Hub Blogs

Beyond Annuities: Innovative Longevity Products for Retirees

Below we canvas 11 retirement experts and financial planners in Canada and the United States about how they and their clients can use new Longevity insurance products above and beyond traditional life annuities.

These experts were gathered by Featured.com, which has been supplying Findependence Hub with quality content for several years. It recently changed its procedure so editors like myself can request input on particular topics we think will interest our readership. The sources are all on LinkedIn, as you can see by clicking on their profiles below.

Here’s what we asked for this instalment:

“In addition to Annuities, what is one new Longevity product or fund that you believe in enough to recommend to clients approaching or already in Retirement? Examples in Canada are Purpose Longevity Fund and Guardian’s Longevity Funds. Are there similar new products in the U.S. (or Canada) of which you are aware?”

Here is what these 11 thought leaders had to say:

LifeX ETF delivers transparent Longevity Income

In addition to traditional annuities, one of the emerging longevity products in the U.S. that I have come to recommend to clients approaching or already in retirement is the LifeX Longevity Income ETF, particularly the LFAI fund.

In addition to traditional annuities, one of the emerging longevity products in the U.S. that I have come to recommend to clients approaching or already in retirement is the LifeX Longevity Income ETF, particularly the LFAI fund.

While it is not a classic insurance product, it is designed to provide predictable monthly distributions over a long horizon, effectively hedging against the risk of outliving one’s assets. The fund invests primarily in U.S. Treasuries and money-market instruments, and its structure is built around the concept of a target cohort’s 100th birthday, which allows for a systematic income stream without relying on a life insurance company guarantee.

For many clients, especially those who purchased assets during low-interest periods or are seeking reliable cash flow without tying up their entire portfolio in an annuity, this product offers a compelling complement to their existing retirement income strategy. What I find particularly valuable is the transparency it provides. Unlike certain annuities, clients can clearly see the underlying investments, understand how distributions are generated, and retain the flexibility to adjust allocations as their personal circumstances or market conditions evolve.

It also fits naturally into a broader retirement strategy where a portion of assets remains growth-oriented, some is allocated to defensive income-generating investments, and a dedicated longevity-income segment addresses the specific risk of living decades beyond retirement.

Of course, it is not without considerations; while the fund aims to provide stable income, it is sensitive to interest-rate changes, inflation, and the assumptions built into its cohort-based design. Clients need to assess the fit carefully, ensuring the time horizon and income targets align with their health, lifestyle, and other holdings. For those who understand these dynamics, however, it offers a sophisticated and innovative approach to longevity planning, bridging the gap between traditional annuities and fully self-managed income portfolios, and giving retirees confidence that they can sustain their lifestyle even as they live longer than expected.

Andrew Izrailo, Senior Corporate and Fiduciary Manager, Astra Trust

BlackRock LifePath Paycheck Fund Offers Flexibility

If you’re getting close to retirement, you might want to check out the BlackRock LifePath Paycheck fund. I’ve been following it. It works like those Canadian longevity funds, designed to give you regular monthly checks. The biggest risk is outliving your savings, and this fund has professionals handle the withdrawals so you don’t run out of money. It seems to offer more flexibility than a traditional annuity, which is worth a look.

JP Moses, President & Director of Content Awesomely, Awesomely

——————————————-

Vanguard and Fidelity Deliver Stable Retirement Income

The Vanguard Target Retirement Income Fund is not an entirely new “longevity” product in the mold of Canada’s Purpose and Guardian funds, but it fulfills a similar role for retirees. It is intended to deliver a steady flow of income while protecting against the effects of inflation by investing in a diversified blend of stocks, bonds and cash. The Fidelity Strategic Advisers (r) Core Income Fund is also designed to provide income for retirees with a diversified approach. The two funds both provide some level of stability for those who want to keep a lid on risk and market vomit in retirement.

