In August of 2020 we asked if Canada’s energy dividends were in trouble? Of course that was before energy prices and energy stocks were dominating the headlines. At the time Canadian oil prices were about $30 a barrel and energy dividends were under a lot of pressure due to collapsed earnings.

Today, that price has more than tripled and has been above $100 and now sits near $92 (May 2022). You’ll notice when you compare the Western Canadian Select price to Brent (closer to $105) just how much Canada’s energy dividends and earnings would benefit from not having to discount relative to world price! That said, that gap in price has been closing. And the generous oil prices have fuelled incredible earnings and dividend growth.

Those higher oil prices are wonderful for Canadian oil producers, mostly operating or active in the Canadian oil sands, but many of the producers also have global operations. They have already become free cash flow gushers. More investors, fund managers and retail investors are going along for the ride.

Over the last year, the returns for the TSX Capped Energy Index are more than 90%. If we go back to the start date of this Canadian energy stock series (August 2020) the energy index is up over 300%.

On my site, I had suggested last October that investors consider Canadian oil producers.

I offered …

“The Canadian energy sector has been beaten up. Foreign investors have given up and so have many Canadian investors. Where there is incredible pessimism there can be incredible rewards. But there is certainly no guarantee that the pessimism for the Canadian energy patch is not deserved.

That said, it is also certainly possible that the pessimism has jumped the shark. There may be incredible value in the energy sector for Canadian investors.”

Canadian investors who went against the flow were rewarded handsomely, and it was not as big a risk as many would think. The macroeconomic and energy-specific story was quite simple.

Economic activity and energy usage was certain to pick up as we made our way through the pandemic. Canadian energy producers were made more lean and mean by the tough years in the energy patch. They had already spent the required amounts (CAPEX investments) to make their oil projects viable and profitable at lower oil prices. If prices do get to $50 a barrel and more, they have a license to print money.

Canada’s Largest Energy Stocks Comparison

|

Ticker |

Company |

Price |

Market Cap |

P/E |

Dividend Yield |

|

ENB.TO |

Enbridge

|

56.94 |

116.26B |

19.78 |

6.03% |

|

TRP.TO |

TC Energy

|

73.13 |

72.42B |

22.11 |

4.91% |

|

CNQ.TO |

Canadian Natural Resources

|

79.19 |

91.96B |

9.94 |

3.81% |

|

SU.TO |

Suncor

|

48.57 |

70.23B |

11.30 |

3.87% |

|

IMO.TO |

Imperial Oil

|

65.22 |

43.41B |

13.68 |

2.11% |

|

CVE.TO |

Cenovus Energy

|

27.07 |

53B |

99.68 |

1.57% |

|

PPL.TO |

Pembina Pipeline

|

50.35 |

27.81B |

22.06 |

4.98% |

|

(Hidden, click for access) |

?????? (Hidden, click for access)

|

?????? (Hidden, click for access) |

?? |

??.?? |

?.??% |

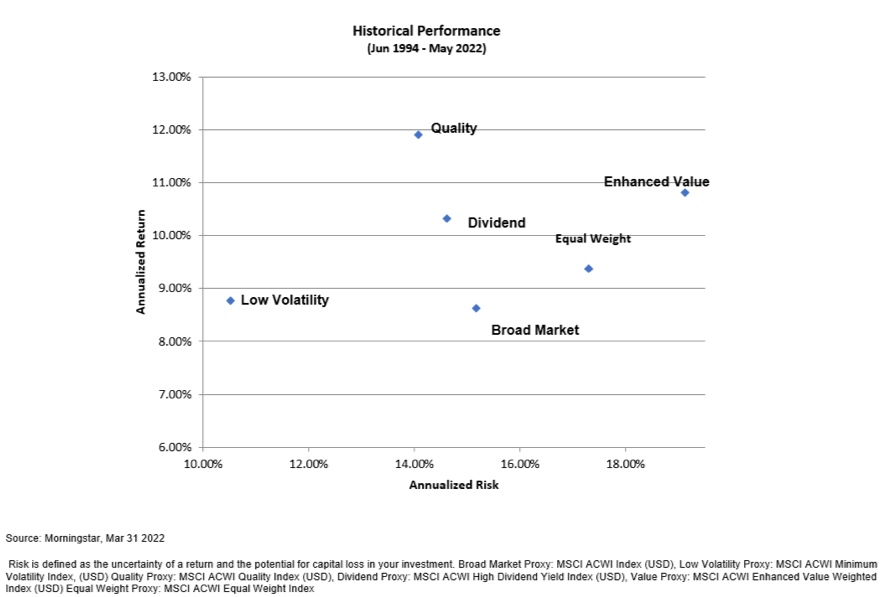

As you can tell from the chart above, if you’re a risk averse dividend investor, Canada’s pipeline’s are a much more stable bet (although potentially with much less of an upside) over the medium- and long-term.

Mike Heroux – the man behind DSR – is a CFA and has been studying Canada’s dividend players for several decades. His free webinars on the value of the mid-stream pipeline companies (they’re not building any more of them) versus the mercurial nature of the oil companies themselves really makes sense. You can read our full Dividend Stock Rocks review here.

