By John De Goey, CFP, CIM

Special to Financial Independence Hub

There seems to be some confusion around what to expect for monetary policy in 2024. There’s a strong consensus that cuts are coming, but what is far less certain is how many – and why they are implemented.

Let’s assume that all cuts are of the traditional 25 basis point variety. Since the bank rate is adjusted every six weeks, there will be eight or nine opportunities to adjust it in 2024 in both Canada and the United States.

There are as many as three narratives making the rounds about what might be in store. Each narrative has a combination of rate cuts for monetary policy and corresponding outcomes for the broader economy. I attended a luncheon last week hosted by Franklin Templeton, where senior representatives outlined three possible scenarios with three different narratives accompanying them. A similar perspective was offered earlier this week by the Vanguard Group.

The three narratives are as follows:

#1 We have a soft landing.

The soft landing involves the economy remaining relatively robust, employment remaining strong, delinquency is modest, and rates are normalizing at a level close to but somewhat lower than where they are right now. Most people would suggest that scenario involves no more than two cuts in 2024.

#2 We have a routine recession.

To be more precise, the second narrative involves a garden-variety recession that lasts perhaps a couple of quarters that involves only modest reductions in economic activity over that time frame. Nonetheless, this scenario includes five or six rate cuts to stimulate the economy to the point where things can become stable going forward.

#3 We have a severe recession.

The final narrative involves massive cuts that are made out of desperation to keep the economy from plunging into an abyss. This scenario is not only the most drastic, but also seems to be the least likely. Nonetheless, if things get really ugly, seven, eight or nine rate cuts might be needed to stanch the bleeding. One or more of those cuts might even be for 50 basis points or more.

While I accept the logic associated with all three scenarios, I cannot help but notice that much of the financial services industry is conflating those scenarios in a way that strikes me as being intellectually inconsistent. The financial services industry has long been overly optimistic in the way it portrays outlooks and forecasts. It routinely engages in something I call bullshift, which is the tendency to shift your attention to make you feel bullish about the future.

There can be little doubt that stimulative cuts are positive developments for capital markets. What the industry seems disinclined to acknowledge is that cuts are often made out of desperation. People need to look no further then what happened throughout the entire industrialized world in the first quarter of 2020. Central banks in all major economies cut rates to essentially zero by the end of March of 2020 in the aftermath of the COVID pandemic. At the time it was seen as being both necessary and reasonable, given the severity and breadth of the challenge.

Reining in Inflation

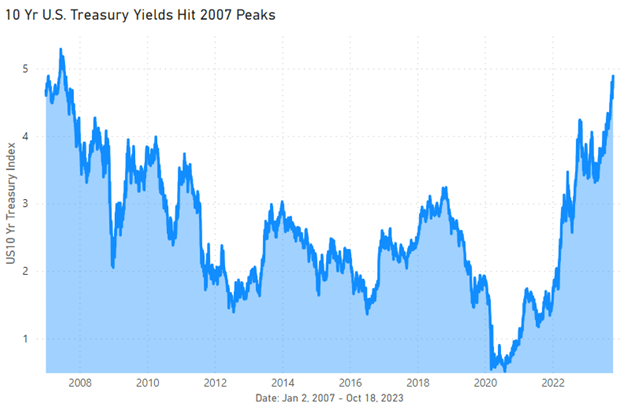

As we all know, inflation became the primary public policy challenge by the beginning of 2022. Central banks needed to take what looked like draconian measures to rein in inflation, which had risen to generational highs and needed to be brought under control lest a sustained period of inflation like what was experienced in the 1970s were to recur. By the end of 2023, inflation is still higher than the high end of the range that is deemed to be acceptable for most central banks.

There is still work to be done, yet many pundits seem eager to take a victory lap, as if a reduction in inflation is somehow akin to bringing inflation under control. Much has been done over the past 20 months, but more work is needed. The admonition that rates will have to stay higher for longer is a very real constraint on economic activity and long-term growth prospects. We head into the new year on the horns of a dilemma. Bond market watchers are now suggesting that rate cuts will come no later than Q2 2024, whereas central bankers are insisting that those cuts will be modest and will only begin in Q3 of 2024 at any rate. They cannot both be right.

It gets worse. Most commentators have taken to suggesting that we will have both a soft landing and five or six rate cuts in the New Year. That strikes me as being fantastic – not to mention intellectually inconsistent. If we have a soft landing, it will likely entail the economy being remarkably resilient as it has been throughout 2023. There is absolutely no reason to have a parade of rate cuts in such an environment.

Stated differently, the financial services industry needs to pick a lane. If it believes we will have a soft landing in 2024, it should also be anticipating a very small number of very modest cuts in the second half of the year. Conversely, if it believes a recession is on the horizon, it should be forecasting multiple cuts only after it is clear a recession is underway. These would likely be needed to stimulate the economy in an environment where inflation will likely be modest as a direct result of economic weakness.

To hear the industry tell it, the economy will remain strong, but we’ll get multiple rate cuts anyway. You can’t have it both ways. I call Bullshift.

John De Goey is a Portfolio Manager with Designed Securities Ltd. (DSL). DSL does not guarantee the accuracy or completeness of the information contained herein, nor does DSL assume any liability for any loss that may result from the reliance by any person upon any such information or opinions.

John De Goey is a Portfolio Manager with Designed Securities Ltd. (DSL). DSL does not guarantee the accuracy or completeness of the information contained herein, nor does DSL assume any liability for any loss that may result from the reliance by any person upon any such information or opinions.