By Bob Lai, Tawcan

Special to Financial Independence Hub

A new year is here and many investing-focused Canadians like us are overjoyed. Because this means new contribution room for TFSA and RRSP.

If you look at our dividend portfolio, you’ll see that we currently own 50 individual dividend stocks and 1 index ETF. Interestingly, despite making an effort at reducing the number of holdings last year, we ended up now at the end of the year with the same number as we had at the beginning of 2022.

The individual stocks we own consist of a mix of US and Canadian stocks:

- 18 US dividend stocks including big international brands like Visa, Apple, Costco, Coca-Cola, Pepsi, and McDonald’s. We only own US dividend paying stocks in our RRSPs in order to avoid the 15% withholding tax on foreign dividends.

- 31 Canadian dividend stocks including well-known Canadian brands like TD, Royal Bank, Enbridge, BCE, Telus, and Fortis. We hold these Canadian dividend paying stocks in TFSAs, RRSPs, and non-registered accounts.

With the new contribution room for TFSA and RRSP, we are eager to purchase more shares of the stocks and index ETF that we already own, rather than initiate new positions. But again, plans are only plans and can change if a new potential new position becomes too attractive to ignore.

Here are 5 stocks we plan to buy in 2023 and our rationale for each:

5 stocks we plan to buy in 2023

Before we proceed further, please note that I’m not a professional financial advisor. Whatever I write and share on this blog is purely my personal opinion. It should not be treated as advice or recommendations. Please always do your own research and due diligence before buying and selling stocks or ETFs. Thank you.

1.) Apple (AAPL)

Despite only owning an iMac at home and no other Apple products, both Mrs. T and I like Apple a lot. We are probably one of the rare households that are not deeply tied into the Apple ecosystem despite owning a Mac.

Why do we like Apple? Well, what’s not to like when the company makes billions and billions of dollars each quarter?

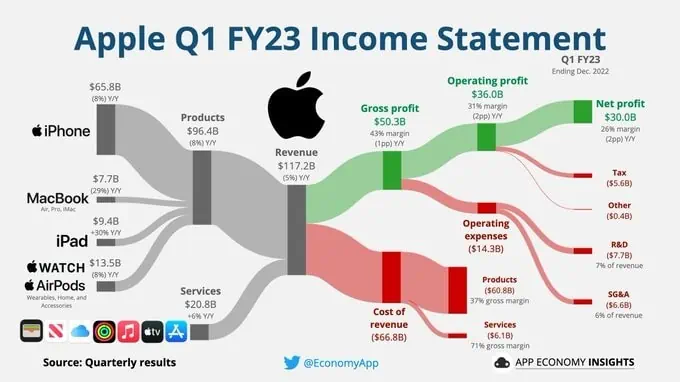

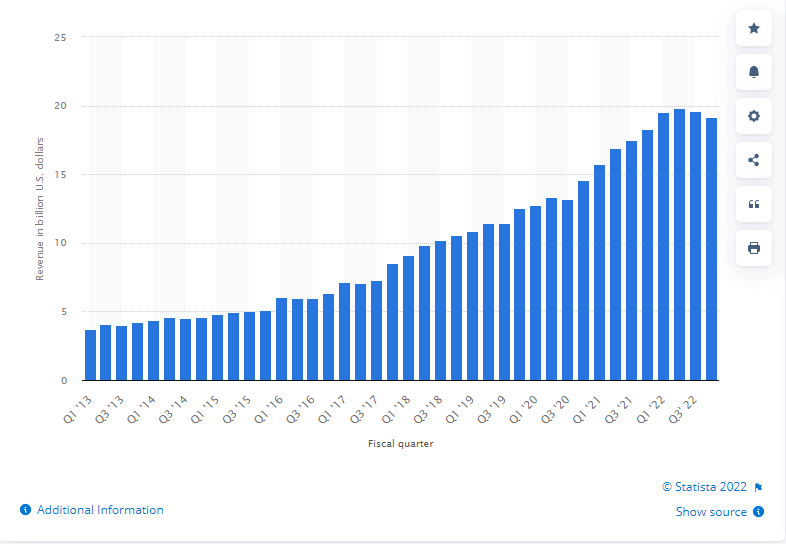

While iPhones make up the bulk of Apple’s revenues, revenues from services have increased over the years as you can see from the chart below.

