From getting over the fear of starting to looking into REITs, here are 12 answers to the question, “Can you share your most recommended tips for how you can invest your money to grow your wealth and increase your income, specifically for financial independence through investing?”

- Get Started Right Now

- Maximize Tax-advantaged Investments

- Avoid Trying to Time the Market

- Remember Diversification is More Important Than You Think

- Put Your Tax Refunds to work

- Create a High-Yield Savings Account

- Think of the Market as a Game

- Prioritize Risk Management Over Chasing High Returns

- Be Patient and Plan

- Raise Your Savings Rate by 5% Each Year

- Repay High-interest Debt

- Try REIT Index Funds

Get Started Right Now

Investing is one of those things that seems like an insurmountable barrier to entry for many people. How can I invest when I don’t have thousands of dollars just kicking around is a common attitude I’ve come across, and in my opinion, it is one of the biggest mistakes toward actually growing your wealth and becoming financially independent.

The thing is that you actually have to get started: even if it’s a few dollars at a time invested in penny stocks, you’ve got to make a start. Even if the amounts are negligible, you’re gaining invaluable experience in financial markets and financial literacy that will pay massive dividends down the line. — Dragos Badea, CEO, Yarooms

Maximize Tax-advantaged Investments

Both IRAs and 401(k)s have tax advantages [and the equivalent RRSPs and group RRSPs in Canada: editor]. You can choose to deduct your contributions from your taxes or contribute after taxes and avoid taxes when you withdraw during retirement.

IRAs and 401(k)s are easy to set up. A 401(k) is offered through employers, so if your workplace offers one and matches a percentage of your contributions, take advantage of that matching benefit.

Anyone can start an IRA. You can open an account online today with Fidelity or another firm. Many people assume it’s hard to set up, but it’s not. You can do it in half an hour.

With both options, you can set up automatic withdrawals from your paycheck. That option helps you succeed in saving because you don’t have to think about it. — Michelle Robbins, Licensed Insurance Agent, Clearsurance.com

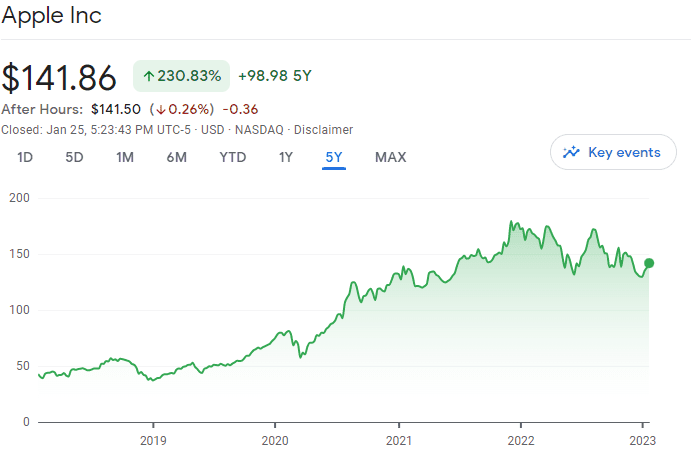

Avoid trying to Time the Market

Almost 80% of active fund managers fall behind the major index funds.

So if these financial professionals can’t beat the market, what chance do ordinary people like you and me have?

This is why my best investing tip is consistently putting money into an index fund like the S&P 500 without trying to time the market.

By putting a portion of your salary into an index fund every month for decades, your investments compound, allowing you to build unimaginable amounts of wealth.

For example, if you put just $300 a month into an index fund growing 8% annually, you’ll have over one million dollars after 40 years. — Scott Lieberman, Owner, Touchdown Money

Remember Diversification is more Important than you Think

Portfolio diversification is a powerful tool that can help protect your investments against large losses due to market downturns. By selecting assets with low correlation, you are essentially increasing the safety of your portfolio while pursuing rewards. This strategy has become indispensable for individual investors and financial advisors alike: after all, who wouldn’t want some extra security for their hard-earned money?

If you split them between two different companies, such as Invest A and B — one providing package deliveries and another offering video conferencing services — you’ll have far less reason for worry in times of economic hardship or other disruptive events! Look at how gas shortages can fuel success with Investment B: when stock prices dip on account of limited resources, people switch to digital communication tools from home, which ultimately benefits Investment B’s performance. — Derek Sall, Founder and Financial Expert, Life and My Finances

Put your Tax Refunds to work

Using your tax refunds to invest is a wise investing tactic to consider that you may have never thought about: for many, the short-term sacrifice is worth the long-term benefits, especially as you settle into life after work.

This is a great way to supplement your current income or even a retirement account, or jump-start a new investment account. Tax refunds can also be used for other pivotal financial reasons, including paying off debt, funding an IRA, building a health savings account, and creating an emergency stash. — Dakota McDaniels, Chief Product Officer, Pluto

Open a High-Yield Savings Account

While savings accounts aren’t exciting ways to grow your wealth, online banks are currently paying 3-4% interest. While 3-4% might not seem like much, it only takes a few minutes to set up an account, meaning you can earn interest risk-free while also keeping your money easily accessible. — Larissa Pickens, Co-Founder, Worksion

Think of the Market as a Game

For investing, I always tell people to think of the stock market as a big game of poker.

Invest in real estate: “I like to think of real estate as the gift that keeps on giving. With rental properties, you’re not just earning income from tenants, but also building equity over time.”

Start your own business: “Entrepreneurship is not for the faint of heart, but neither is settling for a mediocre 9-5 job. Starting your own business is like taking a leap of faith and trusting that you’ve got what it takes to make it happen. Just remember to pack a parachute.”

Invest in yourself: “Investing in yourself is like planting a money tree, except instead of watering it with H2O, you’re watering it with knowledge and experience. So, go ahead and take that online course, attend that industry conference, or volunteer for that new project. Your future self will thank you.” — Russ Turner, Director, GallantCEO

Prioritize Risk Management over Chasing High Returns

Although even small returns can accumulate into significant wealth through compounding, a single failed investment can cause a substantial loss.

To mitigate risk, I employ the dollar-cost averaging (DCA) strategy when investing in the S&P 500. The S&P 500 is already a diversified index, reducing the risk associated with individual stock investing. Furthermore, the DCA strategy further minimizes risk by investing fixed amounts of money at regular intervals, regardless of the market’s ups and downs. Continue Reading…