Evan Tunis, President, Florida Healthcare Insurance

——————————————-

Modern LifeX ETFs balance Freedom and Income

I’ve often been asked about newer longevity products beyond traditional annuities, especially by clients preparing for retirement who want flexibility without giving up stability. What I have observed while working with financially cautious founders and executives is that people want income structures that feel modern, transparent, and liquid, and one option in the U.S. that I genuinely find promising is the Stone Ridge LifeX Longevity Income ETFs. I first came across them while helping a client map out a long term retirement strategy, and what stood out was how these funds provide monthly distributions while still allowing investors to keep full liquidity. I remember reviewing the structure and appreciating how it focuses on Treasuries and a long horizon rather than tying someone into an insurance contract. It felt refreshing. many retirees dislike the idea of locking up money permanently, and this approach allowed them to protect their cash while still receiving consistent income. The experience reminded me of moments with founders who want efficiency without losing control, and pattern is similar

In my opinion, the biggest advantage of these longevity ETFs is the balance between predictability and freedom, since investors receive monthly payouts but can still adjust their strategy if life takes an unexpected turn. The main drawback is that there is no lifetime guarantee, so someone who ends up living much longer than expected might outlive the structure if they rely on it too heavily. I often explain that longevity planning still requires layering different tools rather than expecting one product to solve everything. Another point that came up during discussions with retirees is the sensitivity to interest rate changes, which can affect the value of the ETF itself, and it is important not to overlook that risk. Still, for clients who want something more adaptable than an annuity, this has become a strong option to consider. I also pay attention to emerging pooled longevity concepts, similar to modern tontine ideas, which share risk across participants and create higher payouts for those who live longer. Even though these structures are not mainstream in the U.S. yet, the logic is compelling for retirees who expect longer than average lifespans. Whenever I see innovation like this, I feel the same excitement I do when a founder shows us a new model at spectup because it signals that the industry is shifting toward more transparent, flexible solutions.

Niclas Schlopsna, Managing Partner, spectup

——————————————-

LifeX ETFs offer flexible, predictable Retirement Income

When I think about longevity-focused options beyond traditional annuities, one U.S. product I genuinely find compelling is the Stone Ridge LifeX Longevity Income ETFs. What draws me to LifeX is that it tries to solve the same problem that Canadian funds like Purpose Longevity and Guardian Longevity address — steady income over an unknown lifespan — but without locking someone into an irreversible insurance contract.

Instead of handing over capital permanently, retirees stay invested and receive structured monthly distributions, which feels more flexible and respectful of changing needs. I’ve always liked the idea of having income that mimics an annuity while still keeping the door open if health, family, or market circumstances shift.

I’ve come to see LifeX as especially appealing for clients who want predictable cash flow but aren’t comfortable giving up control of their assets. Because the funds are built largely on U.S. Treasuries, the income stream feels relatively stable, and the target-date structure helps align payouts with the later stages of retirement, when longevity risk becomes more real. The liquidity alone makes it feel like a meaningful evolution in retirement planning: it’s easier to sleep at night knowing the money isn’t trapped.

Of course, I’m also realistic about its limitations. There’s no lifetime guarantee the way a true annuity offers, and the income still depends on market and interest-rate dynamics. It’s not a perfect replacement for insurance-based products. But as a complement — or even a middle ground between full guarantees and full market exposure — it’s one of the few newer U.S. longevity products I’d feel confident putting on the table for someone approaching or entering retirement.

Sovic Chakrabarti, Director, Icy Tales

——————————————- Continue Reading…

AI Bubble Worries? Read This

By Ariel Liang, BMO Global Asset Management

(Sponsor Blog)

If you’ve ever felt nervous about the stock market ups and downs, you’re not alone. Most investors want their money to grow steadily without the wild swings: especially if you’re thinking about retirement. Lately, worries about an AI bubble and changing interest rates have shown just how quickly things can get unpredictable.

That’s why building the right portfolio is important to help you stay calm and stay invested, even when markets get a little rocky.

Low-volatility investing, and specifically using funds such as BMO Low Volatility Canadian Equity ETF (ZLB) and BMO Low Volatility US Equity ETF (ZLU), are designed to give you a smoother experience. These strategies help you stay invested with confidence no matter what the markets are doing.

What does Low Volatility mean for your Investments?

Imagine low-volatility investing as playing it smart in baseball: not trying for risky home runs, but focusing on steady singles and doubles. This way, you keep making progress, scoring runs over time, and avoiding big losses. It’s all about reliable growth, not wild swings that could set you back.

