By Steve Lowrie, CFA

Special to Financial Independence Hub

Now that we’re well into 2024, it’s time to turn the page on last year’s “Play It Again, Steve – Timeless Financial Tips”.

To shift gears, I recently polled my blog post readers, asking them what was on their mind and, although specific topics were varied, the underlying question resounded:

Timeless financial tips are well and good – but how do they apply to my investment decisions in real life?

To address that question, I’m launching Lowrie Financial’s “Real Life Investment Strategies.” Each post in this new series will use case studies to illustrate the choices real people are making, as they contemplate money management concerns in real time.

Active Concerns around Geopolitical Events and their Impact on your Financial Future

In our blog post readers survey, there were several responses with a clear theme:

- worrying thoughts about current events,

- what the geopolitical climate may mean to your money, and

- what investment strategies to avert setbacks for your financial future

So, let’s address some of the more worrisome flash points looming large at this time: the world, its politics, and its politicians.

Of course, it’s natural, and advisable, to want your investments to weather the market storms wrought by geopolitical forces. The catch is there’s always a crisis going on somewhere and we never know for sure how it’s going to play out, until it has. That’s true whether it is history repeating itself, a new and unexpected upset, or (usually) a blend of both.

The other reality is that the most significant risks, with the greatest negative financial impact, are those you don’t see coming.

For example, in the last 25 years, we have had to deal with these three and unexpected and significant events:

- COVID-19

- The bankruptcy of Lehman Brothers on Sept 10, 2008 (ironically considered one of the world’s safest banks three days earlier), which was considered one of the main catalysts of the 2008/09 Global Financial Crisis.

- The terrorist attacks of 9/11 in September 2001.

If there is any good news in these events, which I realize is a stretch, they only come around every ten years or so.

That’s why I’ve long advised the best way to protect your wealth during each crisis du jour is to avoid getting tossed around in its waves. We seek to accomplish this by building — and maintaining — a steadfast, globally diversified portfolio designed to skim across the rough surfaces toward more dependable destinations.

Let’s use a couple of case studies to illustrate how we manage real-life portfolios in the face of ever-evolving, often unnerving current events. Although my stories will be drawn from real conversations and actual investor experiences, they will be fictionalized to protect individual privacy. In particular, names are not real.

The Accumulators: Suzie and Trevor Hall

Meet the Halls

Suzie and Trevor are hard-working professionals in their late 40s, with two teenage children. They own a home, which is almost fully paid off. While they intend to stay in their home long-term, the place could definitely use some renovations.

Current Lifestyle: The Halls have been good about living within their means, while also sustaining a satisfying lifestyle. They take occasional vacations, but they’ve also diligently saved excess cash flow over time.

Financial Goals: The Halls hope to retire within 15–20 years. They also want to fully fund their children’s education, as well as complete those home renovations before they retire.

Investment Profile: Suzie and Trevor consider themselves to be conservative investors. They would like their portfolio to continue to grow. But they also worry: what if today’s global crises really do a number on their nest egg? They think they should avoid experiencing much more than a 30% hit during any given market downturn.

Suzie and Trevor’s Financial Planning Action Items

Here’s how I might advise the Halls moving forward:

- Start with planning, not investing.

“How will the 2024 U.S. presidential elections impact our investments?”

Except in hindsight, the only correct answer is, “Who knows?”

As we’ve covered before in the 2020 blog, Should I Change My Investments During an Election?, leading with these kinds of queries steer the Halls’ conversation toward the market’s concerns, instead of their own.

They are better off considering geopolitical volatility in a more manageable context:

- What is your expected retirement date?

- Other lifetime goals?

- Personal investment style? and so on.

True, personal goals may shift over time. But defining manageable targets helps us define desired saving targets, rate of return expectations, and asset allocations for meeting them. As the Halls’ own circumstances and larger world events evolve, we can review and update their progress annually.

- Establish a spending plan.