Yes, Apple’s Q1 2023 results look a bit disappointing – down 5% YoY, a bigger drop than many analysts expected due to iPhone supply issues. The EPS was $1.88 versus the $1.94 estimated, and down 10.99% YoY.

We all know that Apple products are usually more expensive than its competition, yet people continue to buy them. Due to its brand name, Apple is able to charge a premium over its competition (aka the Apple tax) and as a result, enjoy a higher gross margin (in case you’re wondering Apple’s Q1’23 gross margin was 42.96%!).

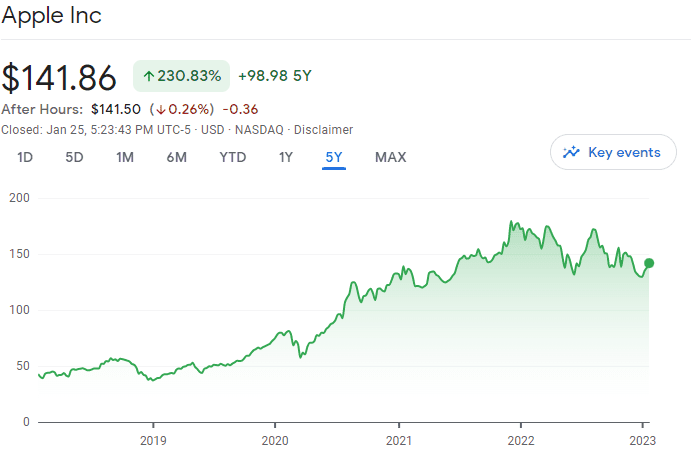

Apple’s share price has struggled a bit in 2022, mostly caused by uncertainties in the rising interest rate environment. But Apple’s share price has continued to go up over the long term.

Apple has a 10-year dividend increase streak with a 10 year dividend growth rate of 25.26%. Although the dividend yield is extremely low, the overall total return has been quite impressive.

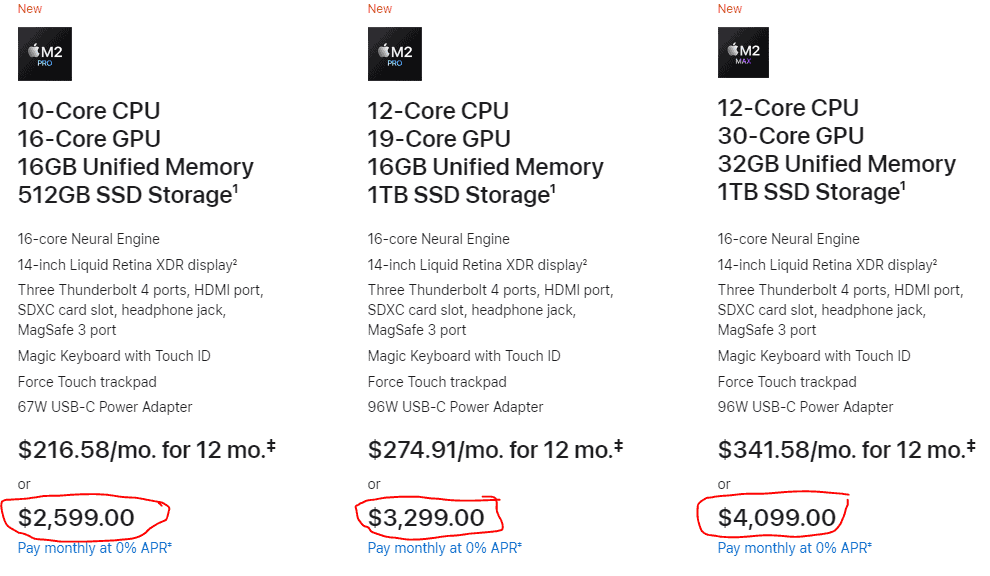

I believe 2023 will be a big year for Apple as we expect many new products to be announced. Just last month, Apple announced M2 Pro and M2 Max based MacBook Pro and Mac mini as well as HomePod.