ZLB and ZLU are designed to help your investments stay on track, even when markets get unpredictable. They pick companies that don’t jump around as much as the overall market: think of them as the steady players on the team. By steering clear of those big ups and downs, your money can grow more smoothly, and you can benefit from compounding over time.

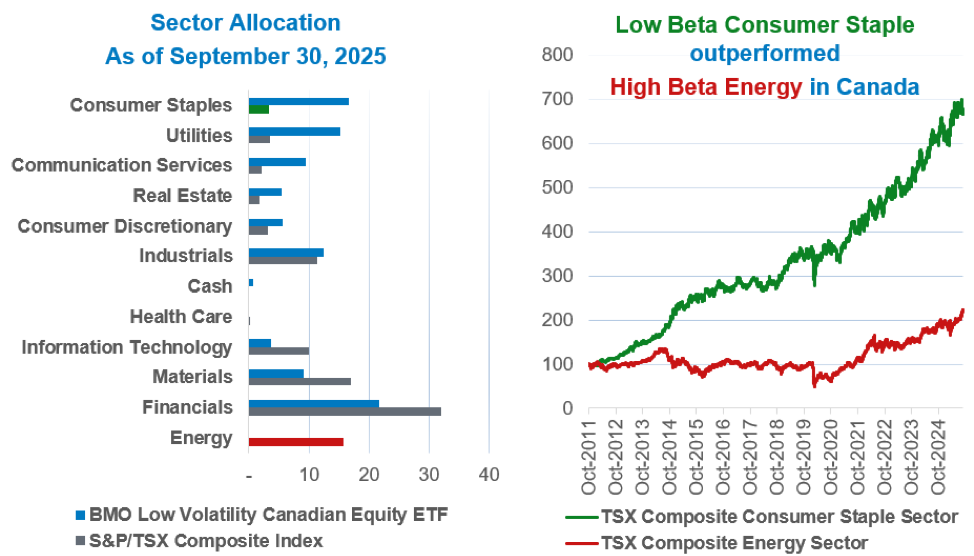

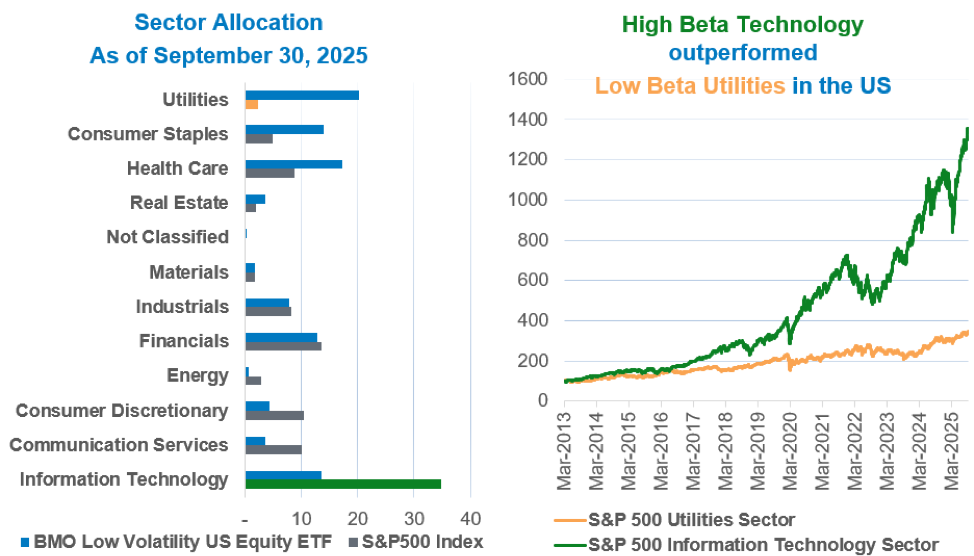

Building a Smoother Ride with Low volatility

ZLB and ZLU focus on defensive sectors like utilities, consumer staples, and healthcare. These ETFs can act as financial shock absorbers, reducing risk from market swings and limiting exposure to more volatile sectors like technology. Position and sector caps further protect against over-concentration, while the selection of low-beta1 companies means the portfolio is designed to cushion losses during downturns.

