“Never spend your money before you have it.”

—Thomas Jefferson

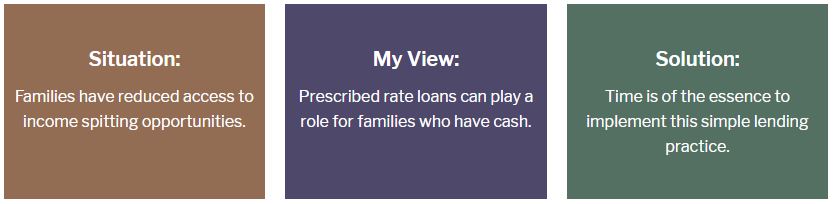

I can’t emphasize enough that time is truly of the essence if you benefit from implementing this simple family lending practice. Interest rates are expected to inch up again and will alter the value of this tactic. Hence, I revisit the benefits of one of the few remaining family income splitting strategies.

It is commonly known as the “prescribed rate” loan. The procedure needs these components:

- One spouse is in a lower tax bracket than the other, or earns little income.

- The higher tax bracket spouse has cash to lend to the other spouse.

“The benefit of the prescribed loan strategy is a bigger family nest egg.”

Examine your family benefits from this income splitting opportunity. All loan arrangements and documentation must be in place by March 31, 2018 to derive maximum benefit. The key is to charge interest at least at the prescribed rate on cash loaned to a spouse/partner. That prescribed rate is now set at 1% for loan arrangements made by March 31, 2018.

The lower income spouse aims to accumulate a larger nest egg while the family pays less tax. The good news is that loans don’t have to be repaid for a long time, say 10 to 20 years or more.

My sample case highlights the income splitting strategy (figures annualized):

- The higher tax bracket spouse lends $200,000 to the other at the 1% prescribed rate.

- The recipient spouse invests the cash, say at 4% ($8,000) and reports the investment income.

- The recipient must pay 1% annual interest ($2,000) to the lender spouse.

- The lender spouse is taxed on the 1% interest, while the recipient deducts it.

- The recipient is taxed on the net income generated ($8,000-$2,000).

- This results in annual income of $6,000 shifted to the lower income spouse.

- A promissory note is evidence for the loan.

- A separate investment account is preferred for the recipient.

- These loans are best made for investment reasons, such as buying dividend stocks.

- A new 1% loan can also deal with an existing higher rate prescribed loan.

- Multiple prescribed loans can be made at 1% while the rate does not change.

- Business owners can investigate the viability of prescribed loans to shareholders.

Prescribed Rate Loan – Sampler

Here is a simplified method to think of such loans:

Cash Borrowed at 1% rate: $200,000

Assumed Investment Income (4%): $8,000

Less: Prescribed Loan Interest (1%): $2,000

Taxable Income for Borrower Spouse: $6,000

Taxable Interest for Lender Spouse: $2,000

The benefit of the prescribed loan strategy is a bigger family nest egg. Your mission is to shift investment income into the hands of the lowest taxed spouse.

Need for speed

Today’s prescribed rate, which is set quarterly, is as low as it can be. However, it is most likely to rise at the next setting later this month. The prevailing expectation is a jump to 2% from the current 1% rate on April 01, 2018. Such an increase reduces the net value of the loan arrangement. Further, we may not enjoy a 1% rate for a long time, perhaps never again. Continue Reading…