By Billy Kaderli

Special to the Financial Independence Hub

Just because you retire, your money doesn’t have to.

In the words of Gordon Gecko from the 1987 movie Wall Street, “money never sleeps.” And your money definitely won’t once you leave your job.

Many people are shocked to learn that since we left the conventional work force almost thirty years ago our net worth has actually increased, significantly out-pacing inflation and spending. Reading financial articles about what if retirees run out of money, I get the impression that the authors do not understand that once retired, your money can – and should – continue to work for you.

Working smart, not hard

Once you clock out or walk out of the office for the last time, that doesn’t mean your investments are frozen at that point. The stock market is still functioning and now your “job” is to become your own personal financial manager. Actually, you should have been doing this all along, but if not, start now.

You need to get control of your expenses by tracking your spending daily, as well as annually. This is so easy — only taking minutes a day — and this will open your eyes as to where your money is going. Not only that, but it will give you great confidence to manage your financial future. Every business tracks expenses and you need to do the same. You are the Chief Financial Officer of your retirement.

Income is important, but …

Many people structure their investments for income knowing they need $3,000 or more per month to cover their lifestyle. Which is fine, but inflation will be eating away at those numbers and most likely taxes will do the same. Over time your expenses will rise and your purchasing power will drop. You need protection to cover the increases.

Stocks provide that protection and there is an added bonus; when you sell, capital gains are taxed at a lower rate than ordinary income. Therefore, tilting your investments for growth as compared to income will help protect yourself against future inflation. Plus, it will minimize your tax liability.

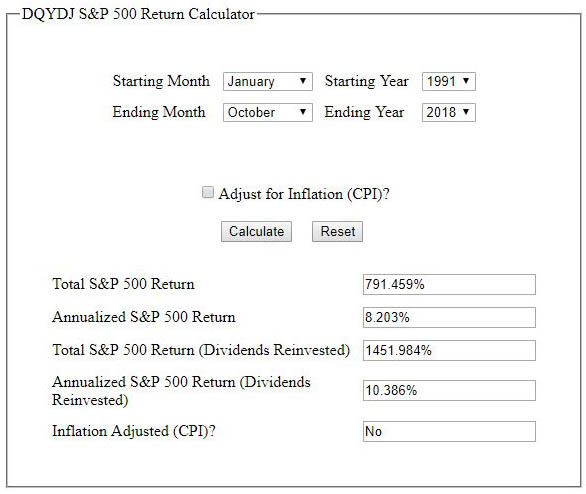

The day we retired the S&P 500 index closed at 312.49. Today, this equates to a better than 10% annual return including dividends.

That’s pretty good for sitting on the beach working on my tan.

Making 10% on our portfolio annually while spending less than 4% of our net worth has allowed our finances to grow out-pacing inflation, while we continue to run around the globe searching for unique and unusual places.

The key is to start as young as you can with as much as you can and let the markets work in your favor. Time is the greatest asset with investing and younger people can utilize this to their advantage.

But what if you’re fifty?

Continue Reading…