One very important to note, as I pointed out in the tweet above, is that every Apple desktop and laptop (except Mac Pro) now all have integrated components. This means the desktops and laptops are not user upgradable at all. To-be-Mac-owners must decide whether to buy additional RAM and SSD storage at the time of purchase.

Let’s not forget Apple charges an arm and a leg for these upgrades! For example, going from 16 GB unified memory to 32 GB on a 14-inch MacBook Pro will cost you $500 CAD. And going from a 1TB SSD to a 2 TB SSD will cost you $500 CAD.

Did I mention that these laptops and desktops aren’t cheap to start with?

It sucks to be an Apple customer when you have to buy a new laptop or desktop and need memory and storage upgrades. But this is really good news for Apple shareholders.

Yes, XAW isn’t a stock, but rather an index ETF. Since we plan to add more XAW shares throughout 2023, I thought I’d include it on the list.

Why buy more XAW shares?

One word – diversification.

XAW holds more than 9,000 international stocks with more than 60% exposure to the US market, 6% exposure to the Japanese market, 4% exposure to the UK market, 3% exposure to the Chinese market, and exposure to other global markets. So by holding XAW, we are able to get an instant asset and geographical diversification. This kind of diversification is nearly impossible to do when holding individual dividend stocks.

Furthermore, XAW is also good for many Canadian investors who have an inherent Canadian bias, holding arguably an overly high percentage of their portfolio in Canadian stocks.

We plan to add more XAW throughout this year in our RRSPs and non-registered accounts and take advantage of the commission-free ETF purchase that Questrade offers.

At the time of writing, XAW is one of the top five holdings in our dividend portfolio. We are hoping to purchase more XAW so it can rise to be the top or second-place holding in our portfolio.

3.) Waste Connections Inc (WCN.TO)

We started buying WCN shares in late 2021 but didn’t get a chance to get more when the stock market was volatile in the latter half of 2022. Overall, I really like the business sector WCN is in – people will produce garbage and waste and companies like Waste Connections will collect, transfer, dispose of them, and make a profit.

Because people produce garbage regardless of whether it’s a bull or a bear market, WCN’s business should be quite stable. In other words, the waste management sector is a recession-proof area. Given a potential recession in the future, it makes sense to add more shares of WCN.

WCN’s dividend yield is below 1%, so many income-focused investors may ignore it. However, WCN has been raising its dividend for 13 straight years with a 10 year dividend growth rate of 14.4% and a 5 year dividend growth rate of 13.6%. Whichever you slice it, WCN’s dividend growth rate has been quite impressive.

In addition to an impressive dividend growth rate over the years, WCN’s share price performance has been quite impressive as well.

While many dividend investors’ prime focus is dividend income, I believe total return does matter.

Which of these two scenarios would you prefer?

- Scenario A: $500k invested, producing $30,000 in dividends a year, the portfolio value is at $550k.

- Scenario B: $500k invested, producing $20,000 in dividends a year, the portfolio value is at $1M.

For me, I’d rather take Scenario B with $1M in portfolio value and a lower dividend income, because I do have the option of selling shares to supplement the dividend income. Furthermore, when you’re still in the accumulating phase, it is probably better to focus on low yield high dividend growth stocks instead of high yield low dividend growth stocks.

