Well, I’m officially “old” if you go by the federal Government’s eligibility date for receiving Old Age Security (OAS) benefits. The traditional retirement age has long been age 65, a milestone I reached on April 6th. As I have previously written, I had a hockey tournament to play that weekend so the party my wife and I host every 5 years or so was postponed to late May, by which time we calculated my first OAS cheque should have been deposited into our joint account. (There appears to be roughly a six-week gap between turning 65 and the first payment, even if you set up the process a year ago: Ottawa invites you to start the OAS process rolling when you turn 65. See the “Related Articles” links at the bottom of this blog for some articles on this.)

Well, I’m officially “old” if you go by the federal Government’s eligibility date for receiving Old Age Security (OAS) benefits. The traditional retirement age has long been age 65, a milestone I reached on April 6th. As I have previously written, I had a hockey tournament to play that weekend so the party my wife and I host every 5 years or so was postponed to late May, by which time we calculated my first OAS cheque should have been deposited into our joint account. (There appears to be roughly a six-week gap between turning 65 and the first payment, even if you set up the process a year ago: Ottawa invites you to start the OAS process rolling when you turn 65. See the “Related Articles” links at the bottom of this blog for some articles on this.)

In any case, my latest MoneySense Retired Money column goes into my (mixed) feelings about reaching this milestone. You can retrieve the full column by clicking on the highlighted headline: I’ve just turned 65: Here’s how I’m transitioning into Retirement.

Regular readers of this site or my books will know I see Retirement as a gradual process rather than a one-time sudden event more likely to generate what Mike Drak and I call “Sudden Retirement Syndrome.” My contraction for Financial Independence (Findependence, coined in the title of my financial novel, Findependence Day) is not meant to be synonymous with full-stop Retirement. Shortly after I left my last full-time journalism job four years ago (almost to the day!), I was happy to co-author a book with Mike and go with his chosen title, Victory Lap Retirement.

Four years into my “Victory Lap”

So I’ve been on my Victory Lap for four years now. That doesn’t mean 65 isn’t a significant milestone: as it tacks on another (albeit modest) stream of income, it means I can slow down a bit, if it’s possible to slow down when you’re running a website like this with daily content.

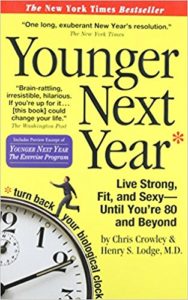

I described in an earlier piece in the FP how I am still working “some semblance” of a 40-hour week, although a good third of that time consists of errands or activities like Yoga or going to the gym, all the subject of the Younger Next Year 2018 Facebook group that a group of us launched late in 2017. Younger Next Year is a New York Times bestselling book that has been around for years but didn’t come to my attention until late in 2017 when regular Hub contributor Doug Dahmer gave me a copy.

The Hub’s subsequent review in the last post of the year led to the creation of the Facebook group, with the lead taken by Vicki Peuckert Cook, who is based in Rochester, but who I hope to meet this weekend for the infamous OAS party at our home in Toronto. For more on the genesis of the group, read member Fritz Gilbert’s blog republished on the Hub late in March: Do you want to be younger in 2018 than in 2017?

The group has already attracted more than 450 members on both sides of the border, including the co-author of the book, Chris Crowley, and his coauthor on Thinner This Year, Jennifer Sacheck.

Certainly the 6-day a week regime recommended in Younger Next Year is more doable if you’re retired or semi-retired/Findependent. Most of the Facebook group appears to be in that category, although there are a few dedicated younger folk still juggling full-time careers with raising a family and doing what they can on the exercise/nutrition front.

So in my own Victory Lap post turning age 65, I expect to keep on keeping on (to use Bob Dylan’s phrase), gradually replacing money-making activity with other perhaps more soulful pursuits. Of course, Findependence does require spending some time and energy on monitoring the markets, although those new Vanguard Asset Allocation ETFs we described earlier this year can in theory take that monkey off one’s newly retired back.

While Victory Lappers should be beyond the Wealth accumulation phase, they soon discover how complex decumulation can be. We have described in Doug Dahmer’s previous Hub posts how important true retirement financial planning is and it’s a theme we will continue to explore here at the Hub and in my columns in MoneySense, the Financial Post and elsewhere.

To quote Change Rangers’ Mark Venning (who I neglected to identify at the end of the FP piece linked above), 65 is “just a number.”

A big one though!

Hey Jon, you are certainly not “old”, like a good wine you are simply “well aged”….