Families confronted with dementia may be encouraged by this New York Times article this week: Biogen reports its Alzheimer’s drug sharply slowed cognitive decline.

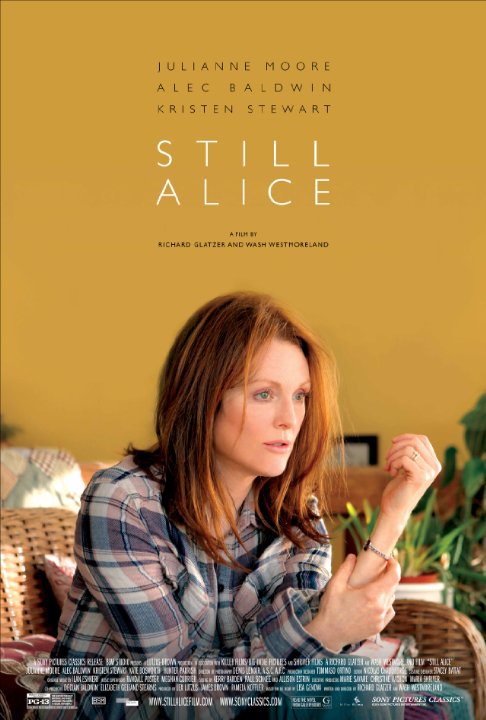

Fortunately, awareness of the scourge of dementia has been greatly raised by the success of the novel and then film, Still Alice, about a Harvard professor who suffers from early onset Alzheimer’s. The movie version debuted last autumn at the Toronto International Film Festival and Julianne Moore won an Academy Award for her performance. Just before the Hub launched in November, our sister site ran this piece, entitled The downside of rising longevity: Dementia.

But on the plus side of extended longevity come the stories of those who found business or creative success only late in life. Check out this piece posted earlier this weekend in the Hub’s Encore Acts section: Hope for late-bloomer Boomers: Success as an Encore Act.

From the Good Financial Cents blog comes 16 hobbies that can actually make you money. We at the Hub have always thought it makes cents (sense) to turn an avocation into a vocation that pays. That’s the whole point of the Encore Acts section of the Hub.

At his Chicago Financial Planner blog, Roger Wohlner takes a look at Schwab’s entry into the robo-adviser space — Schwab Intelligent Portfolios: The Evolution of the Robo Adviser. Continue Reading…