Last week we witnessed another entry into the Canadian Asset Allocation One Ticket Portfolio Solutions.

Welcome BMO.

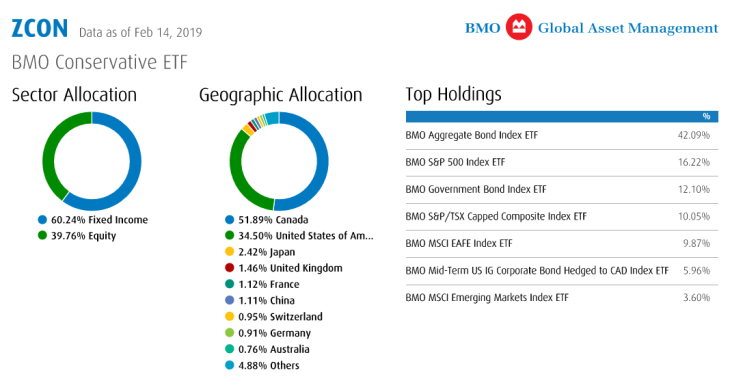

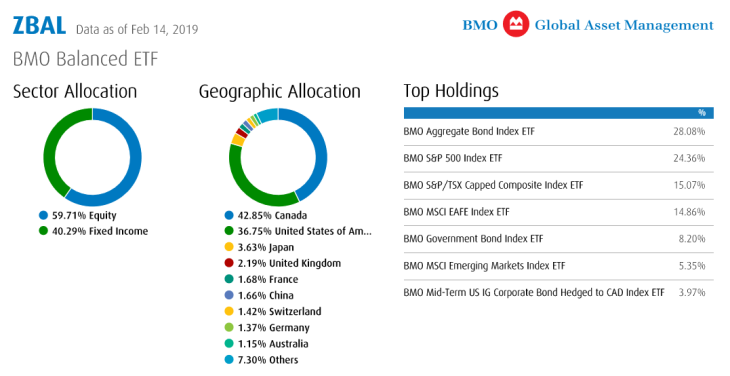

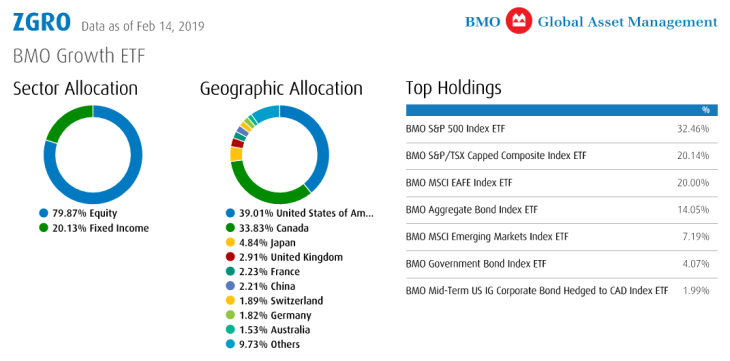

On Friday February 15th BMO launched three asset allocation portfolios by way of the Conservative ZCON, the Balanced ZBAL and the Growth ZGRO.

Here is the overview from the Fact Sheets:

Wonderfully simple or plain vanilla?

Take your pick. These are certainly plain vanilla, they’re not even Lemon Raspberry White Chocolate. But they’re still wonderful.

I am certainly surprised that BMO Global Asset Management kept the portfolios so clean and simple. As you may remember from my review of the BMO SmartFolio. the Robo Portfolios are actively managed. That is to say there is active asset allocation with respect to the core and smart beta ETFs. From my BMO SmartFolio review …

The portfolios will be rebalanced every 2 to 6 months. And back to that human touch, the management team with also make adjustments to that asset mix based on market conditions. They may be more active in periods of market turmoil compared to the current market conditions where we are mostly cruising to the upside for Canadian, US and International stocks.

BMO Global Asset Management is scratching that active itch by way of the Robo portfolios, and of course BMO offers a large suite of ETFs that includes many actively managed ETFs. For the One Ticket Solutions, they stuck to the core couch potato script.