The Long-term Strength of Energy Stock Dividends

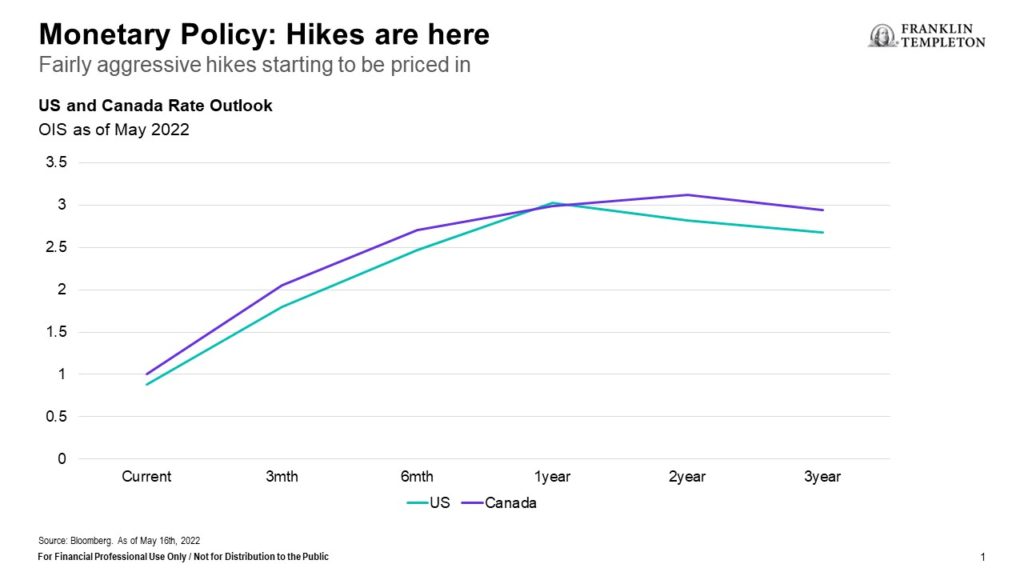

The story on energy stocks has evolved, in that our green desires do not match the energy reality. Today there are reasonable fears of an energy crunch that could turn into an energy crisis. The renewable energy transition will take a decade or two.

In the meantime we have increasing demand for oil and gas and greatly decreased CAPEX: there’s little desire to look for more oil and gas. In fact, it’s politically unfashionable to suggest that we need more oil and gas, or to spend the time and money necessary to find and produce more oil and gas.

That sets up a secular and positive trend for traditional oil and gas. It is an unfortunate reality.

The story goes back to the most basic economic principle: supply and demand.

On the bullish side, Eric Nuttall, portfolio manager at NinePoint Partners, suggests it is a generational investment opportunity. Eric often reminds us that the free cash flow that many of these companies produce is beyond generous, it is ridiculous. They can quickly pay down debt, buy back shares and return more value to shareholders by way of generous dividend increases.

The Big Oil Stocks Idea

Looking at returns for Canada’s “Big 3” oil stocks over the last year have been eye-opening.

Here is the portfolio income chart from that post, with a hypothetical starting amount of $10,000. It is an equal weight portfolio of The Big 3. We see that there was no oil drought, no oil recession for the investor that went ‘big’ with their Canadian energy stock selection.

The big oil stock consideration was and is Canadian Natural Resources (CNQ), Suncor (SU) and Imperial Oil (IMO). In Million Dollar Journey’s post on the top Canadian Dividend Growth Stocks you’ll find ‘The Big 3’.

In August of 2020 I noted that the dividends had held up reasonably well.

- Canadian Natural Resources (CNQ) had maintained its dividend and offered a yield of almost 6.3%.

- Imperial Oil (IMO) has maintained its dividend and at the time delivered a yield of almost 3.8%.

- After a dividend cut of 55% Suncor (SU) was down to a yield of 3.7%.

But the free cash flow is now feeding sweet dividend increases, or should we say dividend gushers.

- In April of 2021 CNQ increased its dividend by 10.6%, followed by 25% and 27.7% increases

- In July of 2021 IMO increased its dividend by 22.7% followed by a 25.9% increase

- In December of 2021 SU increased its dividend by 100% (in June of 2022 they gave it another 11.90% boost.

The Canadian Energy Stocks Dividend Growth Scorecard

From the time of the first energy stock article on MDJ.

- CNQ, 0.425 to 0.75 an increase of 76.5%

- SU, 0.21 to 0.47 an increase of 123%

- IMO, 0.22 to 0.34 an increase of 54.5%

The Big 3 offered an average of 84.7% dividend growth over less than a 2-year period.

I had suggested that the oil and gas sector has the potential to be the greatest source of dividend growth within the Canadian market. That is playing out in spades. Of course Canadian investors were also keeping an eye on Canadian bank stocks.

Regulators had forced the banks to suspend dividend increases and share buybacks during the pandemic. Those restrictions were removed, and we were treated to double digit dividend growth for Canadian banks and financials.

We expect more dividend growth announcements this month.

What if you had Investedin the Big 3 Oil Stocks?

From that time of that post you would have seen some generous and growing income. That said, you would also have total returns that would have almost tripled the total returns compared to the TSX Composite.

You’ll also see the pipelines in there. Those are my two pipe holdings, Enbridge (ENB) and TC Energy (TRP). You’ll find those companies in the portfolio that focuses on Canadian Wide Moat Stocks and are stellar Canadian dividend all stars.

They matched the returns of the market for the period. They have been offering a wonderful inflation hedge as well. While the pipes don’t have the torque of the energy producers, they have delivered returns of over 16% in 2022, to the end of April.

Back in 2020, I had suggested that I would stick with being a toll taker, collecting tolls and dividends by way of those pipelines that move the oil and gas around North America. Of course, Enbridge and TC Energy are much more diversified and do have energy producing operations as well. Continue Reading…