4.) National Bank (NA.TO)

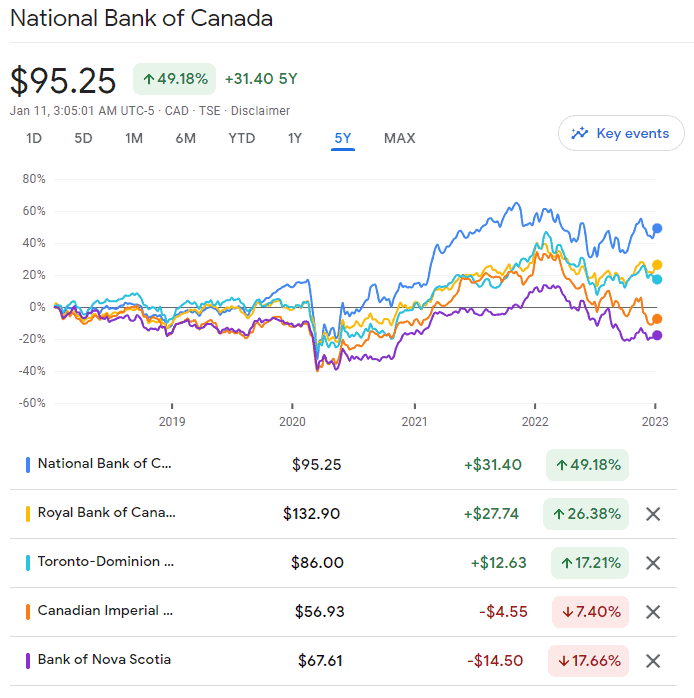

National Bank has performed quite well in the last five years compared to its peers.

In addition, if we compare the total dividend increase of the six Canadian banks since the summer of 2020, we come to the following numbers:

- National Bank +37%

- Bank of Montreal +35%

- Royal Bank +22%

- TD +22%

- CM +16%

- Bank of Nova Scotia +14%

As you can see, National Bank leads the way in both share price performance and dividend increase. The one thing National Bank has on its side is that it is still relatively small compared to the Big Five. This means that National Bank has more room for additional growth.

Interestingly, if we go back further and compare the 10 year dividend growth rate, National Bank falls down to the second position, but still remains quite impressive all things considered.

10-year dividend growth rate:

- TD + 9.4%

- National Bank +8.8%

- Royal Bank +8.1%

- Bank of Nova Scotia +6.4%

- Bank of Montreal +6.8%

- CM +6.1%

For this year, we plan to add more NA shares so it makes a higher percentage of our dividend portfolio than Bank of Montreal.

5.) Telus (T.TO)

In 2022 we were busy buying more BCE shares and completely ignored Telus (Oops!). So in 2023, we plan to buy more Telus shares. Since we don’t own Rogers anymore, I believe it is important to have roughly the same exposure to BCE and Telus in our dividend portfolio.

Telus has a 19-year dividend increase streak with a 15 year dividend growth rate of 8.6%. At an initial dividend yield of around 4.9% makes Telus an attractive dividend-paying stock to hold.

What makes Telus quite attractive is that the management has declared that the target is raising its dividend twice a year, producing an annual dividend growth rate between 7 to 10% for the next few years.

The one thing I like about Telus is that the company has managed to stay true to its telecommunication core. Unlike Rogers and BCE, Telus does not own any media businesses. Telus has been expanding into other complementary segments that utilize the telecommunication core strength, like security and health.

Telus International, which provides IT services for multilingual customer service to global clients, was spun out of Telus and went public in 2021. We may see a similar trend for Telus’ security and health segment in the future.

Summary – 5 stocks we plan to buy in 2023

Above are the 5 stocks we plan to buy in 2023. As you can see, we’re keeping it simple by adding shares to our existing holdings. We plan to max out our TFSA and RRSP and purchase these stocks in these two registered accounts first before buying more shares in our non-registered accounts.

Dear readers, which stocks do you plan to buy in 2023?

This blog originally appeared on the Tawcan site on Feb. 13, 2023 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.

This blog originally appeared on the Tawcan site on Feb. 13, 2023 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month.