The disciplined construction of ZLB and ZLU helps you stay on course regardless of market conditions. This approach isn’t about chasing the latest trends but about building steady, long-term growth through stability and diversification, letting compounding work its magic over time.

Low volatility cushioned the blow with stability

Chart 1

Note: Data as of September 30, 2025. Source: BMO AM Inc. Bloomberg Sector allocation subject to change without notice. Chart compares sector allocations of BMO Low Volatility Canadian Equity ETF and S&P/TSX Composite Index as of September 30, 2025, and shows Consumer Staples outperforming Energy in Canada from 2011 to 2024.

Common Myth: Low-Volatility ETFs reduce Return

Low volatility doesn’t mean you have to settle for lower returns. In fact, Canadian low-volatility investments have consistently outpaced the S&P/TSX Capped Composite Index since inception, offering strong returns while helping to reduce risk.

Chart 2

Note: Data as of September 30, 2025. Source: BMO AM Inc. Bloomberg Sector allocation subject to change without notice. Chart compares sector allocations of BMO Low Volatility US Equity ETF and S&P 500 Index as of September 30, 2025, and shows Technology outperforming Utilities from 2013 to 2025.

The U.S. market is highly concentrated in the Magnificent 72 and generally information. Because ZLU invests more in stable sectors like utilities and healthcare, it provides steady, long-term returns, though it might not keep up with the S&P 500 when the market is booming, as it has more recently with the growth dominated in the Tech sector. Even with this more cautious approach, ZLU still delivers strong annual returns for investors by emphasizing stability and value rather than jumping into the latest tech trends.

Balanced Growth, Less Stress: Blending ETFs for Smoother Returns

If you want steady growth for your portfolio without taking on too much risk, you may not have to choose between safety and strong returns. By combining BMO Low Volatility US Equity ETF (ZLU) with BMO NASDAQ 100 Equity Index ETF (ZNQ), you can get the best of both worlds: reliable stability and exciting growth. This mix has delivered higher returns and lower risk than simply investing in BMO S&P 500 Index ETF ( ZSP) as shown in Chart 3. Continue Reading…

Generational Wealth in Canada: Tailoring Financial Advice for every Generation

By Kevin Anseeuw, CFP

Special to Financial Independence Hub

Canada is about to experience an unprecedented transfer of wealth across generations that will transform household balance sheets, life plans, and the role of financial advisors. Experts estimate that roughly $1 trillion will transfer between generations over the next decade, and this shift is discussed weekly.

As someone who advises families across multiple generations, I see three key implications. First, the amount of capital shifting hands is significant, but equally important are the who and the how: younger recipients seek different things than their parents. Second, the timing and structure of transfers (gifts made during life versus testamentary bequests) are driven by family dynamics as much as tax considerations. Third, the industry itself must modernize to stay relevant: advice now goes beyond portfolio selection to include income architecture, behavioral coaching, private-market access, values alignment, and digital delivery. The landscape is changing more quickly than I have experienced in the past 25 years.

Understanding what each generation needs and why they want it is the foundation for giving meaningful advice.

Baby Boomers: stewardship, income, and legacy

Baby Boomers still hold a disproportionate share of wealth in Canada, and their priorities have shifted from accumulation to preservation, predictable income, and legacy planning. The questions they ask are practical and existential: Will I outlive my money? How do I leave a legacy without causing family conflicts? How do taxes and health-care risks affect my plan? In practice, this means structuring retirement income to address longevity risk, incorporating tax-efficient solutions, and creating estate plans that minimize friction at death.

At Trans Canada Wealth, an advisory group of Harbourfront Wealth’s independent platform, we integrate investment strategies with our in-house CPA tax specialist and estate planning expertise so clients can see the full chain of outcomes, cash flow, taxes, and transfer, rather than isolated portfolio returns. This comprehensive approach is what gives Boomers the peace of mind they value most. We walk clients through our “Atlas” system to ensure they have peace of mind that no stone has been left unturned and that they have a structure and plan that works for their unique situation.

