Special to the Findependence Hub

Why spend days building a stock portfolio when you can almost instantly invest the same amount of money in the units of a popular mutual fund or Exchange Traded Fund [ETF]?

One of the most popular are the Standard and Poor’s 500 Index Exchange Traded Funds and Mutual Funds that are sold by probably hundreds of banks and investment dealers. The rise and fall of the S&P index has become a standard by which the success of all portfolios are often measured against.

The Standard and Poor’s 500 Index is a compilation of stocks selected by a committee called the S&P Dow Jones Indices. It is managed by S&P Global Inc., which sells financial information and analytics. This company is an evolution of the century old McGraw-Hill publishing company.

The S&P 500 tracks the 500 largest American companies selected by their stock market capitalization, which is the value of all the shares held by investors in a company. Fund management companies selling units in their S&P 500 mutual funds and ETFs are quick to brag that just nine of the 500 companies account for 31% of the market capitalization of all 500 companies. These nine are Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta, Tesla, Berkshire Hathaway, and JP Morgan Chase. The sales pitch for buying fund units is, how you can lose with such well known, successful companies in your S&P 500 fund.

These very high-profile companies are the bait to distract you from considering the hundreds of mediocre, but large low-profile stocks in the S&P 500.

I have described the “Magnificent Seven,” which are included in the above nine, as being overvalued when you compare such things as their very high share prices to their much lower book values. For example, Apple’s book value was $4.00 compared to its share price at the time, which was $185. Book values are calculated by professional auditors subtracting what is owed by a company from their assets. The net figure is then divided by the number of outstanding shares to arrive at the stock’s book value. A book value’s logical calculation is far removed from the chaos of optimistic and pessimistic speculators bidding daily for millions of Apple shares in a stock market influenced by media hype, greed, and fear.

Many Investors seek safe stocks that will provide them with a reliable income to support them in their retirement. They look for companies that have demonstrated for years that they share the company profits with the company owners, who are the shareholders. This sharing is done through significant regular dividends.

Only 2 Mag 7 stocks pay dividends

Only two of the Magnificent Seven pay dividends. Their dividends are so small you wonder why they bother. Nvidia is paying a token dividend yield of 0.03% and Microsoft is paying 0.71%.

There are about 25 million companies in the United States. Surely “owning” shares in the 500 largest stocks must be a good investment? However, that very much depends on what your definition of a “good investment” is? My definition of a good, strong, safe stock investment has nothing to do with high market capitalization, which is the primary qualification for being classified as an S&P 500 company.

To me a good stock investment primarily includes:

- A share price that has steadily increased over the last 20 years.

- A high operating margin percent that is calculated from the percentage of the amount remaining after you have subtracted the expenses to generate the revenues from the revenues.

- A company that shares its profits with its shareholders by paying ever-increasing annual dividends yields of at least 5% over the last 20 years. These would include even the market crash years of 2000, 2008 and 2020.

- The profitability of a company as reflected in a price-to-earnings ratio that would be below 20.

- A book value for the company that would be close to or even higher than the share price.

Perfect stocks meeting all these criteria rarely, if ever exist. You thus are required to make compromises based on how close you can come to your ideal stock.

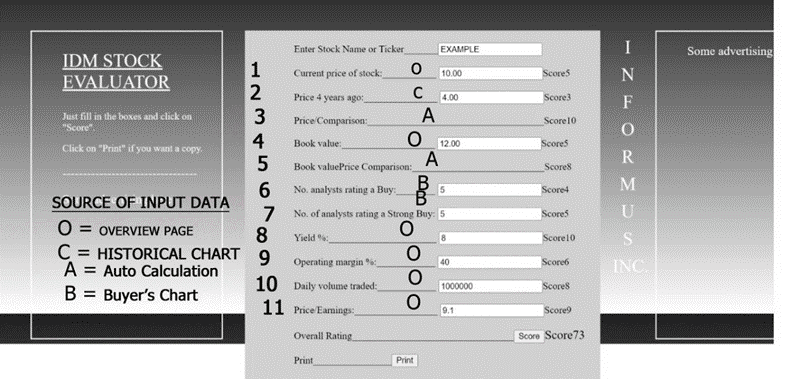

Creating stock-scoring software

To make such compromises easier, I invented for myself stock scoring software that calculates an objective number from zero to 100. This number allows the sorting of stocks from the most to least desirable. The higher the number the more desirable the stock. Having scored thousands of stocks, the lowest I have ever calculated was an 8 and the highest was a 78. I avoid stocks scoring under 50.

