Paying down Debt versus Saving for Retirement has always been one of those conundrums facing every generation.

As a semi-retired baby boomer myself, I was a bit late to both the housing party and Retirement savings exercise.

Once I got married in my mid 30s, buying a house and paying down a mortgage was our priority, although two reasonable incomes made it possible to do both: pay off mortgage debt while also saving for retirement and enjoying some tax savings through the RRSP.

Certainly, I’ve always believed paying down debt on high credit-card interest is a priority, certainly over TFSAs. I think TFSAs are great but it’s hard to beat the guaranteed return of paying down interest being charged at 20% or so per annum.

Mercer’s latest Retirement Readiness Barometer

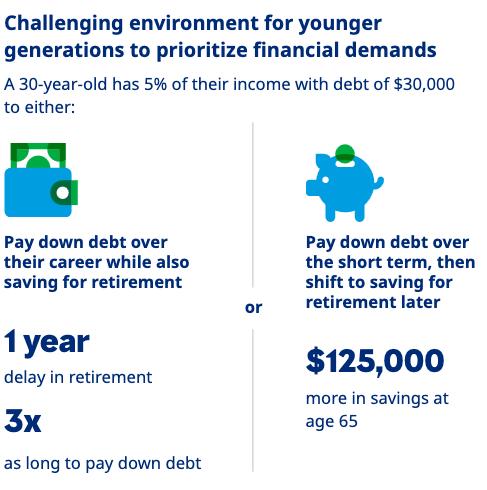

Now a new report from Mercer Canada released earlier this week — the fifth annual Mercer Retirement Readiness Barometer (MRRB) — warns that millennials and younger Canadians who divide their disposable income between saving for retirement and paying down debts could find themselves delaying their retirement by one or two years compared to if they focused solely on paying down debt in the short term.

The MRRB says that in today’s economic climate of elevated interest rates, a 30-year-old with $30,000 of personal (non-mortgage) debt could retire one year earlier with $125,000 more in savings if they solely focus on paying off debt within 10 years, before then shifting focus to saving for retirement.

But if that individual instead splits disposable income between saving for retirement and paying down debt for the entire period until retirement at age 65, it can take more than three times as long to pay down the debt.

These findings assume a 30-year-old worker is earning $70,000 and can allocate 5% of their income either to paying down debt or saving for retirement; with the interest rate on their debt being higher than the expected rate of returns of their investments.

Higher interest rates may help retiring Boomers

Interestingly, despite the MRRB’s focus on the young, it does mention boomers near retirement age and the importance of financial literacy surrounding decisions on what to do with retirement savings as they transition into a period where they are no longer working.

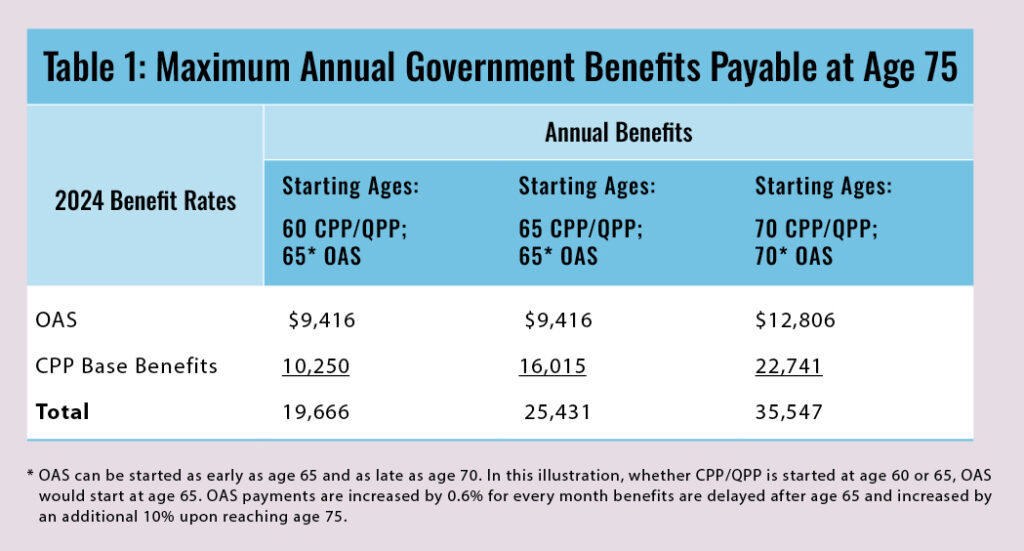

The second infographic shown below shows that while high interest rates make it tougher for young people to get out of debt, boomers already at or near Retirement may find higher interest rates to be an advantage as they retire. It explains that “in an elevated interest rate environment, retirees may have windows of opportunity, although financial literacy will be required to navigate various retirement income options.”

I recently touched on this in a MoneySense Retired Money column on the need to wind up RRSPs at the end of the year you turn 71: in most cases, cashing out and paying stiff taxes is not advised, so most people either convert to a RRIF and/or use the funds to buy a life annuity from an insurance company. Part 2 of that column will run later in April.

You can find the full Mercer release from Tuesday here.

Background on Mercer Retirement Readiness Barometer

Included is an infographic, the major elements of which I’ve reproduced below.