Gen X: the bridge generation demanding clarity

Generation X is in the middle, often financially squeezed, supporting aging parents while raising children, yet they are likely to be the most active people in managing wealth transfers. Many Gen X clients will inherit significant wealth but usually don’t plan for it; instead, they seek control, transparency, and practical plans that address debt today, catch up on retirement savings, and fund education. Unlike parents of previous generations, they have a stronger desire to help their children buy their first home and ensure they start their financial journey on solid footing.

An important role for advisors is facilitation: helping families have clear conversations about intentions and timing. We frequently counsel Boomers on the merits of lifetime gifts versus estate transfers because earlier transfers can increase intergenerational utility and allow parents to witness the benefits. Equally, Gen X wants straightforward, independent advice that filters noise, ensuring one poor decision doesn’t derail a 20- or 30-year plan.

Millennials: aligning performance with purpose

Millennials prioritize differently when they invest. While performance remains important, purpose and fees are now key factors. Studies and industry reports reveal that younger investors are highly interested in sustainable and impact strategies; they seek access to alternative investments and ESG-informed allocations as part of a diversified portfolio.

For advisors, this means providing institutional-grade access and clear discussions about costs alongside values-based solutions. Millennials are well-informed but have limited time; they expect advisors to add value by curating investment opportunities, conducting thorough due diligence, and explaining trade-offs: such as how an ESG focus might affect risk/return, liquidity, and fees. When advisors excel at this, they not only retain inherited capital but also build lifelong relationships.

Gen Z: digital-first, early adopters and learners

Gen Z approaches wealth conversations with a different relationship to money. They are digital natives, comfortable transacting and learning online, and many start their investing journey earlier than previous generations. Research shows a significant rise in early retail investing and financial literacy among Gen Z, and their expectations for digital access, education, and transparency are high. Continue Reading…

Experts on how investors can use AI tools to invest and plan Retirement

Below we canvassed more than 20 retirement experts and financial planners in both Canada and the United States about how they and their clients can use new AI Tools to help investors pick stocks or ETFs and plan their retirement.

These experts were gathered by Featured.com, which has been supplying Findependence Hub with quality content for several years now. It has changed its procedure so that editors like myself can request input on particular topics we think will interest our readership. The sources are all on LinkedIn, as you can see by clicking on their profiles below.

Here’s what we asked:

What is your top recommendation for using AI tools like Grok or ChatGPT to enhance the investing experience or financial planning process for retirement?

Their answers are below, which have been re-ordered by me and in some instances edited down, using an ellipsis (…) to indicate cut passages.

“AI doesn’t replace financial advisors: it elevates investors to think and plan like one.”

One of the most powerful ways investors and retirees can use AI tools like Grok or ChatGPT is to transform information overload into clear, actionable insight not just faster, but smarter. These tools allow individuals to run scenario-based retirement models, stress-test investment ideas against historical data, and translate complex financial language into plain English they can actually act on. What I recommend most is using AI as an always-available financial co-pilot a tool that helps you ask better questions, explore tax and withdrawal strategies, and stay disciplined when emotions run high. Of course, AI should enhance, not replace, professional advice; but when paired with fiduciary guidance, it becomes a force multiplier for better decision-making. The future of retirement planning is not just automated: it’s augmented, where every person can access institutional-grade research and personalized planning at a fraction of the cost. — Justin Smith, CEO, Contractor+

One of the most powerful ways investors and retirees can use AI tools like Grok or ChatGPT is to transform information overload into clear, actionable insight not just faster, but smarter. These tools allow individuals to run scenario-based retirement models, stress-test investment ideas against historical data, and translate complex financial language into plain English they can actually act on. What I recommend most is using AI as an always-available financial co-pilot a tool that helps you ask better questions, explore tax and withdrawal strategies, and stay disciplined when emotions run high. Of course, AI should enhance, not replace, professional advice; but when paired with fiduciary guidance, it becomes a force multiplier for better decision-making. The future of retirement planning is not just automated: it’s augmented, where every person can access institutional-grade research and personalized planning at a fraction of the cost. — Justin Smith, CEO, Contractor+

