Kevin Flanagan, WisdomTree Investments

Special to the Financial Independence Hub

Has the fixed income arena entered a new phase? While the lion’s share of attention has been given to interest rate developments for quite some time now, another topic for discussion has been where we are in terms of the U.S. credit cycle. Specifically, the debate has centered on whether the corporate bond market has entered the bottom of the ninth inning of the current cycle or whether the time frame is more akin to being in the sixth or seventh inning. Interestingly, in sticking with this baseball analogy, there does seem to be agreement that credit is not in the first few innings.

For this blog post, the focus will be on U.S. high yield (HY), particularly because if one was to see the first signs of stress, the argument could be made that this is the sector where investors should turn their attention. Over the last six months, investors have witnessed two episodes where HY spreads have visibly widened. The first of these episodes occurred during late October to mid-November of last year, when spreads rose 53 basis points (bps).1 The second occurrence was more recent, as HY differentials moved from more than a decade low of 311 bps on January 26 up to 369 bps two weeks later, representing a widening of 58 bps.2

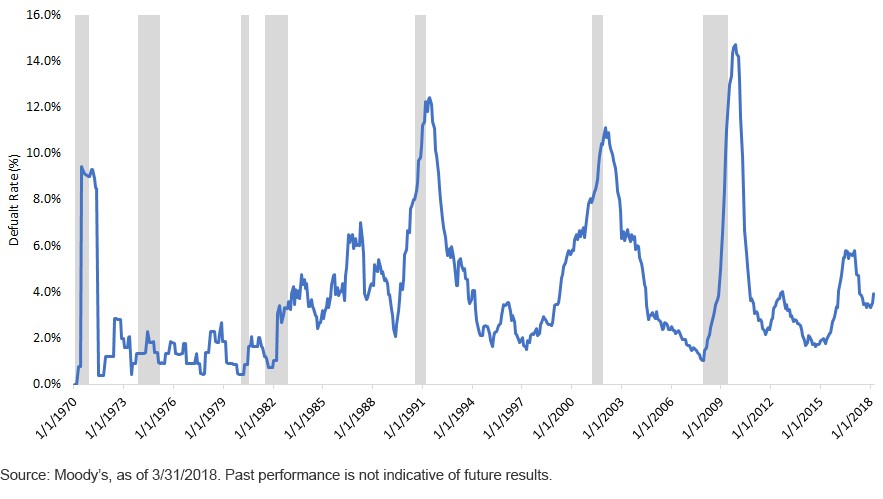

U.S. Speculative-Grade Issuer Default Rate vs. Recessions

It is interesting to note that in both cases the widening trends were rather brief (two to three weeks) and of similar magnitudes. In addition, both times the sell-off was short-lived, as buyers re-emerged and compressed spreads back down.