Higher interest rates are here to stay, according to the Vanguard Economic and Market Outlook for 2024, delivered online on Tuesday, Dec. 12. The following is an advance document viewed under embargo and it has been edited down from a Global Summary prepared by Vanguard Global Chief Economist Joseph Davis and the Vanguard global economics team. Anything below in quotes is directly lifted from that document. Otherwise, I have used ellipses and/or paraphrased to make this fit the Hub’s normal blog format. Subheadings are also by Vanguard. At the end of this blog, we have also added a chart about Canada in particular, and projected investment returns in Canada and the rest of the world, supplied by Vanguard Canada.

Higher interest rates are here to stay, according to the Vanguard Economic and Market Outlook for 2024, delivered online on Tuesday, Dec. 12. The following is an advance document viewed under embargo and it has been edited down from a Global Summary prepared by Vanguard Global Chief Economist Joseph Davis and the Vanguard global economics team. Anything below in quotes is directly lifted from that document. Otherwise, I have used ellipses and/or paraphrased to make this fit the Hub’s normal blog format. Subheadings are also by Vanguard. At the end of this blog, we have also added a chart about Canada in particular, and projected investment returns in Canada and the rest of the world, supplied by Vanguard Canada.

The main paper begins:

“Higher interest rates are here to stay. Even after policy rates recede from their cyclical peaks, in the decade ahead rates will settle at a higher level than we’ve grown accustomed to since the 2008 global financial crisis (GFC). This development ushers in a return to sound money, and the implications for the global economy and financial markets will be profound. Borrowing and savings behavior will reset, capital will be allocated more judiciously, and asset class return expectations will be recalibrated. Vanguard believes that a higher interest rate environment will serve investors well in achieving their long-term financial goals, but the transition may be bumpy.”

Monetary policy will bare its teeth in 2024

“The global economy has proven more resilient than we expected in 2023. This is partly because monetary policy has not been as restrictive as initially thought. Fundamental changes to the global economy have pushed up the neutral rate of interest — the rate at which policy is neither expansionary nor contractionary. Various other factors have blunted the normal channels of monetary policy transmission, including the U.S. fiscal impulse from debt-financed pandemic support and industrial policies, improved household and corporate balance sheets, and tight labor markets that have resulted in real wage growth.

In the U.S., our analysis suggests that these offsets almost entirely counteracted the impact of higher policy interest rates. Outside the U.S., this dynamic is less pronounced. Europe’s predominantly bank-based economy is already flirting with recession, and China’s rebound from the end of COVID-19-related shutdowns has been weaker than expected.

The U.S. exceptionalism is set to fade in 2024. We expect monetary policy to become increasingly restrictive as inflation falls and offsetting forces wane. The economy will experience a mild downturn as a result. This is necessary to finish the job of returning inflation to target. However, there are risks to this view. A “soft landing,” in which inflation returns to target without recession, remains possible, as does a recession that is further delayed.

In Europe, we expect anemic growth as restrictive monetary and fiscal policy lingers, while in China, we expect additional policy stimulus to sustain economic recovery amid increasing external and structural headwinds.”

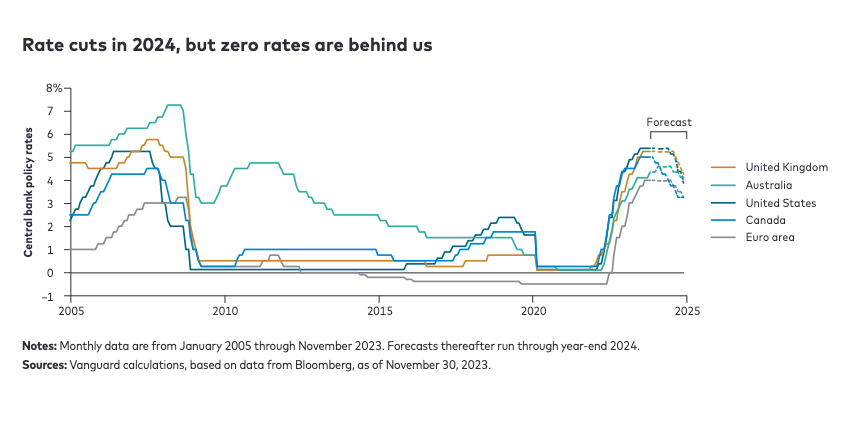

Zero rates are yesterday’s news

“Barring an immediate 1990s-style productivity boom, a recession is likely a necessary condition to bring down the rate of inflation, through weakening demand for labor and slower wage growth. As central banks feel more confident in inflation’s path toward targets, we expect they will start to cut policy rates in the second half of 2024.

