By Fritz Gilbert, TheRetirementManifesto

Special to Financial Independence Hub

On April 12, 2015, I published my first post.

In the nine years since I’ve kept writing… and writing…and writing.

I’ve published 428 articles about retirement (see my Archives page). If you do the math * …

…I’ve written the equivalent of 11 books over the past 9 years. *

(* The Math: 1,500 words per post x 428 posts = 642,000 words. The average 200-page book is 60,000 words, so that’s ~ 10 books. Add in the actual book I wrote, and it’s equivalent to 11 books in 9 years.)

And yet, with all of the writing, I’ve missed something.

I’ve never taken the opportunity to step back and think about what I’ve learned from all of my writing.

During our recent RV trip to the Ozarks, I took some time to reflect, and today I’m sharing the most important things I’ve learned through my years of writing articles about retirement.

I suspect the most important lesson may surprise you. But I’m getting ahead of myself…

I’ve written the equivalent of 11 books in the past 9 years, all on retirement. What’s the most important thing I’ve learned in the process? Share on X

What I’ve Learned Writing 400 articles about Retirement

Reflecting on the past 9 years of writing has been an interesting trip down memory lane.

- The first 3 years, as I was preparing for retirement.

- The middle 3 years, as I was making the transition.

- The final 3 years, as I figured it out.

It’s all there.

The 428 articles are like pebbles I’ve sprinkled on the trail, helping those in my footsteps find their way. I’m thankful I decided to experiment with blogging. It’s turned into something I love.

But what have I learned?

What I’ve Learned about Retirement

- Retirement is Complex: Any topic that can fill 11 books has more layers than an onion. Don’t underestimate how complex retirement is. Yes, we all expect the financial complexity (Bucket Strategies, Roth Conversions, Safe Withdrawal Rates, Estimated Quarterly taxes, Asset Allocation, etc.). What’s been more surprising to me is the complexity behind the non-financial aspects of retirement. Working through your experiments to determine how to replace all those non-financial aspects you once received from work (Sense of Identity, Purpose, Structure, Relationships). As complex as the financial issues are, I would argue the non-financial aspects are more so. Be prepared for ebbs and flows as you go through your retirement transition, you’re entering a maze that’s more complex than most people realize.

- Retirement can be Difficult: I’ve gotten hundreds of emails from readers telling me their stories, and I’ve read every one. Many are stories of the difficulties you’re having adjusting to retirement. Your stories led me to research the Four Phases of Retirement and realize how blessed I was to be in the 10-15% of retirees who skip the dreaded Phase II. As you’ll read in the next bullet, I’m convinced there’s a proven way to make retirement less difficult, and I’m fortunate that I chose the right path.

- There are Proven Ways to Make it Easier: I was 3 years from retirement when I started this blog. I’d seen some of my friends struggle with the retirement transition, and I was obsessed with learning why some people have great retirements, whereas others struggle. I was motivated to find the path that led to success and was fortunate to discover it. I’m convinced it wasn’t merely luck, but rather a result of the extensive planning my wife and I did in my final few years of work. If there’s one trick I’ve learned to make retirement less difficult, it’s the importance of putting in the work to prepare for the transition before you cross The Starting Line. Focus on the non-financial aspects as much (or more) as you do the financial ones. To understand how I approached the challenge, check out The Ultimate Retirement Planning Guide, which lays out all the steps starting 5 years before you retire.

- Retirement Changes with Time: I’ve often said that retirement is like marriage – you never really know what it’s like until you do it. As I thought about what I’ve learned from writing so many articles about retirement, I realized there’s another parallel between marriage and retirement. Just as your marriage will evolve over the years, so too will your retirement. The honeymoon is great, but it doesn’t last forever. Working through the challenges that surface is one of the fun parts of both marriage and retirement. No retirement (or marriage) is perfect, but there’s a lot you can do to make it the best experience possible. Learn to experiment, learn to follow your curiosity, and learn to maintain a positive attitude. If there’s one piece of advice I’d give to help you deal with the changes that occur throughout your retirement, it is to embrace, nurture, listen to, and follow your curiosity wherever it leads.

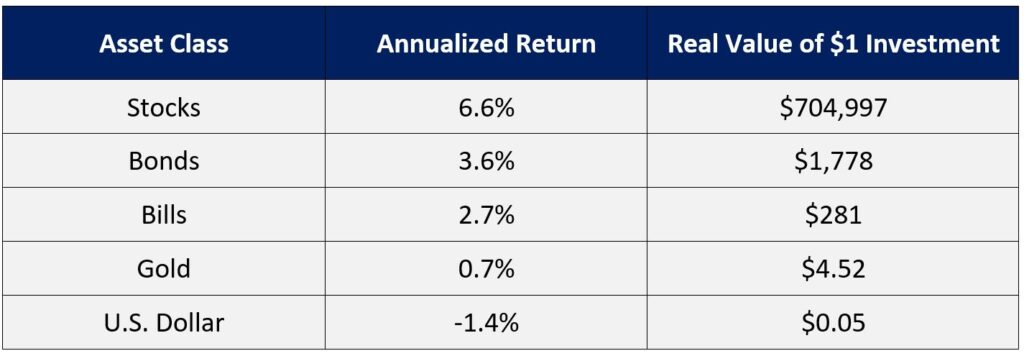

- Retirement can be the Best Phase of your Life: We all want great retirements, right? I’m grateful that retirement is the best phase of my life. Many of you can say the same. But …. there is a large percentage of folks who can’t. If you’re struggling, I encourage you to study those in the first camp. Listen to what they talk about, and observe what they do. Chances are good you won’t hear much talk about money. As I wrote in The 90/10 Rule of Retirement, if you’ve done your planning correctly you won’t worry much about money after you retire. By studying the 72% of happy retirees, you’ll find the common themes of Curiosity, Purpose, Relationships, Fitness, and Planning. Focus on doing those things well, and you’ll find, like many others, that retirement can be the best years of your life. It’s interesting to realize how many of those commonalities relate to the non-financial aspects of retirement. In my experience, it’s in those areas where you’ll find true joy. Continue Reading…