By Dale Roberts, Cutthecrapinvesting

Special to the Financial Independence Hub

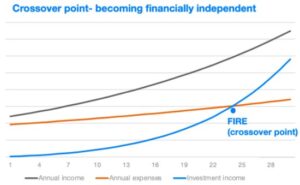

There are a few reasons to play defense. A retiree or near retiree can benefit from less volatility and a lesser drawdown in a bear market. If your portfolio goes down less than market, and there is a greater underlying yield, that lessens the sequence of returns risk. You have the need to sell fewer shares to create income. For those in the accumulation stage it may be easier to stay the course and manage your portfolio if it is less volatile. You can build your portfolio around defensive Canadian ETFs.

For a defensive core, investors can build around utilities (including the modern utilities of telcos and pipelines), plus consumer staples and healthcare stocks. My research and posts have shown that defensive sectors and stocks are 35% or more “better” than market for retirement funding.

I outlined that approach in – building the retirement stock portfolio.

We can use certain types of stocks to help build the all-weather portfolio. That means we are better prepared for a change in economic conditions, as we are experiencing in 2022.

Building around high-dividend Canadian ETFs

While I am a total return guy at heart, I will also acknowledge the benefit of the Canadian high-dividend space. These big dividend payers outperform to a very large degree thanks to the wide moats and profitability. Those wide moats create that defensive stance or defensive wall to be more graphic. And of course, you’re offered very generous dividends for your risk tolerance level troubles.

Canadian investors love their banks, telcos, utilities and pipelines. The ETF that does a very good job of covering that high-dividend space is Vanguard’s High Dividend ETF – VDY. The ‘problem’ with that ETF is that it is heavily concentrated in financials – banks and insurance companies.

Vanguard VDY ETF as of November 2022.

| Sector | Fund | Benchmark | +/- Weight |

| Financials | 55.4% | 55.4% | 0.0% |

| Energy | 26.3% | 26.2% | 0.1% |

| Telecommunications | 9.0% | 9.0% | 0.0% |

| Utilities | 6.2% | 6.2% | 0.0% |

| Consumer Discretionary | 1.9% | 1.9% | 0.0% |

| Basic Materials | 0.6% | 0.6% | 0.0% |

| Industrials | 0.4% | 0.4% | 0.0% |

| Real Estate | 0.2% | 0.2% | 0.0% |

| Total | 100.0% | 100.0% |

VDY is light on the defensive utilities and telcos. The fund also has a sizable allocation to energy that is split between oil and gas producers and pipelines. The oil and gas producers will also be more sensitive to economic conditions and recessions.

Greater volatility can go along for the ride in VDY as it is financial-heavy. And those are largely cyclical. They do well or better in positive economic conditions. But they can struggle during time of economic softness or recessions. Hence, we build up more of a defensive wall.

Building a wall around VDY

We can add more of the defensive sectors with one click of that buy button. Investors might look to Hamilton’s Enhanced Utility ETF – HUTS. The ETF offers …

█ Pipelines 26.8%

█ Telecommunication Services 23.5%

█ Utilities 49.6%

The current yield is a generous 6.5%. Keep in mind that the ETF does use a modest amount of leverage. Here are the stocks in HUTS – aka the usual suspects in the space.

BMO also offers an equal weight utilities ETF – ZUT .

And here’s the combined asset allocation if you were to use 50% Vanguard VDY and 50% Hamilton HUTS.

- Financials 26.7%

- Utilities 24.9%

- Energy 26.5%

- Telecom 16.2%

Energy includes pipelines and oil and gas producers. And while the energy producers can certainly offer more price volatility, there is no greater source of free cashflow and hence dividend growth (in 2021 and 2022). In a recent Making Sense of the Markets for MoneySense Kyle offered … Continue Reading…