By Billy and Akaisha Kaderli, RetireEarlyLifestyle.com

Special to Financial Independence Hub

We at Retire Early Lifestyle like to bring you individual FIRE stories and interviews of interesting people. There is no one single way to retire, and it is our hope that in reading these interviews with those who are on the path to Financial Independence it will inspire you to do the same!

Meet Jon [Jonathan] and Ruth Chevreau

Jonathan (Jon) and Ruth Chevreau

RetireEarlyLifestyle: Could you tell us a little about yourselves? Are you financially independent now?

Jon Chevreau: I’d describe Ruth and me as financially independent, yes, although it’s hard to claim we retired early like yourselves.

I just turned 70 and am still writing and editing, as well as running my own website on Financial Independence. Ruth is a year younger and retired from full-time work when she turned 65. My last full-time employment was at age 61, so by my definition when I became freelance/self-employed that was the start of our Findependence.

But we COULD have left the salaried routine earlier if we had wished to do so: we paid off our mortgage decades ago and our financial assets in combination with small employer pensions and the usual Government pensions are more than enough to fund a modest lifestyle.

REL: What type of work did you do, and what your life was like before FIRE?

JC: I’ve always been a journalist and editor, as well as an author and blogger.

Initially I worked in staff newspaper jobs covering technology in the early 80s ‘for the Globe & Mail (one of Canada’s two national newspapers), then almost two decades covering personal finance and investing for the National Post (Canada’s other national newspaper). I was also editor-in-chief for MoneySense Magazine for a few years after the Post and continue to write and edit for them in addition to running Financial Independence Hub, which I launched in 2014 when I left my full-time job at MoneySense.

REL: Because Billy has a background in finance and securities, he’s very familiar with US investments. Tell us about Canadian-backed assets.

JC: Canada is similar to Australia in its investment profile.

We’re dominated by energy and materials stocks and by six big banks. We have virtually no health care stocks and our consumer staple stocks are really just publicly traded grocery store chains like Loblaw; our tech sector is small. Every once in a while Canada spawns a technology winner: Nortel, which went bust after China’s Huawei “borrowed” some of its technology; Research in Motion, whose Blackberry was a big-time success until the Apple iPhone ursurped it; and currently Shopify is our big tech winner.

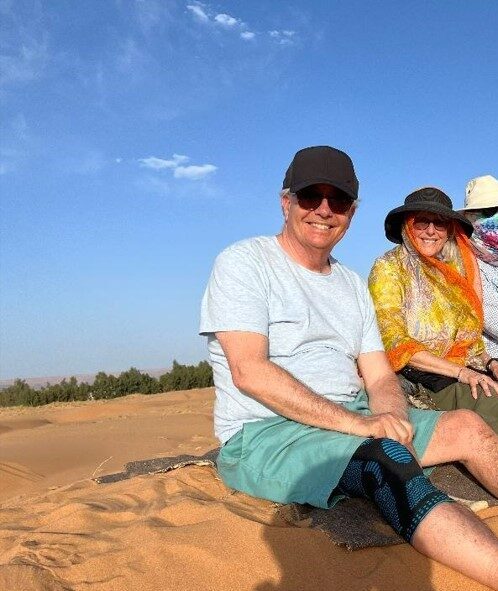

Jon & Ruth sitting on a sand dune in Morocco

But mostly the Toronto Stock Exchange is dominated by banks like Royal Bank, BMO, Bank of Montreal, and TD Canada Trust (all with some US presence) and energy giants like Enbridge and TransCanada Pipelines. An American investor can get away with almost exclusive home country bias since the US is roughly half the global market cap and many of the big players are international anyway.

Canada is maybe 3% of the world’s total market cap, so we are forced to look to the US and global markets to be properly diversified. Once upon a time we were limited to just 20% foreign content in our pensions and retirement plans but that got scrapped so now we can overload on the S&P500 if we wish.

REL: Are discount brokers available to you in Canada like Fidelity, Charles Schwab and Vanguard?

JC: Oh yes, mainly through the big banks, so there’s TD Waterhouse, RBC Direct Investing (both of which we use) and the other banks have similar operations. There are also several independent online brokers like Questrade. Fidelity and Vanguard have Canadian divisions but mostly to sell their mutual funds and ETFs.

REL: Are capital gains taxed more favorably than income in Canada?

JC: Yes. Only half of capital gains are taxed, so that means about half as much tax as is usually paid on interest income or employment income. Also, unlike the US, the capital gains tax in Canada does not rise or fall depending how long you held before taking a profit. Dividends paid by Canadian companies get a lower tax rate than foreign dividends, which are taxed like interest and so best held in tax-sheltered retirement vehicles like the RRSP (Registered Retirement Savings Plan, similar to America’s IRA).

Ruth hiking in Spain

REL: Could you explain Canada’s Old Age Pension, how that works, at what age one can begin receiving it, and how one qualifies for it?

