My latest MoneySense Retired Money column, which has just been published, looks at a self-published book by the semi-retired (at age 64) Howard Pell. His book is titled Retire Fit, Fit & Fit. Click on the highlighted headline to retrieve the full MoneySense column: Retirement fitness involves mind and body, as well as money.

My latest MoneySense Retired Money column, which has just been published, looks at a self-published book by the semi-retired (at age 64) Howard Pell. His book is titled Retire Fit, Fit & Fit. Click on the highlighted headline to retrieve the full MoneySense column: Retirement fitness involves mind and body, as well as money.

So what does the Fit, Fit & Fit mean? It’s in the headline of this blog as well as the adjacent photo taken from the book cover, which is the book’s subtitle. So it’s referring to being all three of financially fit, physically fit and emotionally fit for Retirement.

There are plenty of books about financial fitness so Pell pays only lip service to that aspect: what he brings to the table is insights on how to integrate finances with physical and emotional fitness. (To some extent, so does the book I co-authored with Mike Drak: Victory Lap Retirement)

Pell, who is based in Waterloo, Ont., does add a few newish terms to the semi-retirement lexicon. He dubs the lifestyle “voluntary unemployment” but like many at this stage, finds the word “retired” inadequate. He tosses out several alternatives but the best one is his suggestion to simply adopt the Spanish word for “retired,” which is Jubilado (for males) or Jubilada (for females.”) He would use the term to signify anyone who is financially, physically and emotionally fit.

I can certainly relate to his observation of the semi-retired life that “The big difference is that now all my deadlines and commitments are self-imposed.” Of course, as the old quip goes about driven self-employed business people: “My boss is a slavedriver.”

Pell also went personally through the “glide path” to semi-retirement described in other Retired Money columns and here at the Hub, via working a three-day week for his then employer during the last two years of his time there. This is a good way to test out your financial fitness while also clearing time for more physical fitness and — perhaps the toughest challenge — preparing for emotional fitness for retirement (I’m speaking for myself here.)

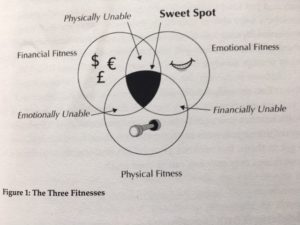

Finding the sweet spot

A Venn diagram on page 7 of Pell’s book (shown adjacent) illustrates that the sweet spot is the intersection where financial, emotional and physical fitness all converge.

A Venn diagram on page 7 of Pell’s book (shown adjacent) illustrates that the sweet spot is the intersection where financial, emotional and physical fitness all converge.

If they don’t, and you became financially fit by selling out either your physical and/or your emotional health, the retirement your finances make possible may be a very limited and unsatisfying one.

It’s also possible to be only physically fit or only emotionally fit but lack the financial resources for retirement. The need to keep working to pay the bills will be frustrating, especially if all your peers have retired.

As I mentioned above, personally I find emotional fitness the toughest of the three. Hopefully anyone who makes it to their 60s has at least a good start to getting their financial act together: if not, at least the Government will provide enough to survive without working, whether via the triad of CPP/OAS/GIS in Canada or Social Security in the U.S. (as I note at the end of the MoneySense review, Pell helpfully includes pictures of US flags to “translate” Canadianese into American.)

Physical fitness is I think easier than the other two, though of course it does require commitment and discipline. As we have discovered in the Younger Next Year 2018 Facebook group launched at the start of this year — described in this recent Hub post — you almost need to be retired or at least semi-retired if you are to embrace the six-day a week exercise regime prescribed by the authors of Younger Next Year.

But as with financial fitness, there are plenty of books about physical fitness. Which makes Pell’s book relatively unique in tackling emotional fitness for retirement, which is how he defines one’s “mental preparation for retirement.” There’s a lot of free time to fill, which I attempted to describe in my recent MoneySense column on my own transition to turning age 65.

A retired friend of mine (mentioned in Victory Lap) talked about his strategy of “buying time” to make room for his art. The whole retirement savings industry is a massive exercise in buying time for future leisure pursuits, which can include physical fitness. But I’m not so sure you can so easily translate financial fitness into emotional fitness for retirement. We’ll explore this theme more this summer through various guest blogs.

“free time to fill” – wow what a concept :)

never had that problem – in retirement or when working (that was a looong time ago)

could still use a 28+ hour day but they are in really short supply

Congruent with our experience. Our formulation is High Wealth, High Health. High Purpose. But purpose is at the core of emotional fitness. Absolutely agree that you need enough wealth or financial fitness to enable freedom of choice in other aspects of your life. Wealth without health is pretty useless. But to the point of emotional fitness or high purpose, there are a lot of unhappy wealthy and healthy people. Not just in retirement. Wealth and health may be necessary but are certainly not sufficient to lead a satisfying life.