What does the Blockchain Revolution have to do with global prosperity and what’s this new cybercurrency called Prosperium?

What does the Blockchain Revolution have to do with global prosperity and what’s this new cybercurrency called Prosperium?

Let’s start with the bestselling book Blockchain Revolution, by technology guru Don Tapscott and his son Alex, a former investment banker. I recently re-read the book in preparation for a series of blogs I am doing for a cybercurrency start-up called Prosperium (http://www.prosperium.io/). Prosperium promotes and more importantly intends to generate actual community prosperity. This blog you’re now reading is the debut of that series.

My connection with the firm is through a serial entrepreneur and Canadian internet commerce pioneer named Tony Humble, who was the co-founder of Basis 100 (BAS: TSX). I have previously done business with Tony via The Wealthy Boomer magazine and website (which ran from 1999 to 2005) and later my financial novel Findependence Day, which spawned the Financial Independence Hub (where you’re reading this blog.)

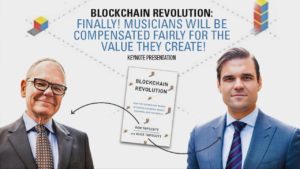

We’ll look at Prosperium and its business model specifically in the follow-up blog to this, including interviews with Prosperium’s founder, Doug Coyle (shown in photo near the end of this blog). But let’s focus first on Blockchain Revolution, since the book is as its title implies a revolutionary blueprint for all things fin-tech, including cybercurrencies like the original Bitcoin and everything spawned in its wake, including Canadian-inspired firms like Ethereum and now Prosperium.

I attended the original launch of the Tapscotts’ book at the Rotman School on May 5, 2016 and you can find my review at the Financial Post and a subsequent one on the Hub. The FP review ran the day after the launch, and the headline is as good a place to kick off this second look at the book: Bitcoin and Blockchain could be the start of a bigger revolution than the Internet itself.

Rather than repeat my points in this limited space I refer readers first to that review and then to my first Hub review of the book, which ran on June 1st, 2016. At the end you can find a link to a half-hour YouTube video produced by ThatChannel.com in which Norman Evans (the Hub’s creative director) and I interviewed both Tapscotts and some others who attended the Rotman launch.

Blockchain promises a quantum leap in global prosperity