JC: Canada’s equivalent to Social Security is actually three programs we dub CPP/OAS/GIS.

The main one is the Canada Pension Plan, to which all employees must contribute. Like Social Security you can take CPP early (even at age 60) but it pays much more if you wait till 70.

There is also Old Age Security or OAS, which people normally take at the traditional Retirement Age of 65. You can’t get it earlier than that but like CPP, can defer it to 70 and get paid more. It’s funded by the government’s general tax revenues but it’s means-tested, so if you have taxable income above $80,000 or so (the threshold rises a bit each year), you start to have OAS taxed away and you lose it all around $120,000. This is for each person, so retired couples normally try to keep their taxable income below $80,000 each, so $160,000 between them.

Finally, there is the Guaranteed Income Supplement (GIS) to the OAS: which is means-tested and aims to top up income for seniors who have no real pensions or retirement savings. Personally, we don’t plan on receiving GIS: most middle-income seniors worry more about preserving OAS benefits: CPP is taxed but benefits are not clawed back.

REL: Could you tell us a little about how your portfolio is structured?

JC: I always used to wonder [in articles] why anyone would need more than a single global balanced mutual fund or these days a comparable Asset Allocation ETF from firms like Vanguard, BlackRock or BMO ETFs.

I believe in diversification by asset class, geography, investment style, and market cap. To some extent I keep in mind the All-Weather Portfolio championed by Ray Dalio, or before that, Harry Browne’s Permanent Portfolio. The latter was 25% in bonds for deflation, 25% stocks for prosperity, 25% gold for inflation and 25% in cash for really bad times. Dalio is a bit like that but would add commodities and maybe real estate. I don’t believe you can consistently predict markets and asset classes so I believe in being exposed to all of these over the long haul, with perhaps shorter-term tactical tweaks if trends become obvious (like interest rates bottoming a year ago.)

REL: How big a part of your retirement plan does the Canadian-based healthcare play? Would you consider permanently relocating to another country? If so, which countries have you considered?

JC: Canadians are a bit spoiled with universal health care. US Democrats would probably call it socialized medicine.

Jon in Malaga, Spain

It’s not entirely free as Ontario levies an annual Health Premium [i.e. tax] depending on income, but it’s lower than private insurance would be. We don’t worry about sticking with a single employer just to keep their health care insurance, although of course some will buy private Blue Cross and that kind of thing beyond what employers provide.

We travel a lot: Florida for a while, more recently Morocco, Mexico and other Spanish-speaking places including Spain itself. But I doubt we’d permanently leave Canada.

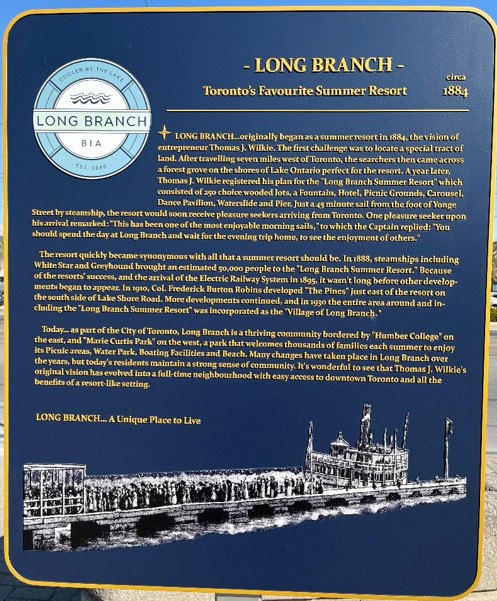

Just today we were walking around our home turf by the lake in Toronto. It’s called Long Branch, which was originally a Summer Resort when founded in 1884: affluent families in downtown Toronto would take the street car to their summer “cottage” in Long Branch. It’s now just another bedroom community but only a 15-minute GO train ride from downtown Toronto.

Canada overall is a blessed place: we’re protected by two oceans and it’s nice having a friendly neighbor and military power to the south. The rest of the world probably considers us boring, which suits us fine: we’ll keep us a best-kept secret! At one point we considered Mexico as a way to avoid Canada’s long winter and relatively high taxes but the high apparent levels of crime in recent years scared us off. My parents were British and French so we like to visit the UK and France, as well as Spain. But we are happy to keep Toronto a home base and to visit places for months at a time through AirBnB.

REL: In your retirement life, what will you do about access to health care? Are you open to Medical Tourism?

JC: Again, Canada’s health care system is almost free for citizens and reasonably accessible. In fact, it’s so attractive that it may prevent some of us from permanently pulling up stakes. I can see Dental Tourism as more likely, as only recently have the NDP started to badger the Trudeau Liberals to provide universal free dental care for young people and low-income seniors.

Sadly, neither category is us!