For safe diversification and to avoid disastrous surprises you should aim at investing equally in 20 carefully chosen stocks. Your expectation from historical trends of strong companies is that most of your dividend payouts and your share prices will increase steadily. This will keep your dividend income well ahead of inflation.

There are about 16,000 stocks available in North America to choose from. Sorting through these thousands of stocks for your “best” 20 is not difficult once you are shown how to do it. It can be done in hours, not days.

When I reviewed all the stocks that make up the S&P 500, I found only 5 stocks that would qualify for consideration in my portfolio. 113 of the S&P 500 had been immediately eliminated for consideration because they pay no dividend. Even some of the very largest companies in the S&P 500 like Amazon, Alphabet, Tesla, Berkshire Hathaway, Facebook, and Disney pay no dividends. A further 288 of the S&P 500 stocks only paid dividends between 3.5% and 1%.

Why would a 3.5% minimum dividend yield be important? For the last 100 years the average inflation rate is reported to have averaged 3.5%. If you had bought a share that never increased or decreased in value but paid out a steady 3.5% in dividends your stock would theoretically have stayed ahead of inflation if it were invested back into the portfolio.

Strong shares have histories of steadily rising share prices.

As share prices increase many companies steadily increase their dividend payouts out of pride and competitive reasons to at least maintain their traditional high dividend yield percents. Usually, the dividend payout increase percentages rise much faster than share prices. This can be easily observed.

Only 100 S&P500 stocks pay dividends higher than 3.49%

Within the 500 stocks you are left with only 100 that are paying dividends higher than 3.49%. To give you a reasonably generous income, the ideal is to realize an annual dividend income generating at least 6% of your portfolio’s value. On a million-dollar portfolio this would be $60,000.

There are only 12 of the S&P 500 companies paying a dividend greater than 5.97%. Two of the 12, AT&T and Altria Group, had return-on-expense percentages of zero or less which eliminated them from consideration. When the remaining 10 were scored it was found that 7 of them were now paying a dividend of less than 6% which eliminated them. Of the remaining three only one had an operating margin greater than zero. This left just one company, Verizon, out of all 500 that would meet my minimum requirements for inclusion in my portfolio. It had a good score of 62.

Verizon’s score was based on a share price of $40.48, a price 4 years previously of $58.22, a book value of $21.98, Ten analysts recommending it as a buy, a dividend yield percent of 6.57%, an operating margin of 16.57%, a daily trading volume of 12,645,534 shares and a price-to-earnings ratio of 14.7.

Verizon’s score was based on a share price of $40.48, a price 4 years previously of $58.22, a book value of $21.98, Ten analysts recommending it as a buy, a dividend yield percent of 6.57%, an operating margin of 16.57%, a daily trading volume of 12,645,534 shares and a price-to-earnings ratio of 14.7.

We still needed 19 more stocks to create a strong diversified portfolio. Fortunately, there is a wide choice of companies with lower capitalization who are paying dividends of 6% and will have scores higher than 50. Some of these are foreign based companies traded on the New York Stock Exchange who were automatically excluded from being included in the American centric S&P 500. Some had high capitalizations that could have easily included them. Foreign stocks can give a portfolio a geographic diversification which strengthens it.

If you had $200,000 to invest, you could do far better investing the $200,000 in 20 carefully chosen, high-scoring, high-dividend stocks than investing that $200,000 in S&P 500 fund units. While the 20 stocks could generate a dividend income of $12,000, the dividend income generated from the fund units of an S&P 500 fund would be a diluted 1.3% or an annual dividend return of $2,600. The total dividend income received from all 500 stocks becomes diluted when it is split among all those S&P 500 stocks paying little or no dividends.

What S&P fund owners receive would also be contingent on how much in management fees would be extracted from their investment. Most investors would not even be aware of how much is being extracted from their fund portfolio.

Investment costs are important

Investment costs are important. Depending on what financial institution you used, you would pay between zero and nine dollars to buy each of the 20 stocks for your self-directed portfolio. Thus, you might incur a charge as high as $180 to acquire all 20 stocks. Since these could be shares, you may intend to hold for the rest of your life, you may never again incur another charge from that financial institution. I can go for years without making changes to my portfolio’s stocks.

