By Noah Solomon

Special to Financial Independence Hub

Barbarians at the Gate

The dramatic increase in the popularity of ETFs [Exchange Traded Funds] represents one of the biggest changes in financial markets over the past three decades. The tremendous growth of ETFs has come largely at the expense of actively managed mutual funds. Investors are increasingly shunning the latter in favour of the former. I will attempt to shed some light on whether this shift is justified from a performance perspective.

The Trillion Dollar Question

The vast majority of ETF assets are passive vehicles. The underlying portfolios of these securities are constructed to mimic a given index, such as the S&P 500 or the TSX Composite. In contrast, most mutual funds are actively managed, whereby portfolio managers and securities analysts conduct extensive research to overweight stocks they believe will outperform while underweighting those they believe will be laggards to outperform their benchmarks. Relatedly, the costs of running actively managed funds are higher than those associated with passive ETFs. As such, the former tend to charge higher management fees.

Logically speaking, active managers’ higher fees should not necessarily be an issue. To the extent that they are capable of more than offsetting the negative impact of their higher fees with higher returns, their investors are better off on a net basis. As such, the trillion-dollar question is whether active managers’ skill is sufficient to justify their higher fees. If this is indeed the case, it follows that the shift away from active management into passive ETFs is ill-founded. Similarly, if active managers have failed to outperform, then the massive growth of ETF assets can be simply explained as investors following the money.

Active Management: The Author of its own Fate

By and large, active management has failed to live up to its promise. Specifically, most active managers have underperformed their benchmarks over both the medium and long-term.

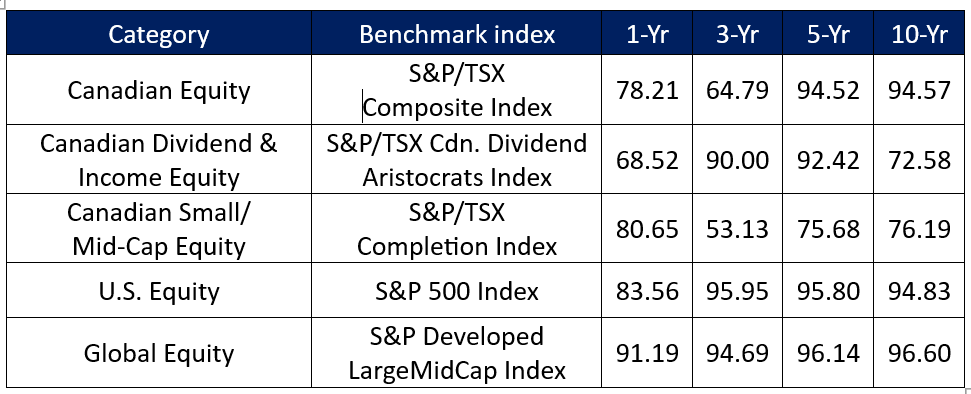

S&P Global’s most recent SPIVA (S&P Index vs. Active) Canada Scorecard, which covers the period ending June 30, 2022, clearly illustrates that the vast majority of active managers have struggled to add value.

Percentage of Funds Underperforming their Benchmarks

As the above table illustrates, the inability of active management to add value over the past 10 years has been nothing short of pervasive. There is not one category in which the majority of active managers did not underperform their respective benchmarks. Importantly, this observation holds true over one-, three-, five-, and ten-year periods.

Outrunning a Bear

To be fair, active management is not alone in its underperformance. While the majority of managers have underperformed, any index-tracking ETF is 100% guaranteed to do so for the simple reason that their returns should be equal to those of their benchmarks less management fees, administrative costs, and trading commissions.

This brings to mind a quote that describes a scenario in which you and another person are being chased by a bear: “You don’t have to run faster than the bear to get away. You just have to run faster than the guy next to you.” To the extent that the average active manager’s underperformance is less than that of their comparable ETFs, then there is hope for the former!

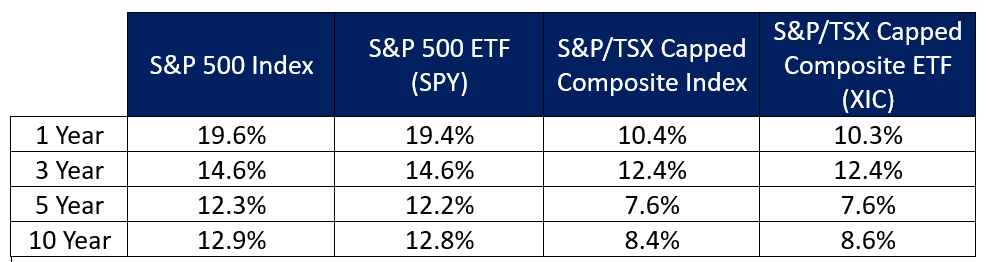

ETF Performance Relative to Underlying Benchmarks

However, as the following table demonstrates, index-tracking ETFs have had essentially no “slippage” vs. their benchmarks. In most cases, their fees and trading costs have been negligible, thereby allowing them to deliver returns that are within a hair of their benchmarks. Over the past ten years, the TSX Composite ETF has actually outperformed its underlying index by a small margin owing to technical factors which I shall refrain from explaining (trust me dear reader, you don’t want me to). The bottom line is that active managers have failed to outrun both the “bear” of their benchmarks as well as the “other guy” of ETFs.