That said, we expect policy rates to settle at a higher level compared with after the GFC and during the COVID-19 pandemic. Vanguard research has found that the equilibrium level of the real interest rate, also known as r-star or r*, has increased, driven primarily by demographics, long-term productivity growth, and higher structural fiscal deficits. This higher interest rate environment will last not months, but years. It is a structural shift that will endure beyond the next business cycle and, in our view, is the single most important financial development since the GFC.”

A return to sound money

“For households and businesses, higher interest rates will limit borrowing, increase the cost of

capital, and encourage saving. For governments, higher rates will force a reassessment of fiscal

outlooks sooner rather than later. The vicious circle of rising deficits and higher interest rates

will accelerate concerns about fiscal sustainability.

Vanguard’s research suggests the window for governments to act on this is closing fast — it is

an issue that must be tackled by this generation, not the next.

For well-diversified investors, the permanence of higher real interest rates is a welcome

development. It provides a solid foundation for long-term risk-adjusted returns. However, as the

transition to higher rates is not yet complete, near-term financial market volatility is likely to

remain elevated.

Bonds are back!

Global bond markets have repriced significantly over the last two years because of the transition

to the new era of higher rates. In our view, bond valuations are now close to fair, with higher

long-term rates more aligned with secularly higher neutral rates. Meanwhile, term premia

have increased as well, driven by elevated inflation and fiscal and monetary outlook

uncertainty.

Despite the potential for near-term volatility, we believe this rise in interest rates is the single

best economic and financial development in 20 years for long-term investors. Our bond

return expectations have increased substantially.

We now expect U.S. bonds to return a nominal annualized 4.8%–5.8% over the next decade,

compared with the 1.5%–2.5% annualized returns we expected before the rate-hiking cycle began.

Similarly, for international bonds, we expect annualized returns of 4.7%–5.7% over the next

decade, compared with a forecast of 1.3%–2.3% when policy rates were low or, in some cases,

negative.

If reinvested, the income component of bond returns at this level of rates will eventually more

than offset the capital losses experienced over the last two years. By the end of the decade,

bond portfolio values are expected to be higher than if rates had not increased in the first place.

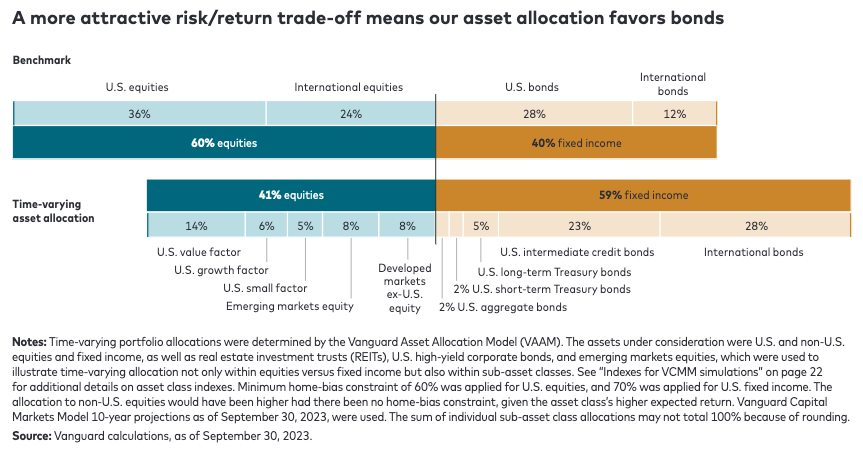

Similarly, the case for the 60/40 portfolio is stronger than in recent memory. Long-term

investors in balanced portfolios have seen a dramatic rise in the probability of achieving

a 10-year annualized return of at least 7%, the post-1990 average, from an 8% likelihood in 2021

to 40% today.

Moving up the risk spectrum, credit valuations appear fair in the investment-grade space but

relatively rich in high-yield. What’s more, the growing likelihood of recession and declining

profit margins skew the risks toward wider spreads.

