By Alizay Fatema, Associate Portfolio Manager, BMO ETFs

(Sponsor Blog)

As we begin the new year, it’s only fitting to cast a retrospective gaze in 2023 and unravel the pivotal moments that altered the landscape of the global markets. 2023 was a year where several themes dominated the global economy while it was still recovering from the aftershocks of the COVID-19 pandemic.

Looking in the rear-view mirror, some of the key contributors to financial markets volatility were the banking crisis, inflation concerns and central banks monetary tightening policies, rise of the artificial intelligence and geo-political risks stemming from the ongoing wars.

Unveiling the Banking Turmoil

Unlike the subprime mortgage crisis of 2008 that was triggered by risky mortgage lending practices, the banking upheaval of March 2023 started owing to deficiencies in risk management and lack of proper supervision which ultimately caused multiple small-medium sized regional banks to fail in the U.S.

During the month of March 2023, Silvergate Bank, Silicon Valley Bank and Signature Bank faced bank runs over fears of their solvency and collapsed [1][2]. As a result, share prices of other banks such as First Republic Bank (FRB), Western Alliance Bancorporation and PacWest Bancorp plunged. FRB was later closed, and its deposits and assets were sold to JP Morgan Chase. Internationally, the jitters of the US banking crisis spilled over into Switzerland, where Credit Suisse collapsed owing to multiple scandals, and was acquired by its competitor, the UBS Group AG, in a buy-out on March 19, 2023 [3].

The Federal Reserve (Fed), Bank of Canada (BoC), European Central Bank, and several other central banks announced significant liquidity measures to calm market turmoil and mitigate the impact of the stress [4].

