By Sa’ad Rana, Senior Associate – ETF Online Distribution, BMO ETFs

(Sponsor Blog)

With recent market volatility, investors are demanding solutions that stay afloat during market ups and downs. When looking at behavioural finance studies around loss aversion, an interesting finding arises that people’s fear of loss is (psychologically) twice as powerful versus the pleasure they experience from gains. This is one reason we have seen investors pulling money out of the markets in the past couple months. In reality, this may be a disservice to themselves, if they could just stay invested in a solution that could ease those bumps in the road, they would be better off. Low Volatility investing is one such solution.

So, what is Low Volatility (Low Vol) Investing? Well, it is an approach to investing that allows one to gain equity exposure for some possible growth in their portfolio while providing downside protection.

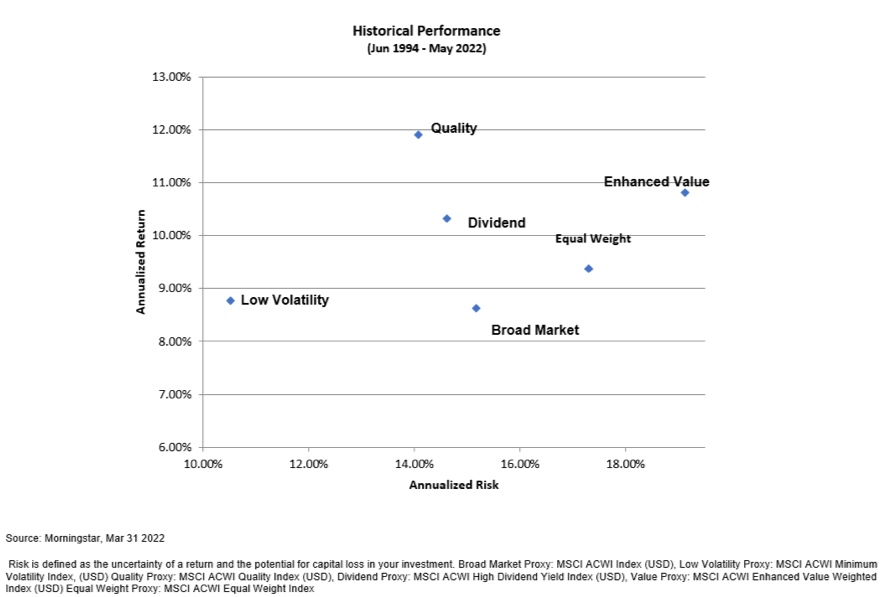

The chart below (long-term historical performance of the MSCI ACWI – global equities) perfectly demonstrates this. Low Vol is sitting a little bit higher than the broad market (from a returns aspect) but, yet significantly reducing risk. Low Vol sitting at around 10%, whereas the average equity risk is approx. around 15%.

Measuring Low volatility and BMO ETFs’ Approach

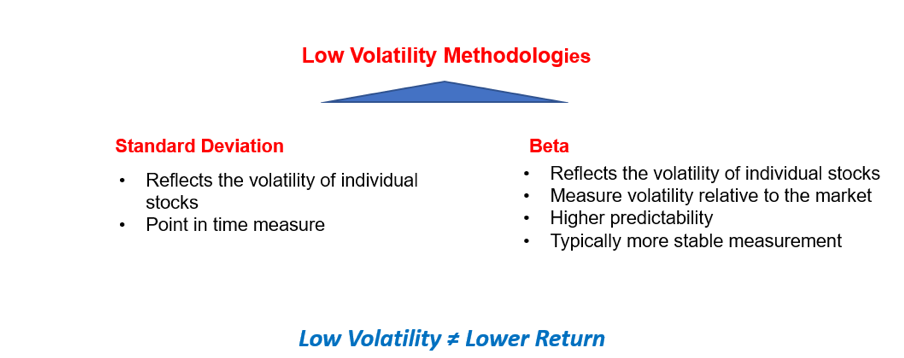

Low-volatility is a type of factor-based investing, which is a process that is repeatable and disciplined in its execution. Therefore, in order to invest in this manner, you need to use metrics to identify between what is considered a low volatility stock vs. a high volatility stock. There are a lot of different approaches in the market. The two most prevalent are the Low Beta and Standard Deviation methodologies.

Beta is a risk metric that measures an investment’s sensitivity to fluctuations in the broad market (market sensitivity). The broad market is assigned a beta value of 1.00, an investment with a beta less than 1.00 indicates the investment is less risky relative to the broad market. Low beta investments are less volatile than the broad market and can be considered defensive investments. Over the long term, low-beta stocks may benefit from smaller declines during market corrections and still increase during advancing markets. Additionally, low-beta stocks tend to be more mature and provide higher dividend yield than the broad market.

Standard deviation helps determine market volatility or the spread of asset prices from their average price. When prices move wildly, standard deviation is high, meaning an investment will be risky. Low standard deviation means prices stable, so investments come with low risk.

BMO ETFs was the first ETF provider to launch a low volatility strategy in Canada (ZLB – BMO Low Volatility Canadian Equity ETF). To develop our low volatility strategy, we identified beta as the most appropriate risk metric as it measures a security’s sensitivity to the movements of the broad market. By selecting securities with lower betas, investors are able to access a portfolio that is designed to reduce market risk.

Beta is a smarter portfolio construction tool when compared to standard deviation (stock’s volatility relative to itself) because it does a better job at sheltering investors from large market events. When using beta, it is also advised to look at a longer term metric (ex. 5 year beta) in order to ensure that the stock performs with less volatility over the longer term.

So why Low Volatility Investing now?

Concerns around a recession have certainly been hitting the markets over the last couple of months. When economic prospects are decreasing, what you tend to see is that cyclical stocks are sold off and the more defensive stocks (on a relative basis) tend to perform better. So, in market conditions such as the one we are in at the moment (most of 2022 for that matter), low vol investments tend to perform relatively well.

This methodology may underperform when you have an indiscriminate rally, but what you see is low volatility is still going to give you some solid equity upside (possibly a little less than the broad market). The real value add with low vol is during these tough times with high volatility in the market. They can help protect capital and help put investors’ portfolios in a better position to succeed for the long term

For more information on BMO ETFs’ Low Volatility suite, please visit and subscribe to our YouTube channel by clicking HERE.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.