By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

The final rate announcement from Canada’s central bank has come and gone: and it appears that the cost of mortgages and other forms of variable-rate borrowing are to remain stable well into next year.

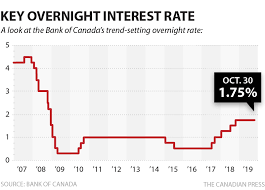

The Bank of Canada (BoC) opted to leave its trend-setting Overnight Lending Rate (which consumer lenders use to set the pricing of their variable mortgages and lines of credit) at 1.75% on December 4th. The rate has held status quo since October 2018, and makes the BoC somewhat of an outlier when it comes to monetary policy; many central banks around the world, including the U.S. Federal Reserve, cut interest rates this year to counter growing U.S.-China trade tensions, as well as the growing threat of recession.

A positive take on the Canadian economy

However, the BoC has maintained all year that while global economic instability remains a key risk, it feels confident enough in both the international and domestic economies to avoid adding stimulus. Of course, tweaking interest rates is a key tool the BoC has at its disposal in times of economic need; by keeping the cost of borrowing lower, it encourages continued consumer spending and helps avoid a credit crunch.

While a number of economists and analysts anticipated at least one downward rate cut in 2019, that never materialized. In its December announcement, the central bank stated, “There is nascent evidence that the global economy is stabilizing, with growth still expected to edge higher over the next couple of years.” It also adds that while the risk remains, a potential recession has become less likely, and that there is reason for optimism as Canada’s economy is stabilizing.

The December report outlines that end-of-year growth has progressed largely in line with what was forecasted in October, with consumer spending rising 1.3%, as well as upticks in business investment and wage growth. As well, the BoC’s most important metric, core inflation, stayed near its 2% target, and is expected to remain in that range over the next two years. As long as that remains the case, it’s unlikely the BoC will be prompted to cut or hike rates in the near future.

Lower rates to spur Housing demand in the New Year

With little chance of rate movement in the short term, what does that spell for Canada’s housing market? In what is somewhat of a self-fulfilling prophecy, the BoC included strengthening real estate activity as one of the main contributors to economic growth, further supporting its platform to keep rates at their current historical lows. Lenders have been able to keep their variable-rate offerings deeply discounted, while fixed mortgage rates have been kept down by especially low yields in the bond market.

That’s led to a boom in cheaper credit and mortgages over the course of 2019, which has fueled growing home-buyer demand; while the federal mortgage stress test did help tamp down some borrowing activity by requiring applicants to qualify for higher rates, the shock impact of the measure has largely been absorbed.

Housing Agency calls for home sales and prices to rise through 2021

That’s a trend that will continue over the next 12 to 24 months, according to several analysts. For example, Capital Economics has forecasted national house price growth will rise at least 6% in 2020 due to low mortgage rates, as well as a growing gap between housing supply and demand.

The Canada Mortgage and Housing Corporation, the federal housing agency that also runs the national mortgage default insurance program, has also forecasted an uptick in demand for homes for sale, as well as price growth, through 2021.

In its most recent Housing Market Outlook, CMHC Chief Economist Bob Dugan stated, “Housing starts are projected to stabilize in 2020 and 2021 at levels in line with long-run averages. This follows two years of declines from elevated levels in 2017. Resale activity and house prices expected to fully recover from recent declines, supported by growth in income and population.”

From a national perspective, sales will hit 497,000 transactions next year, with the average price rising 6.3% to $531,000.

Gains will be especially strong in the Ontario real estate market, as sales will hit 213,800 transactions, an increase of 7.2%, with the average price increasing by 6.5% to $633,700.

The Alberta market, in contrast, will see a much more muted growth, but will still be positive, with a 4.2% increase in sales at 56,900 units, and an average price of $383,400, up 2%.

The strongest recovery though, will be in the British Columbia market, where sales are poised to boom by a whopping 22.6% in 2020 at 84,400 transactions, while average home prices will rise by 3.6% to $749,500.

In total, 2020 is looking to be a competitive year for anyone looking to break into the housing market or get a mortgage; barring any kind of surprise economic incident, the BoC is likely to keep rates where they are, further stimulating real estate demand, and providing stability for those currently holding variable-rate mortgages.

Penelope Graham is the Managing Editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download our free iOS app.

Penelope Graham is the Managing Editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download our free iOS app.