By Alizay Fatema, CFA

(Sponsor Content)

Central banks across the globe are likely to continue with their attempts to tame inflation by hiking interest rates, crushing the hope that markets will return to normality any time soon.

With the unemployment rate at a historically low level, inflation remains a top concern for the Bank of Canada (BoC) and the Federal Reserve (Fed), who are also dealing with looming risk of a recession and uncertainty regarding the impacts of the recent bank turbulence. The BoC and the Fed appear to be ahead of global peers in their attempt to slowdown inflation – raising the question around whether we have seen the peak in rates in North America.

The rapid tightening cycles by policy makers are reinforcing the appeal of owning high-

quality ultra-short bond, and money market ETFs. A series of recent rate hikes by the Bank of Canada and the Federal Reserve gave a boost to yields for these products, making the saying “cash is king” true to a certain extent, as investors who are worried about higher inflation and slowing growth prefer investing in these cash alternatives to ride out the market volatility. In today’s market, you can earn an attractive yield while taking less risk – earning while you wait for volatility to subside.

Yield curve[1], are we in love with the shape of you?

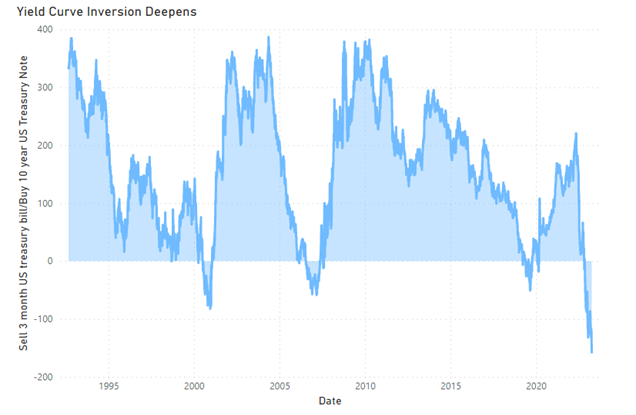

Normally, the yield curve is upward sloping, meaning longer-term bonds yield more than shorter-term bonds as investors often demand higher yields for locking their money up for a longer period. However, at present, the shape of the yield curve is inverted, which means shorter-term securities are yielding more than longer-term ones. This inversion is largely owing to the Central Bank’s quest to reduce inflation by hiking the interest rates.

Due to historically low interest rates in the last few years, investors were compelled to take more duration[2] risk by adding exposure to longer-term bonds and higher credit risk[3] by investing in lower credit quality segments such as high-yield or emerging markets bonds. However, due to the current yield curve inversion, the tables have turned now, offering a unique opportunity for fixed-income investors looking to earn higher yields.

Source: Bloomberg USYC3M10 Index (Sell 3 Month US T-bill & Buy 10 Year US Bond Yield Spread) Sep 1992 to April 2023

Why stash cash in money market & ultra-short-term bond ETFs?

The front-end of the yield curve (0-1yr) offers an attractive asymmetry and opportunity to capture yield between 4-5% + with limited duration and credit risk. This allows investors to earn the highest yields we’ve seen in more than a decade on fixed income and build a more stable high-quality fixed-income portfolio by adding exposure to ultra-short investment grade bonds and money market securities. Based on the current interest-rate volatility, hugging the front-end of the curve seems a more prudent and consistent way to preserve capital in a fixed-income allocation. BMO ETFs offers solutions such as BMO Money Market Fund ETF Series (ZMMK), BMO Ultra Short-Term Bond ETF (ZST) and BMO Ultra Short-Term US Bond ETF (ZUS), which are a great way to get exposure to the front end of the curve.

These money market & ultra short-term bond ETFs invest in high credit-quality instruments that provide a great degree of safety and capital preservation. Firstly, by investing in securities that mature in less than one year, the duration risk is minimal, which results in lower interest rate sensitivity in your portfolio. Secondly, these ETFs offer high liquidity[4] due to the nature of their underlying securities, which means they can be bought and sold easily with minimal market impact.

Moreover, these ETFs, unlike GICs, do not have any lock-up period, and can be bought and sold anytime without penalty. They serve as a place to park cash when moving out of risky assets during periods of market volatility.