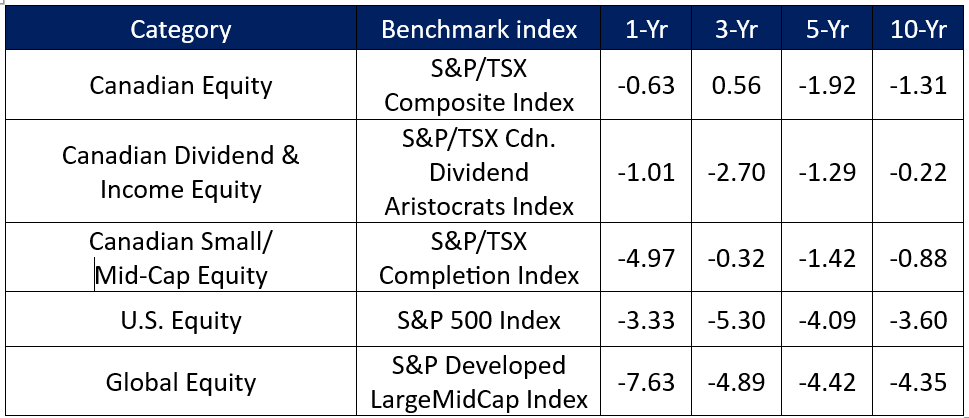

In contrast, not only have the vast majority of active managers underperformed but have done so by a significant margin.

Average Annualized Performance Difference of Funds vs. their Benchmarks (Asset Weighted)

What about Risk?

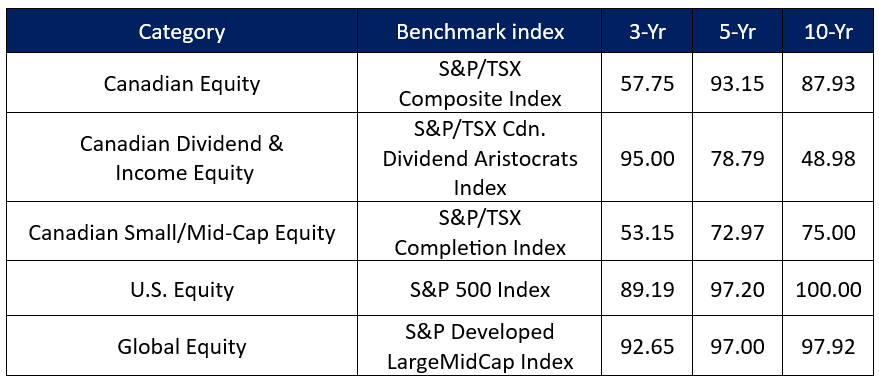

But wait, you say! What about risk? Surely there are many investors who (rationally) would accept some underperformance in exchange for lower volatility. If, on average, active managers have made investors whole for their underperformance in the form of commensurately lower volatility, then one could make a strong case that active management’s bad rap is unjustified.

However, as the following data demonstrate, using risk adjusted returns rather than raw returns does not absolve the active management industry of the albatross of underperformance that hangs around its neck.

Percentage of Funds Underperforming their Benchmarks (Based on Risk-Adjusted Return)

Don’t Throw the Baby Out with the Bathwater!

Although active management has by and large failed to live up to its promise, this does not imply that there has not been a small percentage of managers that have been successful in adding value for their clients.

When we began to contemplate whether to launch a Canadian equity income mandate six years ago, we were resolute in our determination to design an investment approach which was both differentiated and capable of adding value for our clients. Since the fund’s inception in October 2018, we have bucked the trend, outrunning the “bear” of our benchmark.

From October 2018 to the end of February, the fund has produced a cumulative net return of 59.4%, as compared to 48.9% for the S&P/TSX Canadian Dividend Aristocrats ETF. Importantly, we have outperformed by an even wider margin on a risk-adjusted basis, with the fund exhibiting significantly lower volatility and shallower losses in challenging markets.

Noah Solomon is Chief Investment Officer for Outcome Metric Asset Management Limited Partnership. From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds.Between 2002 and 2008, Noah was a proprietary trader in the equities division of Goldman Sachs, where he deployed the firm’s capital in several quantitatively-driven investment strategies.

Noah Solomon is Chief Investment Officer for Outcome Metric Asset Management Limited Partnership. From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds.Between 2002 and 2008, Noah was a proprietary trader in the equities division of Goldman Sachs, where he deployed the firm’s capital in several quantitatively-driven investment strategies.

Prior to joining Goldman, Noah worked at Citibank and Lehman Brothers. Noah holds an MBA from the Wharton School of Business at the University of Pennsylvania, where he graduated as a Palmer Scholar (top 5% of graduating class). He also holds a BA from McGill University (magna cum laude). Noah is frequently featured in the media including a regular column in the Financial Post and appearances on BNN. This blog first appeared in the February 2024 issue of the Outcome newsletter and is republished on the Hub with permission.