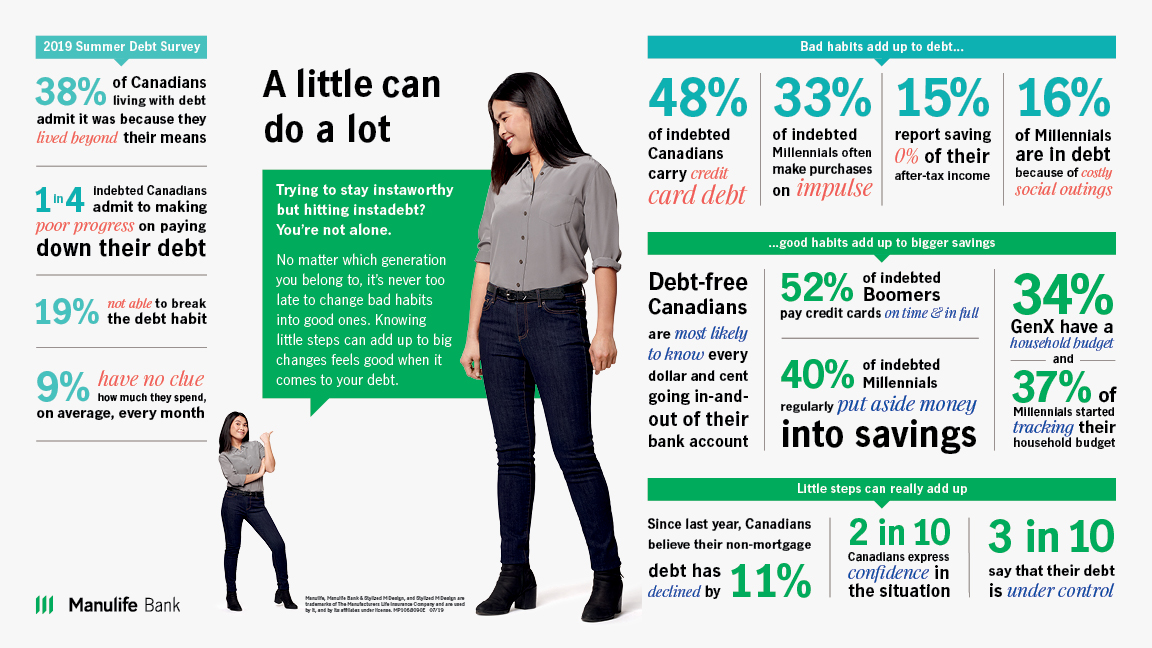

Talk about cause and effect: 38% of Canadians admit that living beyond their means resulted in their being in debt. That’s according to a survey being released this week by Manulife Bank of Canada. It also found a third of Canadians aged 20 to 69 with a household income of at least $40,000 say their spending growth outpaces their income, and 19% of those who went into debt cited not being able to break the debt habit. Almost half (49%) on indebted Canadians between the age of 20 and 34 and a majority of those aged 35 to 54 report carrying credit cards with a balance.

No surprise then that one in ten (9%) admit to being “clueless” about how much they are spending each month on average.

Blame YOLO and FOMO

Apparently cultural attitudes like “You only live once” (YOLO) and “Fear of Missing Out” (FOMO) are starting to take their toll on indebtedness. Apart from the 38% who admit their debt arose because of living beyond their means, 12% directly correlated their indebtedness to the outcome of too many costly outings with friends or family.

While 19% of debtors say they can’t break the habit, the survey also reveals that seeing debt paid off can result in joy, which is what 36% of Canadians say.

And once again (see yesterday’s post on the HSBC study), Canada’s high housing prices are seen impacting this country’s Millennials. Millennials are now at the age many want to get on the property ladder and start families, two areas where Manulife is seeing expenses grow. “Housing affordability remains at near-historic highs across the country and child-care costs have risen faster than inflation for Canadians,” said Manulife Bank president and CEO Rick Lunny in a press release, “We have a financial wellness crisis in Canada.”

Obviously debt can limit one’s social life but the survey quantifies this. it found that debt limits activities with family and friends (22%), makes it impossible to spend money on entertainment (18%) and negatively impacts mental health (in 17% of cases.)

Manulife says Boomers feel less affected by debt: one would hope so since any Boomer contemplating retirement should by now have a healthy positive net worth rather than a negative one! In which case, they will be less constrained in spending on entertainment or meeting with family and friends.

Manulife finds that those under 55, women, and those with high levels of debt are most likely to feel stressed by these circumstances. It also found a “gradual yet significant” decline in the proportion of Canadians with mortgagers who express comfort with the payments. “There has been a sharp year-over-year decline in the proportion who claim to feel very comfortable about both the payments (28%, down 8 from Spring 2018) and the amount owing (21%, down 9) on their mortgage.”

The Joy of getting out of Debt

Asked to rate the perceived joy they would get from various financial accomplishments, two thirds of Canadians put getting out of debt (“escaping”) first or second overall, with having a hefty retirement nest egg a distant third.

Of course, reducing debt is easier said than done. Manulife suggests a clear “area of opportunity” is making adjustments to non-essential spending but there are demographic differences. Millennials are much more willing to sacrifice dining out compared to those who are over 35. Women are twice as likely as men to stop shopping for non-essential goods and services. Men and those who are 35 or older are most willing to give up travelling (which I’d say is certainly a non-essential spending activity!)

There are some positives in the survey. it found that three in ten say their debt is under control and they don’t need any help to control it. Others believe there are more effective ways to track debt and curb spending. Manulife cites its own Manulife All-in Banking Package, which includes Saving Sweeps that automatically moves excess funds into savings accounts each night. For more on the Debt Survey, click here.