Use AI for Grunt Work & Routine Analysis

I use AI to handle the grunt work for my finances. It’s great for automating my investment tracking and finding savings opportunities. For my SaaS business, I have ChatGPT audit expenses and run tax simulations. It catches small details I would definitely miss, but I always double-check with my accountant before making any big moves. — Cyrus Partow, CEO, ShipTheDeal

Running a fintech team, I use AI like Grok to track portfolios and summarize complex financial statements. I have it monitoring global trends that might affect Canadian retirement planning. Integrating these tools took some time, but the process is way less stressful now. My rule is to let AI handle the routine analysis while I double-check any critical decisions myself. — Sreekrishnaa Srikanthan, Head of Growth, Finofo

A good way to use AI tools like Grok or ChatGPT for investing and retirement planning is to treat them as helpful guides that explain financial topics, summarize current market information, and assist with planning choices. These tools can make complex financial ideas easier to understand, break down how different investment options work, and help create scenarios based on your retirement goals. You can ask questions to check your knowledge about topics like spreading your investments or tax rules related to retirement accounts, getting clear answers that fit your situation.

A good way to use AI tools like Grok or ChatGPT for investing and retirement planning is to treat them as helpful guides that explain financial topics, summarize current market information, and assist with planning choices. These tools can make complex financial ideas easier to understand, break down how different investment options work, and help create scenarios based on your retirement goals. You can ask questions to check your knowledge about topics like spreading your investments or tax rules related to retirement accounts, getting clear answers that fit your situation.

These AI tools also provide updated summaries of financial news and alert you to changes that could affect your retirement plans, like new laws or required withdrawals. While they do not replace a human financial advisor’s insight, they give you useful information that helps you talk to professionals with more confidence. Regular use helps keep you informed about your progress and reminds you of important details, making managing your retirement plan easier. — Richard Dalder, Business Development Manager, Tradervue

Use to summarize Market Trends

I work in tech marketing, so I’ve started using ChatGPT to research retirement investments. I’ll have it summarize market trends in telecom or healthcare IT, then cross-check with mainstream financial sources. This saves me hours of initial screening time. My advice is to never act on an AI’s take without fact-checking it first, but it’s a great way to get the lay of the land quickly. — Andrew Dunn, Vice President of Marketing, Zentro Internet

Use AI as a Personalized Planning Engine

My top recommendation is to use AI as a personalized planning engine. Feed it your retirement goals, income range, expected timeline, and risk comfort. Ask it to build draft scenarios, compare tax-advantaged account strategies, summarize differences between contribution options, or outline the impact of shifting a portion of your portfolio into metals, equities, or fixed income. This gives you a structured starting point before you meet with a licensed advisor.

My top recommendation is to use AI as a personalized planning engine. Feed it your retirement goals, income range, expected timeline, and risk comfort. Ask it to build draft scenarios, compare tax-advantaged account strategies, summarize differences between contribution options, or outline the impact of shifting a portion of your portfolio into metals, equities, or fixed income. This gives you a structured starting point before you meet with a licensed advisor.

AI also helps people evaluate items of value they already own. Many Americans keep gold or silver tucked away because they are unsure where to start or who to trust. Ask AI to walk you through how precious metal markets move, how payouts are typically calculated, and what reputable U.S. buyers offer. When people understand what their gold is actually worth, they make smarter decisions about whether to sell, hold, or incorporate it into their retirement strategy.

Using AI this way puts you in control. It speeds up research, cuts through noise, and helps you prepare with confidence before talking to a financial professional. — Brandon Aversano, CEO, The Alloy Market

I work with AI and financial data, and here’s what I’ve found: nobody reads those static retirement planning sheets. We switched to interactive simulations using tools like ChatGPT, letting people play out different investment choices and actually see the results. Engagement went way up. If you’re planning retirement in the U.S. or Canada, this gives you a much better feel for your financial future than any document. — John Cheng, CEO, PlayAbly.AI

I work with AI and financial data, and here’s what I’ve found: nobody reads those static retirement planning sheets. We switched to interactive simulations using tools like ChatGPT, letting people play out different investment choices and actually see the results. Engagement went way up. If you’re planning retirement in the U.S. or Canada, this gives you a much better feel for your financial future than any document. — John Cheng, CEO, PlayAbly.AI

Use to plan Retirement and support Financial Literacy

AI tools like Grok and ChatGPT shine brightest in retirement planning when used to simplify complex financial decisions. One powerful approach is creating personalized scenario models: quick projections that show how small adjustments in savings, expenses, or timelines can change long-term outcomes. This turns retirement planning from an abstract, overwhelming challenge into a set of clear, data-driven choices.

