By Justin Bender, CFA, CFP

Special to the Financial Independence Hub

If there were ever a contest held for “Canada’s Most Boring Investment Ever,” I’ll bet that bond ETFs and guaranteed investment certificates (or GICs) would duke it out in the final round. We buy one or the other, or maybe some of both, to offset our more glamorous (and more risky) stock funds with some sensible dependability. Then, thankless crowd that we are, we cringe at their related paltry returns.

So in the boring battle between them, which should you use? Laugh at the humble GIC if you must, but GICs may just help save the day in today’s fixed income markets.

Consider this. Between January 1st and April 30th, 2022, the 10-year Government of Canada benchmark bond yield has more than doubled, rising from 1.4% to 2.9%. As yields increased, bond prices dropped, causing Canadian broad-market bond ETFs to suffer double-digit losses so far this year, losing over 10% of their value.

Now, seasoned investors may be used to the gut-wrenching double-digit drops we periodically see in the stock markets, but some of you haven’t had to stomach seeing your supposedly “safe” bond ETF holdings show up in bright red when you login to your online accounts. If fixed income is going to be so boring, the least it can do is keep its head above water.

I don’t typically recommend switching up your holdings every time a market disappoints. But if your bond funds are giving you serious heartburn, GICs may be worth a second look.

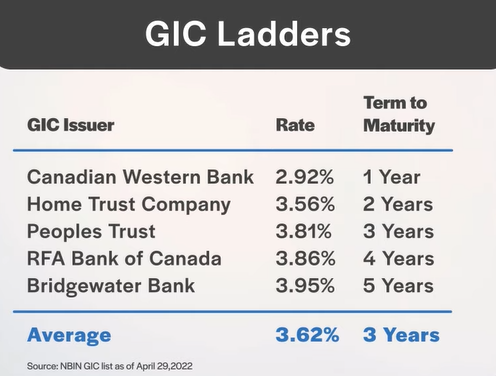

Let’s start off by talking about returns. Many GICs have yields that rival those of your favourite bond ETFs, but with a much lower average maturity. In fact, a 1–5 year GIC ladder currently boasts an average yield of 3.6%, with an average maturity of just 3 years. It’s called a “ladder” because you typically spread your GIC purchases evenly across 1-to-5-year maturities. This eliminates the need to predict future interest rate movements. So, if you have $100,000 to invest in GICs, you buy a $20,000 1-year GIC, a $20,000 2-year GIC, and so on, until you’ve built each “rung” in your 1-5 year ladder. As each GIC matures, you continue the ladder by reinvesting the proceeds into another GIC maturing in 5 years.

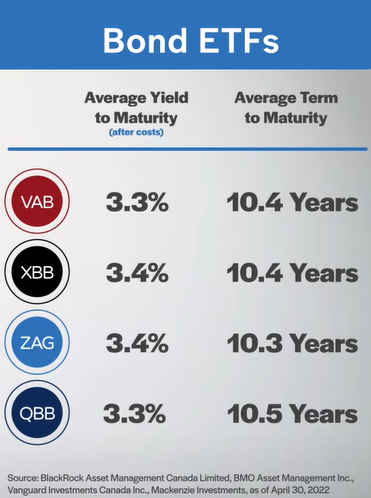

With a bond ETF, the best estimate we have of its future return is its weighted average yield-to-maturity. These days, in spring 2022, the yield-to-maturity on a broad-market Canadian bond ETF is about 3.4% after costs. And at 10.3 years, the weighted average maturity of the underlying bonds is significantly higher than a GIC ladder, exposing your investment to more interest rate risk.