So long, long bonds? Maybe not.

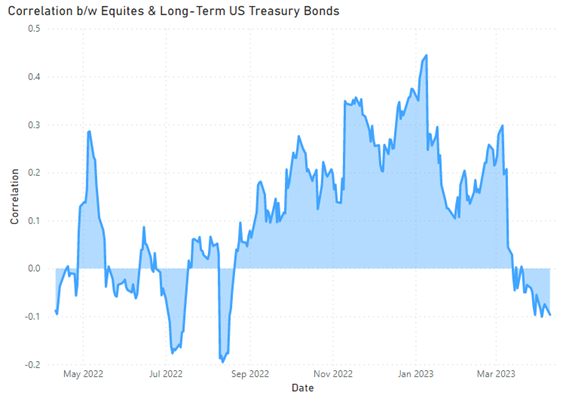

Over the past two decades, equity and bond prices have been negatively correlated, meaning that they typically move in the opposite directions; when one goes up, the other goes down and vice-versa. However, during 2022 markets, the two asset classes witnessed positive correlation with the bond and equities sell-off. Historically, higher interest-rate volatility isn’t ideal for both bonds and equity.

As of late, the correlation between the two has turned negative. Federal Bonds and Treasuries are seen as a safe haven during periods of equity sell-offs. If the economy slow downs, exposure to long-duration government bond ETFs such as BMO Long Federal Bond Index ETF (ZFL) or BMO Long-Term US Treasury Bond Index ETF (ZTL) can act as a hedge against equity market volatility and may help stabilize your overall portfolio.

Source: Bloomberg, Correlation between S&P 500 Index & U.S. Treasury 20+ Year Bond Index

Disclaimer: This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors cannot invest directly in an index. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compound total returns including changes in prices and reinvestment of all distributions and do not take into account commission charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their value change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETFs prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager, and separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

[1] Yield curve: A line that plots the interest rates of bonds having equal credit quality but differing maturity dates. A normal or steep yield curve indicates that long-term interest rates are higher than short-term interest rates. A flat yield curve indicates that short-term rates are in line with long-term rates, whereas an inverted yield curve indicates that short-term rates are higher than long-term rates.

[2] Duration: A measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise).

[3] Credit rating/risk: An assessment of the creditworthiness of a borrower in general terms or with respect to a particular debt or financial obligation. Credit risk is the risk of default on a debt that may arise from a borrower failing to make required payment.

[4] Liquidity: The degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price. Cash is considered to be the most liquid asset, while things like fine art or rare books would be relatively illiquid.

Alizay Fatema is Associate Portfolio Manager for BMO ETFs, where she is responsible for assisting in fixed income trading and portfolio management. She primarily focuses on fixed income segments such as sovereign, provincial, corporate high yield & investment grade bonds as well as emerging markets debt. Over the past few years, Alizay has acquired experience in various areas of treasury and capital markets such as fixed income trading, ALM, FX sales, product development and product control. Prior to joining BMO, she worked with CIBC. Alizay holds a master’s degree from the University of London, majoring in accounting and finance and is a CFA charter holder

Alizay Fatema is Associate Portfolio Manager for BMO ETFs, where she is responsible for assisting in fixed income trading and portfolio management. She primarily focuses on fixed income segments such as sovereign, provincial, corporate high yield & investment grade bonds as well as emerging markets debt. Over the past few years, Alizay has acquired experience in various areas of treasury and capital markets such as fixed income trading, ALM, FX sales, product development and product control. Prior to joining BMO, she worked with CIBC. Alizay holds a master’s degree from the University of London, majoring in accounting and finance and is a CFA charter holder

Question for Alizay. I am interested in ZUS.U with its current gross yield of 5.38%. ZUS.U base currency is USD. I have USD funds in my CIBC account. If I purchase ZUS.U, with my USD funds, does this mean that there will be no currency risk or fluctuations. Even though ZUS.U is a Canadian ETF on the TSX, the price is in USD? Thanks

Hello, That’s correct, if you purchase ZUS.U, your funds will remain in USD and there are no currency conversions.