Another strong use case is ongoing financial literacy support. AI assistants can distill dense market insights, tax rules, or investment updates into plain-language summaries tailored to an individual’s stage of life. From my experience building learning systems at Edstellar, the real value comes when AI acts as a translator: cutting through jargon and helping people understand the “why” behind decisions. That level of clarity dramatically improves confidence, especially for long-horizon goals like retirement. — Arvind Rongala, CEO, Edstellar

An on-demand Analytical Partner

In my opinion, the best use of AI tools like Grok or ChatGPT when it comes to retirement planning is to enlist it as a personalized, on-demand analytical partner. When you present an AI with your financial data (savings, trajectory, risk profile, retirement age), it has the ability to remit stress testing of your assumptions at a breadth and speed most people will never do for themselves. I have even gone a step further and even asked the AI model to create a variety of long term simulations: good markets, flat markets, inflationary periods, tax shifts, and a few unexpected life surprises here and there. This is when you will feel a much better understanding of what the reality will look like on your retirement path versus static projections.

In my opinion, the best use of AI tools like Grok or ChatGPT when it comes to retirement planning is to enlist it as a personalized, on-demand analytical partner. When you present an AI with your financial data (savings, trajectory, risk profile, retirement age), it has the ability to remit stress testing of your assumptions at a breadth and speed most people will never do for themselves. I have even gone a step further and even asked the AI model to create a variety of long term simulations: good markets, flat markets, inflationary periods, tax shifts, and a few unexpected life surprises here and there. This is when you will feel a much better understanding of what the reality will look like on your retirement path versus static projections.

Where I do think AI can take the planning to another level is the rigor of thinking it is going to force on you. It will find blind spots you didn’t even know to look for, it will challenge your assumptions, it will allow you to show up to your advisor meeting with the potential to be prepared. In the U.S. and Canada—complex situations in retirement planning to say the least, not to mention personal—AI will present a great utility. It won’t replace your financial professional, but it might very well allow you to ask better questions and gain confidence in your decision making. — Kevin Baragona, Founder, Deep AI

AI is NOT a financial advisor

Running a finance team, I’ve found AI like ChatGPT is great for the first pass at retirement planning. It can explain jargon or summarize options way faster than reading a 20-page PDF. But here’s the thing: it’s not a financial advisor. Use it to get the lay of the land, but always talk to a licensed professional before you put any real money in. — Edward Piazza, President, Titan Funding

Treat AI tools as a Scenario Partner

One of the most useful ways I’ve leveraged AI tools like ChatGPT and Grok in the investing and retirement-planning process is by treating them as a “scenario partner.” Not a financial advisor, not a spreadsheet replacement, but a way to explore the assumptions behind long-term decisions.

One of the most useful ways I’ve leveraged AI tools like ChatGPT and Grok in the investing and retirement-planning process is by treating them as a “scenario partner.” Not a financial advisor, not a spreadsheet replacement, but a way to explore the assumptions behind long-term decisions.

When I was first building Zapiy, I didn’t have the luxury of long planning sessions with advisors. I needed quick clarity on questions like how much I should be contributing, how aggressive my allocations should be, or how different timelines would reshape my retirement targets. What I found was that AI excels at helping you pressure-test your thinking before you make any commitments.

I’d feed ChatGPT a basic profile — income, savings rate, intended retirement age, preferred account types like a Roth IRA or TFSA — and ask it to model a few “what if” versions: what if I increase contributions by five percent, what if I shift to a more conservative allocation in my forties, what if I retire earlier but maintain the same lifestyle? The answers weren’t perfect, but they gave me a clearer sense of how small behavioral changes compound over time.