REL: Are you a traveler or more of a stay-at-home, community kind of guy? Are you and your wife on the same page regarding retirement and travel?

JC: I think we are. Ruth retired from her full-time job in the transportation industry three years ago but still does a bit of consulting and a lot of church work, volunteering, tutoring and the like.

Lake Ontario, a 30-second walk from Jon and Ruth’s home

As I said to you before this interview, I still put in a “gruelling 3-hour day” Monday to Thursdays, with Friday mornings if necessary. Like yourselves, I can run the web site from anywhere with good Internet access. Most recently we spent 4 weeks in Malaga, Spain and I kept things going from there. But in our next stage we will try to avoid more of the long Canadian winter and spend 2 or 3 months at a time abroad in January/February/March.

However, I anticipate I’d need to cut back on my freelance editing and web site publishing frequency to pull that off. Right now I’m still keeping to a self-imposed one blog per business day schedule: probably because my motto when I was a newspaper reporter was “a story a day keeps the editor away.”

REL: Do you plan to work part time, mentor, or in some way financially supplement your retirement once you pull the plug?

JC: My wife is more into mentoring. I don’t see myself doing part-time work like being a Starbucks barista or Home Depot assistant, as I prefer running the web site and doing a bit of freelance writing or editing.

As you no doubt know, a small business is tax-efficient and pays for things like Internet, newspaper & magazine subscriptions, office equipment and whatever else your accountant can justify. In my case, I’m fascinated by the markets and investing. Like Billy, I’m keeping tabs on my own account and it’s not a huge stretch to share it with the world.

In addition to Findependence Hub and my monthly MoneySense Retired Money column, I’m still pretty active on social media: mostly Twitter and now Mastodon, but also Linked in and Facebook. I’m @JonChevreau at Twitter and JonChevreau@mstdn.ca.

In both places, there’s a community of market watchers that share financial insights. I’m watching Elon Musk seemingly destroy Twitter but with my own 65,000 followers am reluctant to pull the plug, as my Web Site also features my Twitter feed.

REL: Since housing is a big expense, how do you plan to manage lodging when you retire? Will you downsize? Travel? House sit? Rent apartments? Stay in hotels? AirBnBs? Do you plan to keep a home base?

JC: We love our home, which is literally a 30-second walk from Lake Ontario.

Every day we walk west and east along the lake for our 10,000 steps. We’ll eventually give it to our daughter, who has long threatened to send us to “a crappy nursing home.” But we’ll age in place as long as possible. Toronto has great weather except for winter, so we’re happy to enjoy the three non-winter seasons and relax at home in our big back yard with a small pond and waterfall and feed the birds, maybe drive for long weekends to visit friends with cottages in the Muskokas.

Two vacations of a month or so at the start and end of winter are about right to us and yes, AirBnB is our preferred way to go there. So Long Branch is our permanent Home Base and the rest of the world is our vacation playground.

Lake Ontario in Long Branch

REL: What do you average in spending annually? Does this include health insurance? Do you track your spending?

JC: Health insurance has so far not been a major issue, apart from dentistry.

You can live a pretty good life in Canada with $5,000 a month pre-tax. We do a bit more than that but mostly reinvest the difference, especially in TFSAs or Tax-free Savings Accounts – the equivalent of American Roth plans. The TFSA was only launched in 2009. Generally, we try to keep our incomes down to the point where the government would claw back benefits of means-tested programs like OAS, which we described earlier.

We have a rough picture of spending but are frugal enough we’re not obsessive about it: we’ve always believed in living below our means.

REL: Do you own a vehicle? Will you continue to own one once retired?

JC: Yes, we own two hybrid Toyota vehicles, both paid for.

They mostly sit In the driveway since we work from home but recently discovered a program with the CAA [Canadian Automobile Association], which charges car insurance proportionate to your usage. Little use, little payments! Long Branch has a decent walkability score but of course cars are useful for grocery shopping and visiting friends and going on weekend trips to the country. I suppose at some point we’ll cut down to one and eventually none. As I tell older friends wondering about keeping their cars, you can get a lot of Uber rides for the price of car insurance.

REL: What is your biggest challenge to retirement?

JC: I don’t consider myself retired but findependent (financially independent). As I say in my financial novel Findependence Day, I choose to work because I enjoy it, not because I have to, financially speaking.

Our challenge is mostly squeezing everything into a day: I read a lot of books, 5 or 6 newspapers and online articles that I share on social media; we like to watch a few streaming services after supper: usually one long who-dunnit or two shorter shows. We walk a lot but even then I’m multitasking, listening to financial or news podcasts or free audio books from the library, or paid ones from Scribd ebooks and audiobooks.

