There is something very wrong with the work world today. It is far too common to find employees who are tired, over-worked, stressed out, and living in fear of an uncertain future.

There is something very wrong with the work world today. It is far too common to find employees who are tired, over-worked, stressed out, and living in fear of an uncertain future.

As a result, people are eating too much, watching too much television, and complaining too much, often self-medicating with drugs and/or alcohol or taking prescription medication to cope with their stress.

How can it be that in North America, with two of the most prosperous societies in the world, people are taking more medications for anxiety, depression, and sleep disorders than ever before?

Blame it on the big dip.

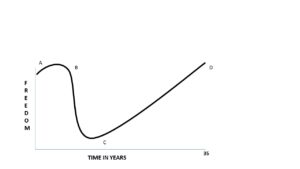

The graph above represents a typical person’s (mine) working lifecycle. I call it the “big dip” as it’s only fair to recognize Seth’s influence on the development of the concept.

You will note two axises, the vertical one representing personal freedom and the horizontal one representing time spent in years. The graph isn’t to scale but it does get the point of the story across. Be warned, it might scare you: it gave me the jitters when I first drew it so you might want to sit down for this one.

Entry point A is when you leave school and start working, maybe in a “corp.,” like I did. It’s a happy time. Life is fun and exciting and you do not have any significant worries. You are finally making some real money for the first time. One could reasonably say a person at this point is financially independent. They carry no personal debt, their parents still provide them with a roof over their head and food on the table. Life is as simple as it could be. Work-Eat-Have Fun-Repeat.

Everyone’s goal at this point is similar. Work hard, get promoted and make more money. This was the path to success as taught to them by their parents and teachers and every kid wants to look successful in the eyes of their parents, right?

Eventually you meet that special person, move out of your parents’ basement and get married. You are totally free for the first time. You are now calling the shots, as well as enjoying the benefits of two incomes. Life is sure sweet!

Impact of Mortgage Debt

Watch out because Point (B) is where the big dip starts. Point (B) is when you decide to buy a house in anticipation of starting a family and this of course requires the taking on of a hefty mortgage. Say bye bye to financial freedom and hello to debt and lots of it!

I can’t remember anyone warning me about the big dip and the impact that it would have on my life. It would have been nice to know what was going to happen but maybe not knowing what lies ahead is a good thing. I ended up just sliding down the dip like everyone else.

The depth of the dip is dictated by the size of your mortgage, how many kids you end up having and if your significant other decides to take some time off from work in order to take care of the kids.

You can think about the big dip as the world’s largest rollercoaster ride. At first you make your way slowly to the top and then you hit that big drop and boy what a drop it is.

You eventually arrive at point (C) which is the bottom of the big dip, the most vulnerable point in the ride. You can’t get off. You are locked in. There is no way out other than to work hard, play it safe and start on the long climb out of the big dip.

It’s the longest ride you will ever be on and the price of admission is the trading of your personal freedom and dreams for money and security for your family. So for the next 25 years you force yourself to suck it up, not make any trouble and simply, follow orders. After all, what else can you do? You can’t quit the ride because you have a responsibility to your family to keep them safe and your employer — the ride operator — knows this.

Through adopting a somewhat frugal lifestyle and working hard after many years you reach point (D) where you are finally financially independent again and free to do whatever you choose. The struggle out of the big dip is finally over and to think it only cost you thirty-five years of your life to get back to where you essentially started from.

Appreciate what you’ve been through

Most people don’t appreciate what a tremendous accomplishment getting through the big dip is. Taking a ride down the big dip can really mess up a person. For evidence of this just take a close look at some of the people around you.

For the longest time our driving goal, our mission was to hang on, take care of our family and survive the ride. That’s what got us out of bed all those mornings over the years.

Think about the big dip as the hardest, longest, most taxing endurance event you will ever experience because that’s exactly what it is.

Getting through the big dip is hard and not without it’s risks. You were probably knocked down more than a few times on the journey but you always got up and persevered. Really, when you think about it you didn’t have another choice did you?

Post Dip Depression

Everything makes sense when you have a why. Why did you work so hard? Why did you work at a job that you disliked? The simple answer is because you had to pay the bills and take care of your family.

But the challenge is that when you finally climb out of the big dip and financial security is not an issue anymore you will start to feel that you have lost your primary purpose in life, your why and life for awhile feels meaningless. It’s hard to get out of bed in the morning when you don’t have a good why to live for. When you lose your why you lose your way.

You need to find purpose in something else. You need to take the steps that will put new meaning back into your life.

That is why we wrote our book Victory Lap Retirement to help people -discover another why for themselves and help them transition to a new satisfying, healthy and fulfilling lifestyle. Believe me it’s a lot easier than going through the big dip.

By getting through the dip you have proven that you are good enough, talented enough, strong enough. You can accomplish anything in life that you want to if you find a good why and are willing to do the work.

Don’t settle for a mediocre life when you are capable and deserving of so much more. You earned it!

P.S. I had my son Danny read a draft of this article and he asked me if I could do an updated one for the millennial crowd. The thought of that intrigued me. Stay tuned for more!

Mike Drak is an author, blogger and speaker based in Toronto. He can be reached at michael.drak@yahoo.ca. Victory Lap Retirement, co-authored with Hub CFO Jonathan Chevreau, is now available for orders online and on Kindle and Kobo ebooks, where it is a bestseller. The paperback edition is available in Chapters Indigo and many independent bookstores, as well as Costco, and the book has been on the Globe & Mail bestseller list. This blog originally ran on Mike’s blog on January 19th and is reprinted here with permission.

Mike Drak is an author, blogger and speaker based in Toronto. He can be reached at michael.drak@yahoo.ca. Victory Lap Retirement, co-authored with Hub CFO Jonathan Chevreau, is now available for orders online and on Kindle and Kobo ebooks, where it is a bestseller. The paperback edition is available in Chapters Indigo and many independent bookstores, as well as Costco, and the book has been on the Globe & Mail bestseller list. This blog originally ran on Mike’s blog on January 19th and is reprinted here with permission.