By Dale Roberts, Retirement Club/Cutthecrapinvesting

Special to Financial Independence Hub

Most Canadian Do-it-yourself (DIY) investors are hybrid. They own a basket of Canadian stocks and largely manage U.S. and international diversification by holding ETFs. The ETFs are managed for you; that means the holdings (stocks and bonds) are rebalanced for you. When you hold a portfolio of individual stocks you will have to manage your own rebalancing.

When to rebalance your stocks in retirement offers its own considerations. It can be a different ball game when we consider RRSPs and TFSAs where there are no tax ramifications, compared to taxable accounts where every buy and sell is a taxable event. In the Globe & Mail, Norm Rothery offered up a wonderful study of rebalancing schedules. We can start with which rebalancing strategies might create the greatest total return over time.

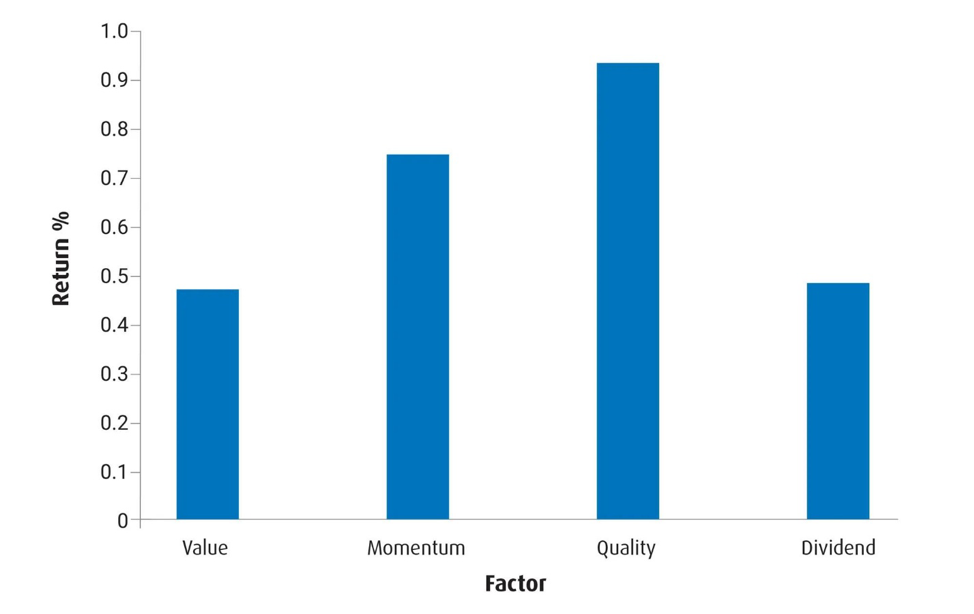

We’ll start with the good news. Canadian blue-chip stock portfolios have historically outperformed the market over longer periods. Here’s the chart, once again courtesy of Norm Rothery …

As a measure of blue chip we can start with the strategy of investing in the 100 largest stocks with out-performance of almost 2.5% annual compared to the TSX. That advantage increases as we move to the low-volatility strategy that I have suggested for consideration (from the beginning of this blog in 2018). As always this is not advice. But investors who create their own stock portfolios might prosper from understanding the history of Canadian stocks.

The Canadian low-volatility portfolio

When you build a low-volatility portfolio in Canada you will gravitate towards the Canadian banks, insurance companies, pipelines, utilities, railways, the grocers and other consumer staples. You might argue the ‘safest’ stocks in the Canadian market.

The good news for those who do not want to create their own stock portfolio is that BMO has you covered with the BMO Low Volatility Canadian Equity ETF – ticker ZLB-T. Who doesn’t like out-performance with lower volatility?

As always: past performance does not guarantee future returns.

For those who create their own stock portfolio you’d simply buy enough of ’em from the various sectors. You might end up with a portfolio in the area of 20 stocks.

How often should you rebalance?

Here’s the Globe & Mail article from Norm (sub required) – How often should you update your portfolio?

Norm looked at several successful Canadian stock portfolio models …

We see that monthly rebalancing offered a benefit in six out of the seven models. I’m more than surprised by that. Rebalancing monthly or quarterly was a benefit in all of the models, compared to annual rebalancing.

Here’s the numbers for the stable-dividend (low-volatility) portfolio.

- Monthly rebalancing – 14.2% average annual

- Quarterly rebalancing – 13.84% average annual

- Annual rebalancing – 11.59% average annual

The positive effect of regular rebalancing is MASSIVE according to this study. Remember, rebalancing is the process of selling your winners and moving money to your ‘losers’ or underperformers to keep your original allocation consistent.

Buy low, sell high

If you have 20 stocks and begin at an equal-weight allocation of 5% in each stock, you’ll sell the high-performance stock that is now 7% of your portfolio. You’ll move that money to a few of the stocks that are now only 3% of your portfolio (for demonstration sake). You’ll bring them all back to a 5% weight.

Of course, Norm’s evaluation is based on a time period calling for regular rebalancing. Ironically, ZLB is rebalanced twice a year: maybe they need to ramp that up?

Of course with regular rebalancing we have to consider transaction costs. Fortunately the trend for many discount brokerages such as Questrade and the investing app from Wealthsimple is to offer free trades. Some of the big bank brokerages will still have considerable trading fees.

Rebalancing your stock portfolio in retirement

The lesson from Norm’s study is: take the money and run. Or in retirement, you might take the money and fly to the Caribbean … your call. Continue Reading…