Special to the Financial Independence Hub

We’re half-way through the year, so I thought it would be a good time to check back into my ROBO portfolio to see how it’s doing and if there is anything interesting going on.

Three and half years ago I decided to try an experiment and find out for myself. I set up an account with one of the big Robo Adviser firms and invested $5000 of my own money into it. My goal was to go through the process and blog about my experience and more importantly, the results. I said that we need a good five years to really get a handle on how effective these services are compared to traditional wealth management services. Well, we’re coming upon the 4th anniversary of my ROBO account, so let’s take a look at how it’s doing at the mid-year mark.

Performance

Since we last checked in at the 3-year mark in January, the markets had a bit of a throw-up in February and March and so I was curious to see how the ROBO portfolio handled that pressure.

Year to date the portfolio is up 4.2 per cent. Since the January 30th anniversary date the portfolio is up 1.5 per cent. Going back to when setup the portfolio in January of 2015, the portfolio is up 26.6 per cent. The portfolio has increased $92 this year, of which $80 was in dividends.

So far this year ROBO has been rather pedestrian, which it should be. The value proposition of the robo advisor model is steady, consistent implementation of a passive oriented, low cost investment strategy. We haven’t had any adjustments to the weightings of the portfolio unlike last year. There haven’t been any rotation of ETF products.

Despite my concerns about the weighting of the portfolio to Canadian and US equities, the allocation has paid off nicely, especially the US components. In fact all the equity allocations have performed quite well. Fixed income components continue to lag, which makes sense as interest rates continue to track up.

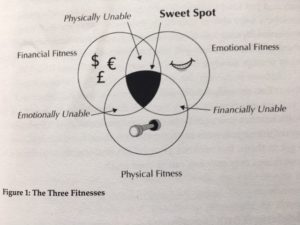

Given the strong performance I’m curious to see if the ROBO will actually take some profits and redistribute money towards fixed income or whether they will stay the course. In other words, how “emotional” will my ROBO be? It would be a shame to lose all those gains but I guess that’s what this is all about. That’s me the human being talking and when we let emotions into our thinking we often make the wrong decision. Will the ROBO be different and ignore?

Fees

Year to date I paid my ROBO $20.12 in fees, which represents about 0.32% of my assets. If this trend continues (they charge a couple of dollars a month), the total fees I pay to the ROBO will come in around 0.6-0.7%. This does not include the Management Expense Ratio fees that are paid to each ETF itself, which would add additional costs.

The Missing Piece

I’ve commented frequently that one thing we don’t know about ROBO portfolios is how they behave in a significant market downturn. We got a small glimpse in February and March when the markets appeared to be on the verge of a major correction. The Dow Jones Industrials were dropping 1000 points a day at one point. How did the ROBO behave during that period? Continue Reading…