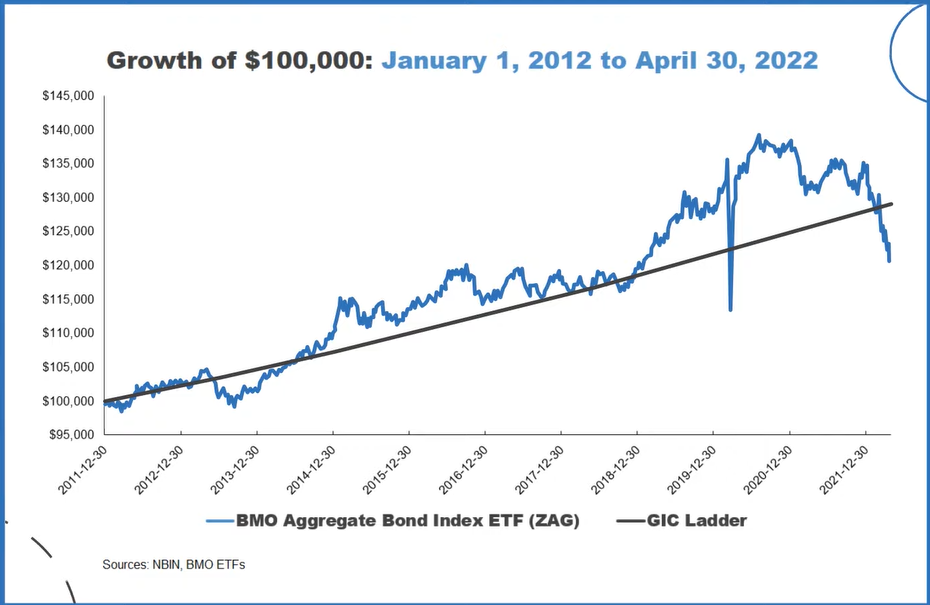

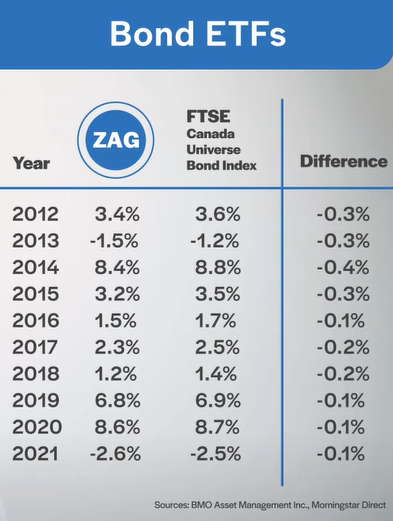

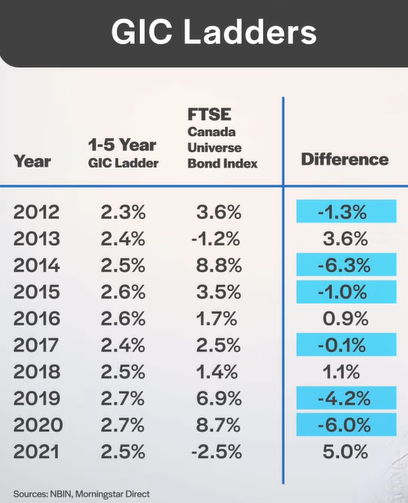

With the GIC ladder, you can currently expect similar returns with far less term risk than what you’ll find in a bond ETF. In fact, since the end of 2011, a ladder of GICs has actually outperformed a broad-market Canadian bond ETF, with a much smoother ride along the way. It’s interesting to note that both options had the same 2.3% yield at the beginning of this measurement period.

Looking forward, there’s no guarantee that a ladder of GICs will always outperform a bond ETF over your specific investment timeframe, but there are still additional advantages of the strategy worth noting.

Advantages of GIC Ladders

GICs have shorter maturities. As mentioned earlier, the average maturity is 3 years for a typical 1–5 year GIC ladder (with an equal investment in each of the ladder’s “rungs” or years). In comparison, the average maturity is 10 years for a broad-market Canadian bond ETF, like the BMO Aggregate Bond Index ETF (ZAG). This makes the bond ETF more vulnerable to interest rate increases than a GIC ladder. If you’re concerned with the potential of further interest rate hikes down the road, a ladder of GICs may be more appropriate for your risk appetite. Keep in mind that if bond yields decrease from their current levels, bond ETFs could recover some of their losses (while your GIC ladder won’t experience the same price pop).

GICs won’t experience gut-wrenching price drops. Investors hate seeing their “safer” bond ETFs in the red, but it happens. The losses can show up due to increasing interest rates or a liquidity crisis (such as during March 2020 of the pandemic, when bond ETFs lost over 16% of their value in less than two weeks). Either way, it’s enough to send conservative investors running for the hills … or worse, into high-dividend-paying equity ETFs.

GICs largely avoid these behavioural issues. Their daily values tick up (never down) due to the money the GIC issuer owes them in the form of accrued interest. If GICs traded on a stock exchange or in a similar secondary market, their daily values would also rise and fall, just like a bond ETF. Since they don’t, this is really one of those “ignorance is bliss” situations.

GIC deposits have insurance. The Canada Deposit Insurance Corporation (CDIC) covers GICs and other eligible savings up to a maximum of $100,000 in principal and interest at each CDIC member institution – per depositor, per insured category. As long as you stay within these limits, you’ll be made whole if your GIC issuer were to go belly-up.

The same cannot be said for some of the bonds in an ETF. Roughly 70% of the underlying bonds in a broad-market Canadian bond ETF are government-issued, which are unlikely to default. But the funds still invest in about 30% investment grade corporate bonds. While these higher-quality corporate bonds are less likely to default than lower-quality “junk bonds”, the risk is still more than a GIC investment’s default risks which, for practical purposes, approaches zero.

Disadvantages of GIC Ladders

Now all this sounds pretty good, but there are also disadvantages to GICs, relative to bond ETFs.

GICs are more complicated to manage. It’s much easier to purchase one bond ETF instead of managing a multi-GIC ladder. This is especially true if you need to take extra care across many accounts to avoid exceeding the CDIC limits.