Higher rates leave equities overvalued

A higher-rate environment depresses asset price valuations across global markets while squeezing

profit margins as corporations find it more expensive to issue and refinance debt.

Valuations are most stretched in the U.S. As a result, we have downgraded our U.S. equity

return expectations to an annualized 4.2%–6.2% over the next 10 years from 4.4%–6.4% heading

into 2023.

Within the U.S. market, value stocks are more attractive than they have been since

late 2021, and small-capitalization stocks also appear attractive for the long term.

U.S. equities have continued to outperform their international peers. The key drivers of this

performance gap over the last two years have been valuation expansion and U.S. dollar strength

beyond our fair-value estimates, both of which are likely to reverse. Indeed, our Vanguard Capital

Markets Model® (VCMM) projections suggest an increasing likelihood of greater opportunities

outside the U.S. from a U.S. dollar investor’s perspective. We project 10-year annualized

returns of 7.0%–9.0% for non-U.S. developed markets and 6.6%–8.6% for emerging markets.

The global equity risk premium that emerges from current stock and bond market valuations

is the lowest since the 1999–2009 “lost decade.”

The spread between global equity and global bond returns is expected to be 0 to 2 percentage

points annualized over the next 10 years. In contrast to the last decade, we expect return

outcomes for diversified investors to be more balanced. For those with an appropriate risk

tolerance, a more defensive risk posture may be appropriate given higher expected fixed

income returns and an equity market that is yet to fully reflect the implications of the return to

sound money.”