The Interest Rate Hiking Odyssey

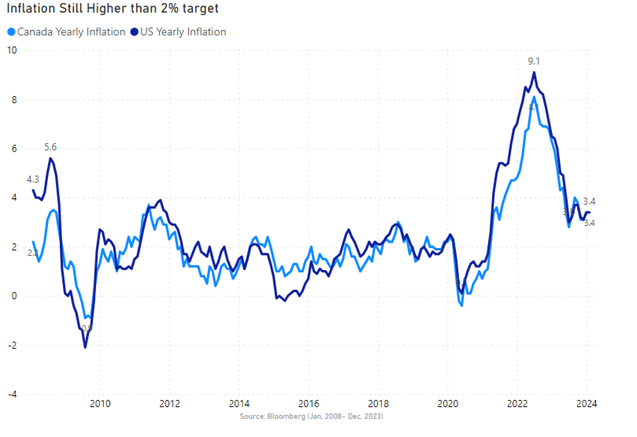

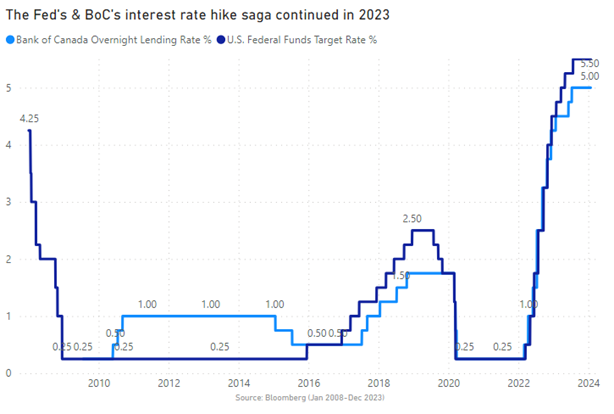

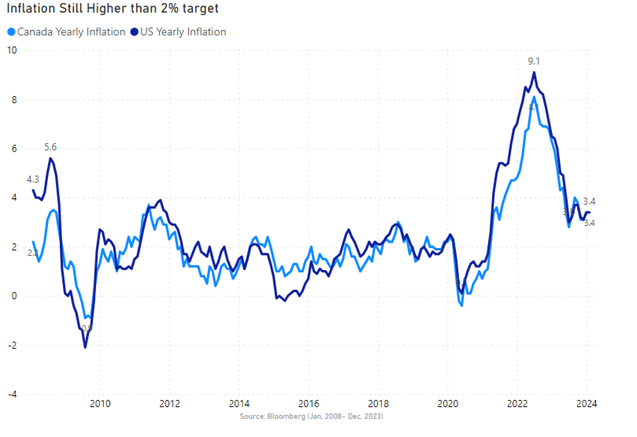

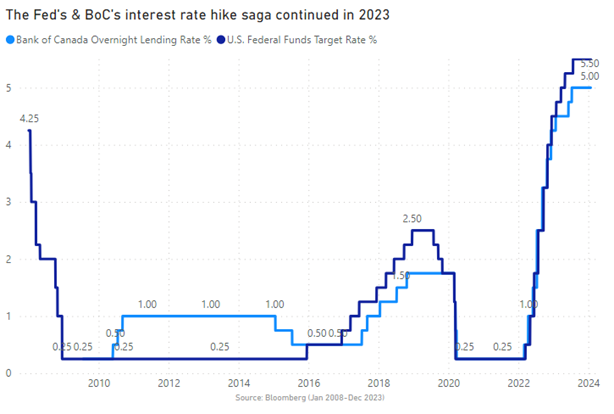

Deeming inflation as transitory during 2021, central banks finally embraced inflation as a persistent problem and engaged in interest rate hiking saga starting from March 2022 which continued into 2023. These aggressive rate hikes had a significant impact on the financial markets as they made borrowing more expensive and led to record high bond yields. The chart below shows that the Fed conducted multiple hikes to bring the rates to 5.5%, highest level in more than 22 years [5]. BoC also increased its policy rate to 5% in a similar fashion.

Any “good news was bad news” in 2023 as robust labour market and resilient economic growth meant that central banks would have to keep interest rates higher for longer to the detriment of equities. Given the effect of monetary policy changes are subject to a lag, we would have to wait and see the full impact on the economy in the coming months.

The Rise of Generative Artificial Intelligence (AI) reshaping the future

2023 left an indelible imprint on the trajectory of technological evolution due to the rise of artificial intelligence and its profound effects that reverberated across numerous industries. We witnessed a pivotal juncture in the progression of generative AI in 2023 ever since Open AI released ChatGPT on November 30, 2022 [6], and within a few months it became one of the fastest growing applications in history and created a massive frenzy in the tech world. Despite concerns about the repercussion of higher interest rates in 2023, investors’ enthusiasm for AI took centre stage and the Nasdaq 100 index achieved the best year in over a decade owing to a stellar performance of the leading tech companies.

The Ascendance of Money Market ETFs in an Uncertain Financial Landscape

Assets in money-markets, high-interest savings accounts (HISAs) and other cash-like investments reached an all-time high during 2023 after the most aggressive monetary tightening cycle that was started by the Fed & BoC in 2022. There is nearly $6 trillion parked in these funds and cash deposits in the U.S. [7], and over $25 billion in cash and HISA ETFs in Canada.

Yielding over 5%, these money market funds attracted retail investors, serving as a great avenue to park cash with guaranteed liquidity, minimum risk, low volatility, and flexibility. However, the recent shift in the Fed & BoC stance is signaling the end of the tightening campaign and projecting rate cuts in 2024. The latest ruling by office of the Superintendent of Financial Institutions (OSFI) to uphold 100% liquidity requirements on HISA ETFs may impact the dynamic of these money market/HISA funds during this year.

Geopolitical Risks amidst two Ongoing Conflicts

2023 went down in history as being a year marked by two big wars: an ongoing conflict in Ukraine that started in 2022 as it fights off a Russian invasion and the outbreak of violence in the Middle East in October 2023 between Israel and Hamas [8].

Fear of potential escalation in the Middle East conflict and prospects of the war spilling over in the wider region added to uneasiness in the markets as the region is a crucial supplier of energy and a key shipping passageway. The market reacted to the news of the conflict by shifting towards safe-haven assets as this unforeseen geopolitical event increased uncertainties [9].

Dodging Recession, Double Digit Equity Returns and a Comeback in Fixed Income

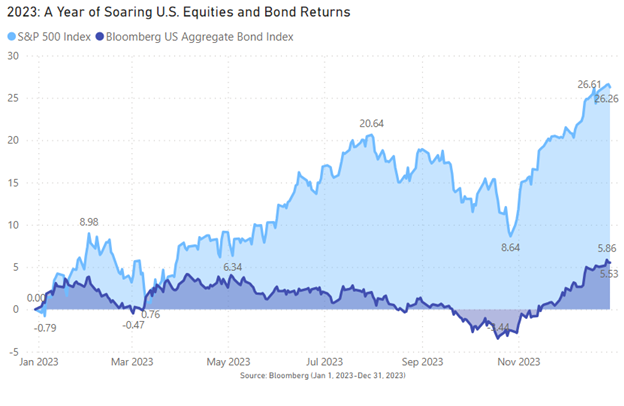

During 2023, many investors feared that higher-for-longer interest rates would trigger a recession in the U.S and would take a toll on corporate profits and bond returns. As the Fed embarked upon the most aggressive rate hiking cycle, the yield curve inverted, sending a classic warning signal of a looming recession.