On my daughter’s urging, I’m dabbling with painting a bit and I fantasize about some day playing around with digital music. I also enjoy playing tennis, hockey and, until the pandemic, Yoga. My wife still does Pilates and this summer we’re going to take up pickleball. Church is becoming a significant part of our routine, especially for Ruth, as she is a warden, so I’m often “voluntold” for various tasks. In short, we’re pretty busy, but happy about it.

REL: What would you say are your most unique talents?

JC: I guess I’m good at absorbing and synthesizing lots of information and can string words together reasonably well.

Once upon a time I aspired to creative writing but except for Findependence Day, I’ve not really had the time or mental energy to try again writing the great Canadian novel. [Findependence Day was published in 2008 in Canada, and a US edition in 2012, available through Amazon, Trafford.com and Best Books Media. I used to sell it directly but lost the domain FindependenceDay.com.]

Story of Long Branch, Canada

REL: Tell us about your greatest personal success, not necessarily finance related.

JC: That’s a tough one.

I wrote several non-fiction financial books, like The Wealthy Boomer, which spawned a short-lived magazine and a vibrant discussion forum that closed around 2005. I’m sort of semi-famous in Canadian financial circles and was once cited as a top Canadian finance influencer on social media. In my time I did a lot of TV and radio but I’ve scaled that back in recent years. It’s probably accurate to say that like a lot of Canadian creative types, I’m not really all that well known outside Canada.

REL: What are your greatest passions in life?

JC: I’ve always been a reader and enjoy listening to music – just about anything apart from rap or hip hop. And like any red-blooded Canadian male, I’ve been playing hockey since I was six years old, and still play in an Old Timers league. I used to be keen on playing chess, which was later replaced by bridge. For awhile I was a fanatical online bridge player, although I let that lapse. You’ll know I’m finally fully retired if you see me again on Bridge Base Online, where my handle was Canuckstan.

REL: How do you contribute to the world?

JC: By sharing my financial insights and beyond that, whatever Ruth gets me involved in. I’m hoping that if she gets into heaven, I’ll be able to accompany her on a technicality. Apart from financial activity on the web, I’m also a co-moderator for a vibrant Facebook group about health called Younger Next Year 2023, which has about 1500 users spread evenly between the U.S. and Canada.

REL: What is a secret fact about you?

JC: If I tell you that, it wouldn’t be a secret anymore!

But since you insist, let me elaborate on your previous question. I’ve told you about how beautiful Long Branch is and I’m always astounded by how inconsiderate people can throw garbage on the walkways by the lake when there are plenty of garbage bins only a few yards away. Now that Covid is all but over, I’m less squeamish about picking up other people’s litter and putting it in the bins.

REL: Where do you see yourself in 5 years from now?

JC: Probably still doing a version of what I’m doing now, but maybe the web site will be down to a weekly blog and I probably won’t be writing or editing for money anymore. Likely 3-month vacations over winter.

REL: What is your biggest splurge?

JC: I guess our home. In Findependence Day, I write that “a paid-for home is the foundation of Financial Independence.” Our biggest splurge is likely upcoming when it’s time to help our daughter buy her first home. Toronto housing is still pretty expensive.

REL: What do you do for fun or entertainment?

JC: Reading, TV, walking, eating out or entertaining friends for dinner or cocktails.

REL: I understand that you keep a blog about financial independence. Where can people find it?

JC: FinancialIndependenceHub.com or FindependenceHub.com, which bills itself as “North America’s Gateway to Financial Independence.”

Since 2014 we have included many guest blogs from bloggers in both Canada and the United States, including Fritz Gilbert’s Retirement Manifesto and RetireEarlyLifestyle.com, so thank you for that! Regular Canadian blogs that give us permission to republish include Dale Roberts’ Cutthecrapinvesting, Mark Seed’s MyOwnAdvisor, Bob Lai’s Tawcan, Michael J. Wiener’s Michael James on Money and a few others. There are also blogs from financial advisors or experts like Patrick McKeough, Steve Lowrie, Noah Solomon, Anita Bruinsma, Robb Engen (of Boomer & Echo), financial executives and in the case of regular advertisers, blogs labelled as sponsor blogs.

REL: Thank you, Jon, for taking the time to answer our questions and share your Findependent Lifestyle. We appreciate that, and are hoping you get that “Heaven technicality” you mentioned previously!

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com. This blog ran jointly on the Hub and their site, as published here.

Billy and Akaisha Kaderli are recognized retirement experts and internationally published authors on topics of finance, medical tourism and world travel. With the wealth of information they share on their award winning website RetireEarlyLifestyle.com, they have been helping people achieve their own retirement dreams since 1991. They wrote the popular books, The Adventurer’s Guide to Early Retirement and Your Retirement Dream IS Possible available on their website bookstore or on Amazon.com. This blog ran jointly on the Hub and their site, as published here.

Nice story. A life worth living! Yes Long Branch is one of TO’s best kept secrets. Well done!

Shhhh: don’t tell anybody!