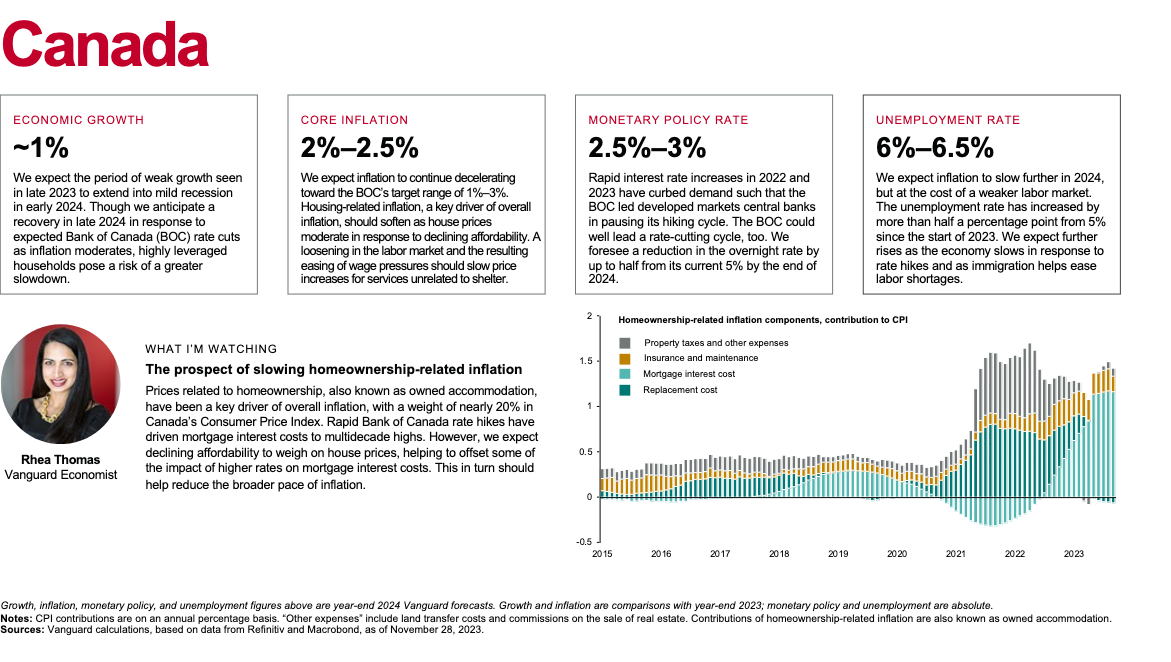

Outlook for Canada

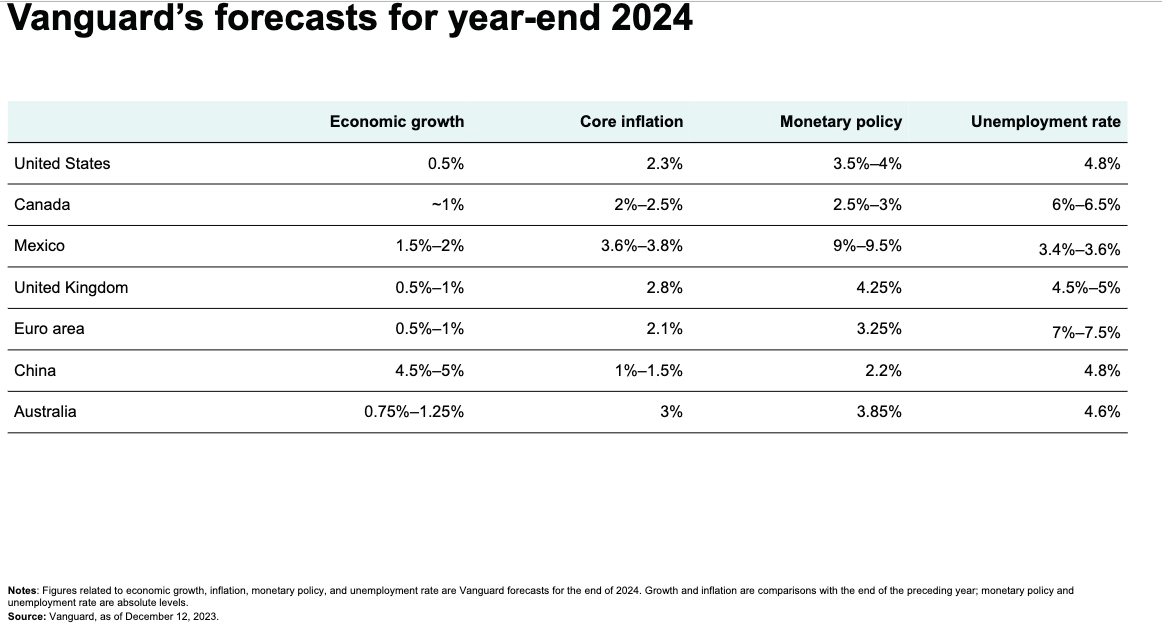

Vanguard Canada also released some Canadian-specific charts and commentary, shown below, plus these updated 10-year annualized return projections:

- Canadian equities: 5.3%-7.3%

- Canadian bonds: 4.3%-5.3%

- U.S. equities: 4.2%–6.2%

- U.S. bonds: 4.8%-5.8%

- Global equities (developed): 7.0%-9.0%

- Global equities (emerging): 6.6%-8.6%

- Global bonds: 4.7%-5.7%

Finally, a press release issued by Vanguard Canada sings the praises of the traditional 60/40 Balanced portfolio (60% stocks to 40% bonds), the asset allocation used in its own VBAL Asset Allocation ETF, and by competitors BMO in its ZBAL ETF and BlackRock iShares in its XBAL ETF (among others.)

Long live 60/40!

From Joe Davis again:

Vanguard’s global outlook is designed to guide investors in maintaining a long-term perspective and support the case for portfolio diversification. Despite misguided criticism from skeptics, the case for a balanced portfolio is strong. Long-term investors in 60/40 portfolios have seen a dramatic rise in the probability of achieving a nominal return of 7% (currency in USD). This is due in part to higher interest rates spurring a substantial increase in bond return expectations. For equities, however, the higher-rate environment depresses asset price valuations across global markets while squeezing profit margins, as corporations find it more expensive to issue and refinance debt.

“This rise in interest rates is the single best economic and financial development in 20 years for long-term investors … we believe this is a secular trend that will last not just months, but years.”

Despite misguided criticism from skeptics, the case for a balanced portfolio is strong. Long-term investors in 60/40 portfolios have seen a dramatic rise in the probability of achieving a nominal return of 7% (currency in USD). This is due in part to higher interest rates spurring a substantial increase in bond return expectations. For equities, however, the higher-rate environment depresses asset price valuations across global markets while squeezing profit margins, as corporations find it more expensive to issue and refinance debt.

“This rise in interest rates is the single best economic and financial development in 20 years for long-term investors,” concludes Mr. Davis. “We believe this is a secular trend that will last not just months, but years.”