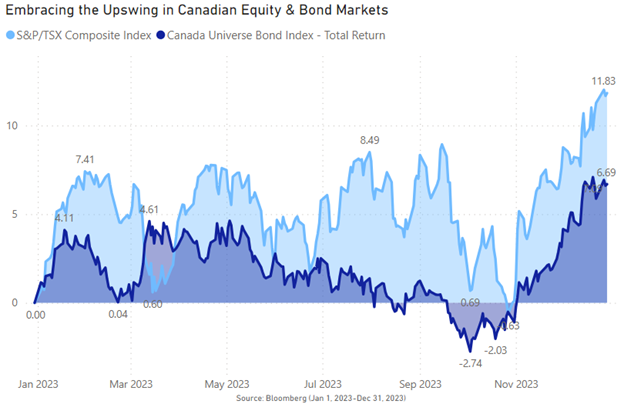

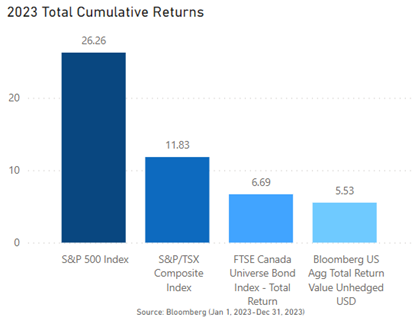

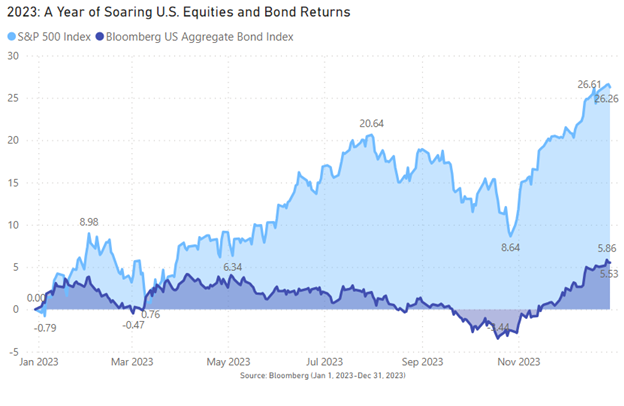

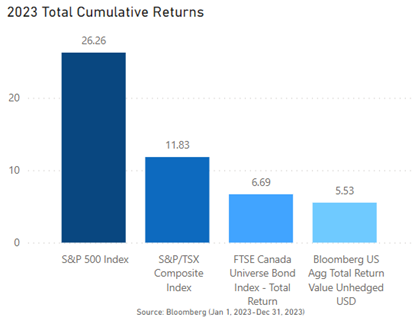

Moreover, the U.S. Institute for Supply Management’s (ISM) manufacturing index dropped below 50 in November 2023, indicating a contraction in manufacturing activity. Despite having the highest prediction of a recession with heightened volatility in the markets throughout 2023, the US economy avoided recession and equities posted double digit returns. Moreover, fixed income rebounded in 2023 and reported positive returns after persistently declining for two years, thanks to the bond rally in the last two months of 2023 as markets priced in rate cuts for early 2024.

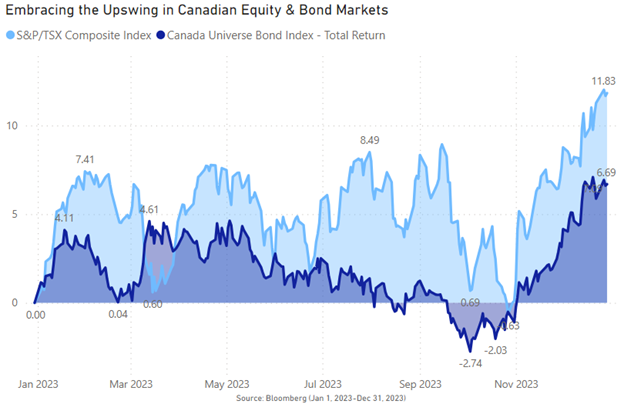

The Canadian economy also dodged recession, largely attributed to substantial immigration which bolstered overall spending and economic growth. However, the GDP per capita declined, indicating that spending hasn’t matched the influx of newcomers primarily due to the increasing costs of home ownership and rent further exacerbating the housing crisis.

