I started investing in individual stocks shortly after the Great Financial Crisis ended in 2009. I picked an investing strategy that closely resembled the Dogs of the TSX, buying the 10 highest yielding Canadian dividend stocks. As you can imagine, the share prices of these companies got hammered during the stock market crash so I was able to scoop up shares in banks, telecos, pipelines, and REITs on the cheap.

I started investing in individual stocks shortly after the Great Financial Crisis ended in 2009. I picked an investing strategy that closely resembled the Dogs of the TSX, buying the 10 highest yielding Canadian dividend stocks. As you can imagine, the share prices of these companies got hammered during the stock market crash so I was able to scoop up shares in banks, telecos, pipelines, and REITs on the cheap.

Stocks came roaring back right away and my portfolio gained 35% by the end of 2009. Investing is easy, right?

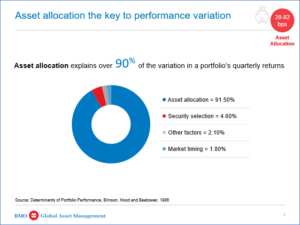

It took me a while to figure out that my portfolio returns had less to do with my stock picking prowess and more to do with market conditions, luck, and the timing of new contributions. The rising tide lifted all ships, including my handful of Canadian dividend stocks.

I started comparing my returns to an appropriate benchmark to see if my judgement was adding any value over simply buying a broad market index fund. My portfolio outperformed for a few years until it didn’t. In 2015, I had enough and switched to an index investing strategy. Now I invest in Vanguard’s All Equity ETF (VEQT) across all of my accounts.

Related: Exactly How I Invest My Money

New investors who started trading stocks in the past 18 months have likely had a similar experience. Stocks crashed hard in March 2020, falling 30%+ from the previous month’s all-time highs. Since then markets have been on an absolute tear. The S&P 500 is up 91% from the March 2020 lows. The S&P/TSX 60 is up 70%.

That’s just country specific market indexes, mind you. Since March 2020 individual stocks like Facebook and Apple are up 137% and 155% respectively. Tesla is up 700%. Meme stock darlings AMC and GameStop are up 1,045% and 3,621% respectively.

No doubt, unless they’ve done something disastrous, new investors participating in this market have seen incredible returns so far.

This can lead to overconfidence – when people’s subjective confidence in their own ability is greater than their objective (actual) performance.

Overconfident Investors

Larry Swedroe says the biggest risk confronting most investors is staring at them in the mirror. This is the first type of overconfident investor.

Overconfidence causes investors to trade more. It helps reinforce a belief that any investment wins are due to skill while any failures are simply bad luck. According to Swedroe, individual investors tend to trade more after they experience high stock returns.

Overconfident investors also take on more uncompensated risk by holding fewer stock positions.

Furthermore, overconfident investors tend to rely on past performance to justify their holdings and expectations for future returns. But just because stocks have soared over the past 18 months doesn’t mean that performance will continue over the next 18 months.

In fact, you should adjust your expectations for future returns – especially for individual stocks that have increased by 100% or more. No stock, sector, region, or investing style stays in favour forever. If you tilt your portfolio to yesterday’s winners (US large cap growth stocks) there’s a good chance your portfolio will underperform over the next decade.

The second type of overconfident investor is one who makes active investing decisions based on a strong conviction about how future events will unfold.

Related: Changing Investment Strategies After A Market Crash

Think back to the start of the pandemic. As businesses shut down around the world it seemed obvious that global economies would suffer and fall quickly into a massive recession. The stock market crash reinforced that idea. Investors hate uncertainty, but this time it seemed a near certainty that stock markets would continue to fall and remain in a prolonged bear market.

Markets quickly turned around as central banks and governments doled out massive stimulus to keep their economies afloat and their citizens safe at home. Now it became ‘obvious’ that investing in sectors like groceries, cleaning supplies, online commerce, and video technology would produce strong results. Continue Reading…