If we look back to the fund fact sheets we see that the portfolios all use 7 BMO ETFs. The fees are a competitive .20% MER. Once again, a game changer, complete portfolios for about 1/10th the cost of traditional mutual funds.

Where they ‘spiced’ it up a little is with the greater growth ingredient known as Emerging Markets. The Emerging Market component adds more risk and more of that growth potential. The MCSI EAFE Index covers Europe, Australasia and the Far East, the Developed Markets of the world outside of North America. The Emerging Market ETF will add countries such as China (the second largest economy in the world), India, South Korea and more. These economies offer greater growth compared to the developed world as more citizens are moving from levels of lower-income (even poverty) to the middle classes and beyond. That said, these countries present greater economic, political and currency risks. We see that risk and return proposition at work once again.

A different mix of bonds. More shock absorber.

You might call this a bar bell approach. While BMO has added some growth potential by way of Emerging Markets they’ve taken a conservative approach to the fixed income component. In addition to the classic couch potato broad-based aggregate bond fund they’ve also included a Canadian government bond ETF. Government bonds, especially federal treasuries, are typically considered of the lowest risk for bonds as government agencies can raise taxes or print monies to pay you back your bond principal. Many call them risk free. With these longer dated government bonds there is the potential of greater portfolio risk management. That is, these types of bonds traditionally go up in price when stock markets take a severe hit.

More risk with emerging markets covered by more government bonds.

On the fixed income side these portfolios also include a small allocation to US mid-term corporate bonds, currency hedged. That can add some yield and greater portfolio diversification. Many of the Robo Advisors like to add US bonds or foreign bonds.

Where are the REITs?

I am surprised that there is no Real Estate top up in the portfolio. BMO does have the ZRE Equal Weight REITs ETF. That can offer some additional diversification and decent yield.

That said, the ‘idea’ for these portfolios according to BMO is to potentially use them as a more-than-solid core that you might build around at your own discretion. That’s the same approach I suggest with the ETF Model Portfolio ideas on Cut The Crap Investing.

All said, I would have liked to have seen the REITs included in the BMO offerings as many investors are likely to use these One Ticket Solutions as a complete portfolio designed to address a specific investment goal. But it’s not a big deal: the lack of a modest REIT top-up is not a deal breaker.

With respect to the geographic equity allocation the funds are nicely and solidly overweight the US market. I hold that same current bias. That is contrary to the folks at ModernAdvisor, who take a value-driven approach to asset allocation: they find more current earnings and earnings growth potential in International and Canadian markets.

It will be more than interesting to watch the battle between the active asset allocators and the truly passive couch potato portfolio managers. I am here to keep score, not judge.

How do you know what One Ticket Portfolio to choose?

Here’s a helper: last week I penned Which Vanguard All-In- One, One Ticket Portfolio Should You Invest In? You can use the same parameters and methods to help find the BMO fund that matches your time horizon, goals and risk tolerance level.

This is a brave offering from BMO. It’s an obvious move perhaps for Vanguard and iShares, but BMO has a full suite of mutual funds, ETFs, the Robo option, AdviceDirect and more full service advice offerings. There’s the potential here for the One Ticket Solutions to attract monies away from more profitable ventures. To me that suggests or reinforces my belief that my friends at BMO Wealth Management have their hearts and their wallets in the right place. They are there for investors who want to get access to the needed amount of advice in tandem with lower fee investment offerings. One could easily claim that no big Canadian bank does more for the Canadian investor than BMO.

Silvio Stroescu, President of BMO InvestorLine and Head of Digital Investing at BMO offers …

These new ETFs provide diversified exposure with quarterly rebalancing, reinforcing our commitment to empower Canadians to invest smart.

Good on ya! Doing the right thing for investors is a wonderful business model.

If you have any questions please feel free to contact me (Dale) at cutthecrapinvesting@gmail.com. Better yet, leave a comment on this blog post.

While I do not accept monies for feature blogs please click here for more about Dale and ‘how I might get paid’ disclosures.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Feb. 16, 2019, and is reproduced here with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Feb. 16, 2019, and is reproduced here with his permission.