By Mark Seed, myownadvisor

Special to Financial Independence Hub

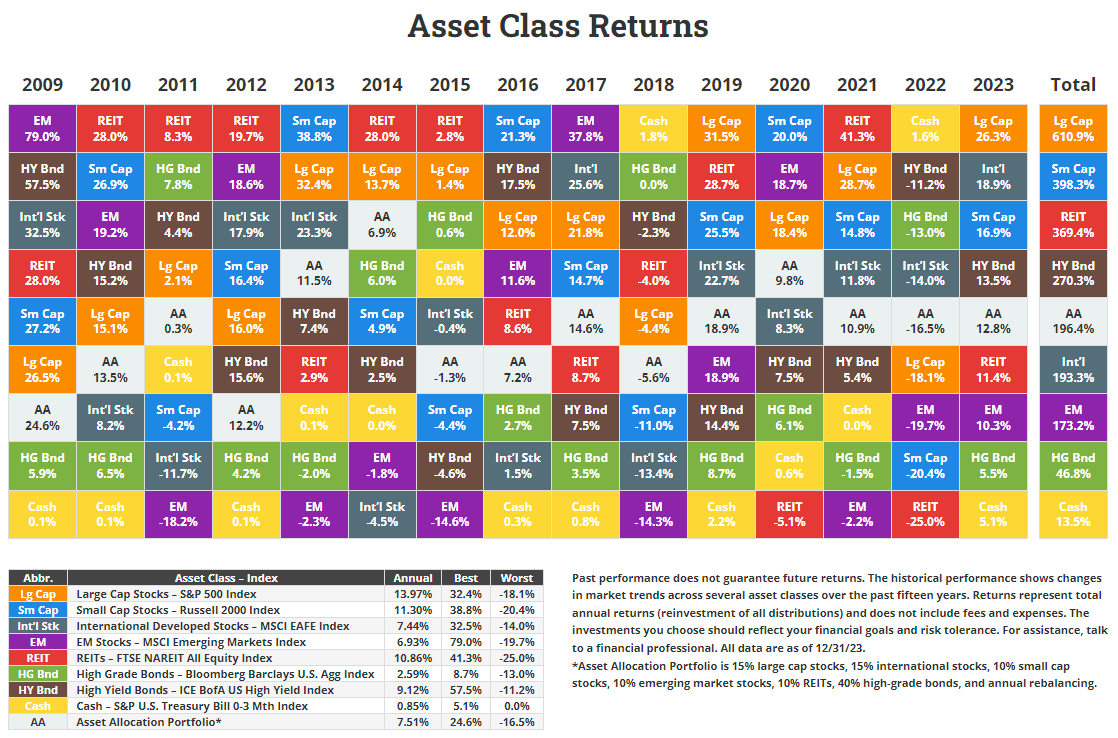

Headlining Weekend Reading is this asset quilt for various returns in 2023 thanks to @NovelInvestor.

Source: NovelInvestor.com

How did your portfolio perform in 2023?

Overall, if you were in low-cost, diversified ETFs, including some all-in-one ETFs, it should have been a VERY good year for you!

To answer the question, our portfolio performed just fine – since I/we tend to focus on the meaningful income our portfolio generates to eventually cover expenses along with returns. Staying invested in a number of stocks and low-cost ETFs as we do are designed to generate market-like returns since we don’t trade nor tinker with the portfolio, and low-cost ETFs invested in stocks outside Canada offer growth.

Further Reading: Why I decided to unbundle my Canadian ETF for income.

If your bias was more simplicity than my approach and seeking total returns, then these ETFs including some great all-in-one ETFs might have done very well for you in 2023 after a terrible 2022:

| ETF | 2023 | 2022 |

| VEQT (100% equity) | 16.95% | -10.92% |

| XEQT (100% equity) | 17.05% | -10.93% |

| ZEQT (100% equity) | 16.75% | -5.25% |

| HEQT (100% equity | 22.64% | -19.20% |

| XAW (100% equity ex-Canada) | 18.16% | -11.77% |

Beyond some of these great all-equity ETFs for your portfolio, consider these in this post that might hold a mix of stocks and bonds to match your risk tolerance and investing objectives:

No financial advisor or money manager needed for these ETFs. The wise ones would tell you to index invest in some diversified ETFs anyhow. Just food for thought in 2024 if you haven’t considered DIY investing.

More Weekend Reading – Beyond Asset Quilt 2023 …

Last week, I also enjoyed this post from Tawcan, a few stocks he’s considering for his TFSA in 2024.

Jon Chevreau wrote about why Canadian investors should include U.S. stocks in their portfolios.

Here are some essential tax numbers for 2024.

Dale Roberts shared some year-end returns and other investing musings from the year that was…

My friend Dividend Growth Investor released a great list of U.S. Dividend Champions.

I thought this was a very worthy list of key Canadian vloggers and personal finance YouTubers – some I try and check out from time to time…

Here are some interesting, early YTD returns from the oil and gas sector. Gurgen is a must-follow IMO.

What does 2024 have in store?

I have a few (fun) predictions that I will share soon but they are just that, some thoughts and this is a good reminder that experts know nothing about what the financial future might hold – but they have to put food on the table as well…

Vanguard still took a leap of faith though, will they be right in 2024?

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site Jan. 6, 2024 and is republished on the Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site Jan. 6, 2024 and is republished on the Hub with his permission.