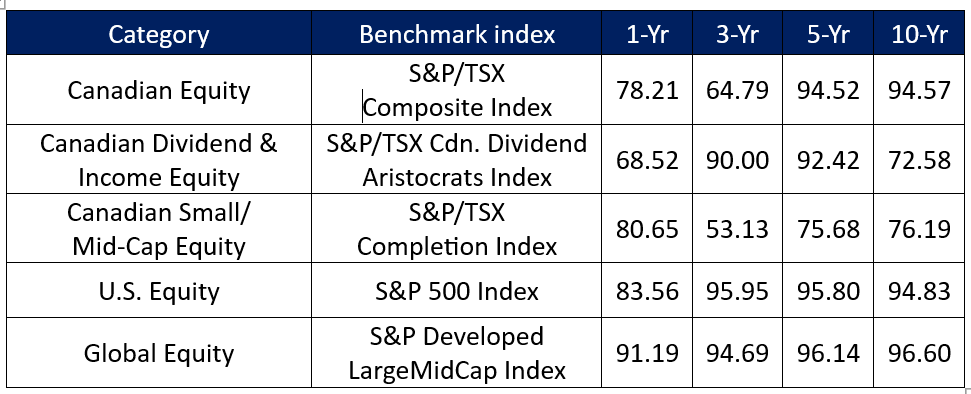

“Index returns do not reflect transactions costs, or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.”

“Index returns do not reflect transactions costs, or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.”

Could 2024 be the Year of Fixed Income?

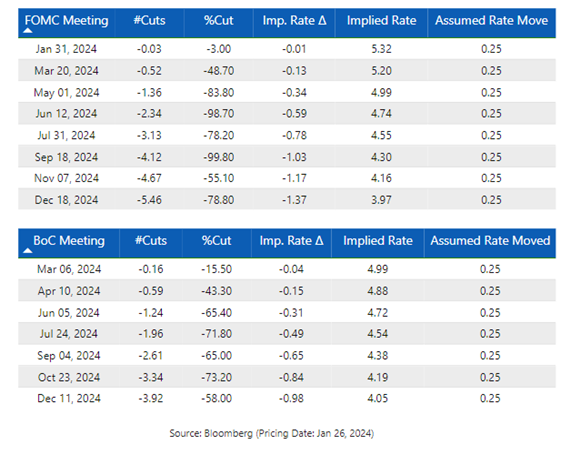

After having a humbling experience in 2023, the market consensus has now shifted for 2024 with the majority of fund managers in the U.S. expecting a soft landing for the economy [10], which might fuel rate cuts now that the sky-high inflation is subsiding and heading down towards the Fed’s & BoC’s target.

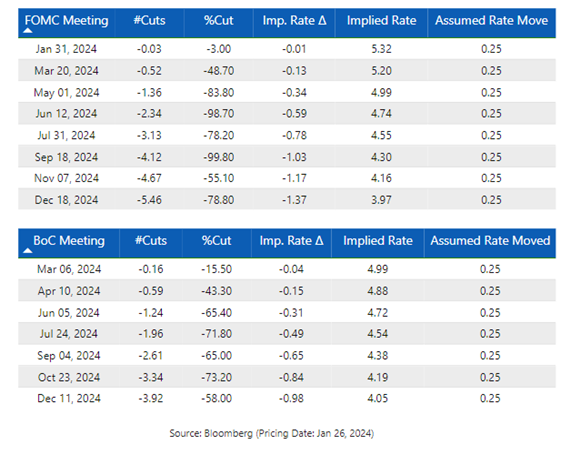

The chance of higher policy rates going forward is slimmer and the potential for rate cuts in 2024 is much stronger if inflation cools off further, the labour market weakens, consumer demand diminishes, and economic growth slows down. Both central banks indicated that future policy decisions will be data dependent and any rate cuts in 2024 will be contingent on inflation cooling off meaningfully, i.e., in line with their 2% target.

The market is currently anticipating rates to remain elevated till Q2 of 2024 as the labour market still seems robust and the December Consumer Price Index (CPI) print pushed the expectation of rate cuts even further. Continue Reading…