The real value is that this preparation makes every conversation with a human advisor more productive. You walk in understanding your own priorities, trade-offs, and risk tolerance instead of starting from zero. For many investors in the U.S. and Canada, this hybrid approach — AI for exploration, experts for validation — seems to strike the right balance.

If I had to give one recommendation, it would be this: use AI to sharpen your financial instincts, not to substitute professional judgment. Let it help you see the landscape more clearly so you can plan with confidence and ask better questions when it’s time to make real decisions. — Max Shak, Founder/CEO, Zapiy

Large-language models aren’t crystal balls

With new AI tools, the first impulse is always to ask for a prediction. People want to find the next winning stock or time the market perfectly. I’ve seen this happen for decades with every new wave of technology.

With new AI tools, the first impulse is always to ask for a prediction. People want to find the next winning stock or time the market perfectly. I’ve seen this happen for decades with every new wave of technology.

But these large language models aren’t crystal balls. They’re incredibly good at synthesizing information and finding patterns in past data, but they also have a tendency to invent things with absolute confidence.

The hardest part of long-term investing isn’t about finding more data. It’s about managing your own psychology, your biases, and the emotional urge to react to every bit of market noise. This is where AI’s real, and more subtle, value comes in.

My top recommendation is to stop treating these tools like an analyst and start using them as a sparring partner to challenge your own thinking. Instead of asking something simple like, “What are the best Canadian dividend stocks for 2025?”, give it a much more powerful prompt.

Try something like this: “Act as a skeptical financial advisor. My plan is to invest 30% of my retirement portfolio in Canadian dividend stocks for income. Poke holes in this strategy. What are the biggest risks I’m ignoring, what behavioral biases might be at play, and what alternative approaches should I consider?”

What this does is force the AI to act as a “red team” for your own ideas. It uses its vast knowledge of economic principles and market history to find the flaws in your logic before you commit real capital.

This reminds me of a brilliant young engineer I once mentored. He had designed this complex, theoretically perfect trading algorithm and was in love with its elegance. Instead of telling him it would fail, I just spent an hour asking questions.

What happens if this data source is delayed by two seconds? How does the model behave in a flash crash? What’s the single point of failure? He came back two days later and scrapped the whole thing, starting over with a simpler, more resilient design.

The AI can be that patient questioner for you. True financial security isn’t built on finding the perfect answer, but on developing the wisdom to question your own. — Mohammad Haqqani, Founder, Seekario AI Job Search

Use for Stress Testing Assumptions

My top recommendation for using AI tools like Grok or ChatGPT to enhance retirement planning is not to use them for advice, but for stress testing assumptions. Never take financial advice from a large language model. That is a path to financial ruin. Instead, use the AI to aggressively challenge the core numbers you are already getting from a human financial advisor.

My top recommendation for using AI tools like Grok or ChatGPT to enhance retirement planning is not to use them for advice, but for stress testing assumptions. Never take financial advice from a large language model. That is a path to financial ruin. Instead, use the AI to aggressively challenge the core numbers you are already getting from a human financial advisor.

The effective use is feeding the AI a series of complex, negative scenarios based on your existing US or Canadian retirement plan. Ask the AI: “If inflation averages 5% over the next ten years, and my portfolio only returns 4%, where does the system fail?” or “If I move to a high-tax state and health care costs double, how does the plan survive?”

This approach works because it turns the AI into a powerful, objective risk auditor. It exposes the hidden vulnerabilities in your human-designed plan without the emotional filter of your advisor. This is the only high-value application: using AI to force clear, honest conversations about competence and failure points in your retirement strategy, ensuring you have the strongest system possible. — Flavia Estrada, Business Owner, Co-Wear LLC

Use to get a head-start on when to retire

Use AI tools like Grok or ChatGPT to get a head start on how to retire. These services will evaluate the state of your finances and most can administer a wide array of retirement and other accounts then recommend investments that fit your criteria. They demystify complicated financial subjects. They can help you with budgeting, monitor progress and shift plans as markets change. Ask questions in a frame where hopefully will receive clear and good advice. Bots driven by AI help save you time, reduce mistakes and change the way you think about money. It makes retirement planning much simpler and more straightforward. — Keith Sant, Founder & CEO, Kind House Buyers Continue Reading…