I’m also a big advocate of one-fund asset allocation ETFs (which include both stocks and bonds in their funds). With one-ticket funds, you don’t need to worry about rebalancing the individual asset classes within your portfolio, as the ETF company takes care of this for you.

If you include a GIC ladder in your portfolio, you need to manage the individual holdings directly, increasing the likelihood of messing things up. For this reason, most investors should consider sticking with a single asset allocation ETF for simplicity.

GICs are not liquid. You can essentially sell units of your bond ETF any time during regular market hours, whereas GICs are typically locked in until their maturity date. However, you can mitigate this liquidity risk by investing a portion of your portfolio in cash equivalents or bond ETFs – this can potentially address your emergency spending needs or provide liquidity to rebalance your portfolio during a stock market meltdown.

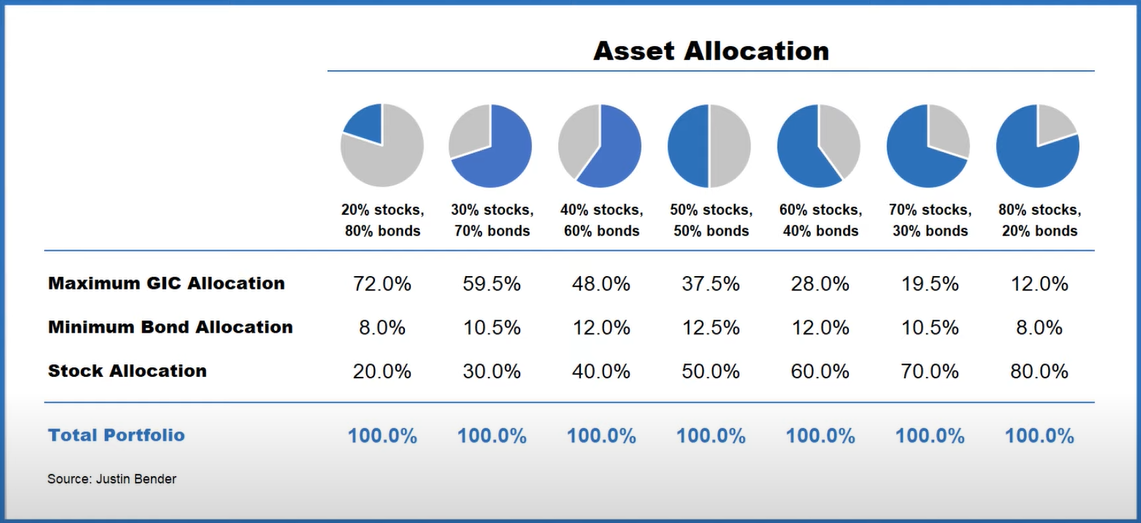

As a rule of thumb, I tend to hold enough of the portfolio in bond ETFs to allow me to rebalance a portfolio back to my target asset mix in the event of a 50% stock market drop. This rule is a bit confusing, so I’ve included a chart with the maximum GIC allocations we use with our PWL Toronto clients for various asset mixes.

Source: Justin Bender

GICs will have benchmarking tracking error. Even if a GIC ladder and a bond ETF end up having comparable returns over your investment horizon, you’ll likely benchmark, or compare, your yearly fixed income returns to a bond index. A bond ETF’s annual returns are expected to closely match the annual returns of its underlying bond index. But a GIC’s returns can be substantially better or worse than the return of a bond index from one year to the next – especially during periods of rising or falling interest rates.

For example, over the past 10 calendar years, a laddered GIC strategy underperformed the FTSE Canada Universe Bond Index in 6 out of 10 years. If you prefer to closely track a bond index with no surprises along the way, GICs may not be for you.

In short, GICs can be a great addition to your portfolio if you prefer less fluctuation in your fixed income holdings. And since the yields seem comparable for GIC ladders vs. bond ETFs, you shouldn’t feel like you’re compromising on returns by including a GIC ladder. If you’ve already incorporated GICs into your portfolio, fill us in on your strategy in the comments below!

Justin Bender, CFA, CFP is a Portfolio Manager with PWL Capital in Toronto, where he helps clients reach their financial goals through disciplined, low-cost investing. With more than a decade of experience managing portfolios, Justin is focused on keeping costs and taxes low for his clients. His skills as an analyst and researcher have made him widely respected in the ETF industry.

After graduating from the University of Guelph, Justin spent two years with a large mutual fund company and quickly learned that the financial industry doesn’t always serve its clients well. He spent his lunch hours reading books by John Bogle (the legendary founder of Vanguard) and hoped to one day work with a firm that put investors first. He joined PWL in 2007 and obtained his Certified Financial Planner designation the following year. He earned the Chartered Financial Analyst designation in 2010. This post originally appeared on the Canadian Portfolio Manager blog and is republished on the Hub with permission.

Why are you comparing GICs to broad market bond funds? You should be comparing them to short-term bond funds such as VSB.