The costs in acquiring $200,000 worth of S&P 500 fund units is much more expensive. You pay the financial institution you buy them through a percentage of the $200,000. It could be between .05 and 2%. In buying 200,000 of units this could be $1,000 and $4,000. The fund management company also takes a hidden cut directly from the fund which could be between .05 and 1% or $1,000 and $2,000 of the amount you purchased. They do not take this fee just one time. The fund and the financial institution take their fees every year that you own that fund.

Is the only benefit of buying a fund that you did not have to spend time picking your stocks? Interestingly, neither did the fund. All they did was buy all the stocks listed in the S&P 500. No expensive analysts had to be employed to pick the “best” stocks.

The largest and oldest ETF S&P 500 fund management company owns $425 billion dollars of the stocks in their fund. They charge each fund unit holder 0.095% annually for managing the fund. This seemingly tiny 0.095% creates $403,750,000 in revenue for this fund management company every year. They report that this amount covers their accounting costs, marketing costs, distribution costs and legal fees.

You would wonder how much of this money finds its way to the hundreds of thousands of investment advisors to encourage them to sell S&P 500 fund units to their clientele? How much is spent on advertising to convince millions of investors that an S&P 500 ETF or mutual fund is the only safe option for their investment dollars?

When a fund’s unit value decreases in the inevitable next market crash, the investment advisor tells the fund owners to shrug off the loss and hope that next year the market will recover. The lack of a supportive dividend income from an S&P 500 fund, which could take away the sting of the capital loss, is not mentioned. Like sheep, they accept what they believe is the wise advice of an investment “professional,” who is just a fund salesman. The fees earned by the financial industry come with no guarantees that the investor will make money.

S&P 500 share prices are totally dependent on the often illogical, impulsive buying and selling of shares by speculators. Just because fund units increased last year is no guarantee they will increase this year. No one can accurately predict future share prices. What can be proven to be far more predictable are the regular dividend payouts made by the managers of those companies who have consistently paid good dividends for decades.

It is interesting to look over the 500 stocks and see yesterday’s market leaders languishing. For example, Ford Motor Company’s return-on-investment is minus 4.30% and its price-to-earnings is minus 24.5. eBay’s return-on-investment is a minus 16.90% and its price-to-earnings is a minus 19. Most of the software and computer service companies in the S&P 500 not only do not pay dividends but have minus price-to-earnings figures.

Apparently about 80% of all the money invested by individuals is invested in funds. This is understandable since funds are heavily promoted. This is an investment in which the investor has no control over and little understanding of what they have invested in or how much it is costing them. These investors are just along for what is a costly ride. Getting off the roller coaster early in the ride may even result in a withdraw charge.

Investors must never lose sight of the reality that ETFs and Mutual funds are vehicles to create profitable income for the fund management companies and financial service companies.

With 50 years of commercial risk experience Ian Duncan MacDonald saw stock investing as just another form of commercial risk. His first job was as a commercial credit reporter with Dun & Bradstreet. Here he observed the pride and dedication executives needed to create successful businesses. His final D&B promotion was to General Sales Manager of all four divisions of the company.

He left and soon joined Creditel, where his final position was as Senior Vice President responsible for the profits of its Commercial Reporting Division. He took it from a million-dollar loss to the company’s main multi-million-dollar profit maker. Banks, insurance companies, wholesalers, manufacturers, and service companies relied on the database and commercial risk scoring systems he built to manage their daily customer risks.

Nineteen years later, Equifax bought Creditel to acquire Ian’s systems. As a Vice President he managed the merger.

His imminent retirement looking bleak when the mutual funds in which an investment advisor had invested Ian’s life savings lost $300,000. Ian took back what money was left and created a stock scoring program. It allowed him to build a. generous, ever-growing dividend portfolio. Seeing his success, friends asked him to show them how he invested. They copied his strategy and were also successful. They then pressured him to write a book to guide them. This has led to six investment books and 165 weekly “Safe Dividend Investing” podcasts. For more information on his books, videos, podcasts, and art visit his www.informus.ca

His imminent retirement looking bleak when the mutual funds in which an investment advisor had invested Ian’s life savings lost $300,000. Ian took back what money was left and created a stock scoring program. It allowed him to build a. generous, ever-growing dividend portfolio. Seeing his success, friends asked him to show them how he invested. They copied his strategy and were also successful. They then pressured him to write a book to guide them. This has led to six investment books and 165 weekly “Safe Dividend Investing” podcasts. For more information on his books, videos, podcasts, and art visit his www.informus.ca