Editor’s Note. The Hub originally ran the book review that appears below last February but in light of last night’s shocking defeat of Hillary Clinton by Donald Trump, it seems timely to rerun it now, when the world is thinking of no other topic.

Editor’s Note. The Hub originally ran the book review that appears below last February but in light of last night’s shocking defeat of Hillary Clinton by Donald Trump, it seems timely to rerun it now, when the world is thinking of no other topic.

In the meantime,for the possible financial implications of the Trump victory: see my FP blog today on what investors should do in light of the feared “Trumpocalypse.“

In brief, and as I noted in my Twitter feed last night, those overweight stocks could reasonably have expected a major plunge on the major US and stock indexes at this morning’s open. Markets elsewhere started to plunge as soon as the historic result became clear well before midnight. However, this did NOT occur once the American markets opened at 9:30 this morning: instead, US markets were mostly positive almost from the get-go and by the close, the Dow Jones Industrial Average was up 257 points, while the Canadian market was up more than 100 points.

Things could change over the coming days but as always diversification and asset allocation offers a degree of protection under such uncertain conditions. Those with cash, gold or precious metals, bonds, real estate and who are in some way partly hedged by being short certain equity ETFs should find themselves partly cushioned should markets go south.

The unexpected election outcome was predicted in certain circles: documentary maker Michael Moore and currency expert James Rickards come to mind. But of course, very few would have heeded these warnings, so unbelievable did this outcome appear. While the expectation was that Clinton was good for markets and Trump was not, Wednesday’s market action confounded this notion. Still, if you’re an investor, definitely consult your financial advisor.

I’d argue that if you didn’t take steps to hedge against this outcome before, the horse has already escaped the barn and it may be best to sit aside, try not to panic and wait for things to stabilize in a day or two. If you’re with a robo-adviser service, hopefully your asset allocation reflects your true investment personality and no major actions should be necessary.

As advertised, here’s the (very short) book review, as I originally wrote it:

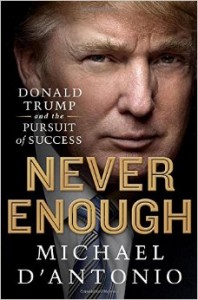

Book Review: Never Enough — Donald Trump and the Pursuit of Success

The title of Michael D’antonio’s new biography of Donald Trump — Never Enough: Donald Trump and the Pursuit of Success — was enough to get me to order the book from the library and read it from cover to cover. After all, I was a big fan of John Bogle’s book with a similar but diametrically opposed title: Enough.

Perhaps my view of Donald Trump was long coloured by my late mother’s assessment that if I ever turned out like the Donald, she’d disown me, or words to that effect. After all, Trump epitomizes the main worldly goals of our era: his career was all about pursuing the holy triad of fame, money and power: in that order. And add a fourth, his admission that his main vice has been sex, even though he was largely an abstainer from other popular vices like drinking or drugs.

The original Wealthy Boomer

Born in 1946, which makes him 70, Trump is also on the vanguard of the huge Baby Boom generation. And, since I once wrote a book and published a magazine called The Wealthy Boomer, it goes without saying that Trump is the prototypical “wealthy boomer.”

I found the book a compelling read. I always enjoy biographies but read them sparingly. In the case of Trump, it’s possible to find the story of his ascent to money, fame and possibly power a fascinating one, even if his character appears in some ways as less than appealing.

If anything, though, I found myself grudgingly admiring his determination and single-minded pursuit of his goals. For anyone watching the U.S. electoral race with interest, Never Enough should be on the reading list. After all, there’s a not-inconceivable chance this man may be the next president of the world’s most powerful country.

Had she not been cremated, my mother would be turning over in her grave.