By Ted Rechtshaffen, CFP

Special to Financial Independence Hub

As you may know, the recent Federal Budget announcement had a few important changes that can have an impact for some, but certainly not all. The most discussed has been the increase to the capital gains tax.

The most directly impacted are those with investments in a Corporation or a Trust. Not only will they face an increase in taxes on every dollar of capital gains (not just after $250,000 as it is on personal accounts), but this is forcing some important near term decision making.

For many people in this situation, the question for investments with unrealized capital gains is whether to hold those securities longer term or sell them prior to June 25th to avoid the new higher tax rate.

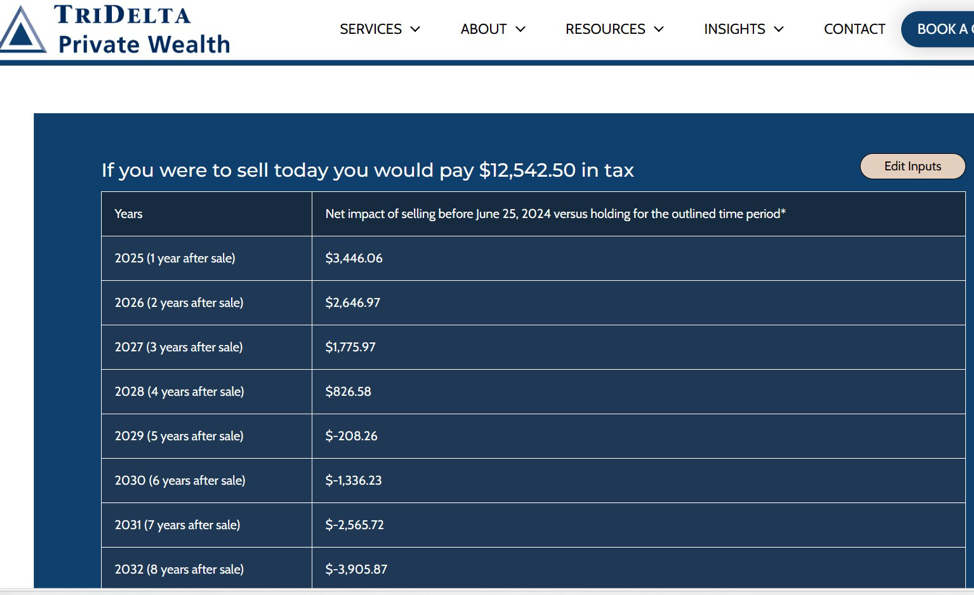

To help with that choice, we have just launched a new calculator aimed at this group.

It is free for anyone to access. They don’t have to provide any details.

The calculator can be found at New Capital Gains Tax – Sell or Hold Calculator – TriDelta Private Wealth

Choice is a Tradeoff

The choice being made is a tradeoff of whether to pay tax now at a lower rate and lose that capital to CRA or hold on to the larger value longer but pay a higher tax rate when the investment is sold. One factor is how long you plan to hold the investment. Another is the expected growth of the investment and how much of that growth is made up of capital gains or other income.

As you can see, the output of the calculator will show you the tax bill today for selling a particular investment, and also the impact of doing that sell now as opposed to holding the investment for another year or two or longer.

Of interest, many people with a Corporation believe that they are paying lower taxes on the passive investment portfolio than they really are. This is because active business income is taxed at a much lower rate. In Ontario, the corporate tax rate on passive investment income is 50.17%. While a little more complicated than personal rates, there are still meaningful tax breaks on Canadian dividends and capital gains.

For Trusts, again, some people think that Trusts have a lower tax rate, but in most cases today (there were big Trust tax changes a few years back), Trusts are taxed at the highest marginal tax rate in each province.

In a few cases, the increase in Capital Gains may even change people’s views on whether to keep or set up a Corporation or Trust. There is a lot to think about, but when it comes to current holdings in these accounts, not much time to think about it. The Capital Gains tax ‘sell or hold’ calculator will hopefully help with the process.

Ted Rechtshaffen, MBA, CFP, CIM, is president, portfolio manager and financial planner at TriDelta Private Wealth, a boutique wealth management firm focusing on investment counselling and high-net-worth financial planning. You can contact him through www.tridelta.ca.

Ted Rechtshaffen, MBA, CFP, CIM, is president, portfolio manager and financial planner at TriDelta Private Wealth, a boutique wealth management firm focusing on investment counselling and high-net-worth financial planning. You can contact him through www.tridelta.ca.