Next, I’d advise the Halls to use their available cash flow to support their three key mandates: saving for their kids’ education costs, completing their home renovations, and investing toward retirement. Three goals, calling for three different investment amounts, return expectations, and timeframes.

- Invest systematically.

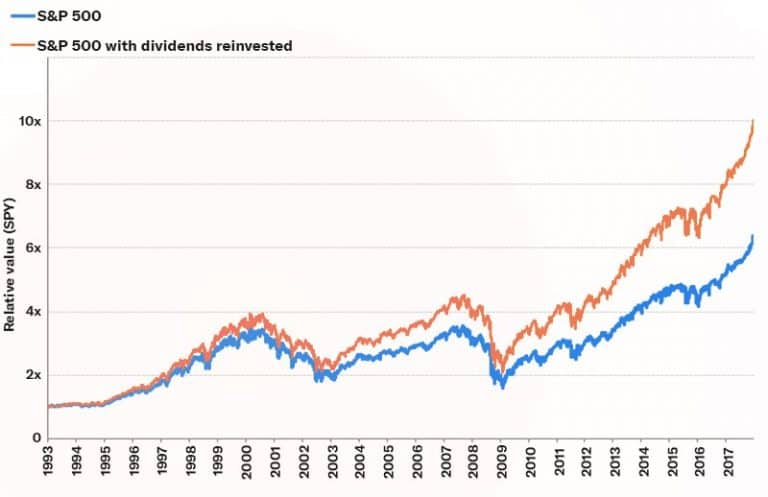

Next, we can invest systematically across future unknowns. For example, whether Russia and Ukraine remain at war indefinitely or eventually reach an accord, global markets are expected to trend upward over time; we just don’t know when or where the growth spurts will occur. For the Halls, I may recommend adding assets monthly, so they can dollar-cost average across varied market conditions. If (or more likely, when) another crisis occurs and prices decrease, they may even want to increase their saving and investing during these “buy low” windows of opportunity.

- Do a lifeboat drill.

Suzie and Trevor had said they wouldn’t want their portfolio to ever drop by more than 30% as they pursue expected market returns. But would they really be ok with that much of a drop? I like to replace vague percentages with real dollar declines. We would look at past market downturns and corrections, how long they lasted from start to finish, and how long the Halls’ target portfolio would have taken to recover from each. This “life-boat drill” helps them use realistic numbers for withstanding real future declines.

- Remember, it’s priced in.

How will today’s heightened Middle East tensions play out for Suzie and Trevor’s investments? Once again, we don’t know; we can’t know. But I do know, whatever happens next, “by the time you’ve heard the news, the collective market has too, and has already priced it in” (as we wrote in our first timeless tip, Play It Again, Steve – Timeless Financial Tips #1: Repeat After Me: “It’s Already Priced In”). Besides, since the Halls are still in their wealth accumulation years, a price decline could even come as welcome news. Lower prices today give future market prices more room to grow over time.

In our next case study, let’s look at how today’s geopolitical pressure points may impact a couple closer to retirement.

Almost Ready to Retire: Jim and Carol Oates

Meet the Oates’

Jim and Carol are in their early 60s. Jim owns a business and Carol manages the household. They became empty nesters when the youngest of their three children recently moved to British Columbia. They own their principal home outright and are considering purchasing a winter property in warmer climes.

Current Lifestyle: To pursue a satisfying retirement, the Oates were careful to avoid lifestyle creep during their career years. Now, Jim is making moves to sell his business, and their retirement days are fast approaching. They expect to support their retirement lifestyle with the proceeds of Jim’s business sale, along with their investments. Will they be ready to loosen up a bit? Yes … and no. Maybe? They wonder whether they will have enough to do so.

Financial Goals: The Oates would like to make significant travel plans, after many years of shorter getaways, closer to home. (A business owner is never fully “off duty.”) Plus, if the sale goes well, they’d like to help their children buy into today’s housing market. Continue Reading…

Share this:

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on Reddit (Opens in new window) Reddit

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print