today finds that more than two thirds (69%) of Canada’s Gen Z generation [defined as Canadians aged 18 to 27] have embraced the mobile wallet, while almost as many (63%) would rather leave their old-fashioned physical wallets at home for short trips. Gen Z’s Interac contactless mobile purchases also rose 27% in the first half of 2024, compared to the same period a year earlier.

Gen Z appears to be more enthusiastic than their counterparts in older cohorts: 60% of Millennials [aged 28-43] embraced mobile wallets, compared to 44% of Gen Xers [aged 44-59] and just 27% of Baby Boomers [aged 60-78.] Only 10% of the older Silent Generation [age 79 or older] did so.

A whopping 63% of Gen Z mobile wallet users have loaded their Interac debit card on their smartphones, and 31% plan to set debit as their default method of payment. For 63% of them, the reason is perceived faster payment times compared to physical card payments.

“Choosing your default payment method may feel like a small step, but it can play a big role in shaping Canadians’ ongoing spending habits,” said Glenn Wolff, Group Head and Chief Client Officer, Interac in a press release. “When consumers tap to pay with their phones, the decision to select a card from the digital wallet is easy to miss. Canadians could end up unintentionally using a default payment method that prompts them to take on more debt. This differs from traditional physical wallets where the consumer had to select the card they wanted to use each time.”

Majority want to be smarter with money

62% of Gen Z want to be “more mindful when spending” with 57% saying they want the option to use debit when paying in store or online; 79% of them say the cost of living is too expensive and 59% feel the need to be smarter with their money.

Interact says this generation’s desire to control overspending is heightened by back-to-school season: last year, family clothing stores saw almost twice as many Interac Debit mobile purchases in September and October compared to earlier that year in January and February. 54% of Gen Zs see the need to develop new habits to stay in control over their finances, while 56% are setting a timeline for this September to introduce new habits.

“Younger Canadians are focused on making their money go further. This generation is among the worst hit by cost-of-living pressures, and it’s no wonder that they see the value of Interac Debit as a smart and controlled approach to digital spending,” Wolff said.

For the report, Hill & Knowlton used the Leger Opinion online panel to survey 1,500 Canadians in mid July, 2024, with sampling by age, gender, and region.

Interac and Interac Debit are trademarks of Interac Corp.

MoneySense publishes list of the 25 most timeless personal finance books

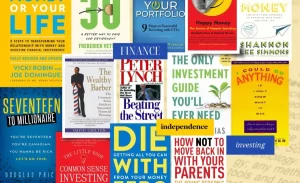

Speaking of being smart with money, no matter what generation you are a member of, MoneySense.ca on Friday published a list of 25 “timeless” books on personal finance and financial independence.

It includes 25 mini-reviews written by various journalists and financial people. I wrote one of them, on the classic Your Money or Your Life, which spawned many subsequent books on Financial Independence.

As you can see from the collage on the left, the list spans the generations and includes both Canadian and American authors. While my own Findependence Day didn’t make the cut, I’m pretty sure that anyone who reads and acts on all 25 books will certainly find their Findependence Day arriving early!

Findependence is of course a contraction of Financial Independence, and was the book that spawned the Financial Independence Hub that you are now reading. Originally available in a Canadian edition, the link above is to the later American edition.

“Gen Z appears to be more enthusiastic than their counterparts in older cohorts: 60% of Millennials [aged 28-43] embraced mobile wallets, compared to 44% of Gen Xers [aged 44-59] and just 27% of Baby Boomers [aged 60-78.] Only 10% of the older Silent Generation [age 79 or older] did so.

A whopping 63% of Gen Z mobile wallet users have loaded their Interac debit card on their smartphones, and 31% plan to set debit as their default method of payment. For 63% of them, the reason is perceived faster payment times compared to physical card payments.”

Wonder when Gen Z has grown up from babyhood, only knowing debit (and credit) card payment method, if it’s a bit harder for them to control impulsive buying…