Special to the Financial Independence Hub

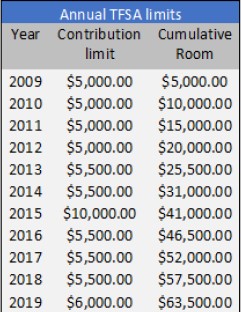

2019 TFSA limits will likely see an increase to $6,000 for 2019, up $500 from $5,500 in 2018. But is taking advantage of the TFSA the right choice for you?

The big story

Most Canadians still don’t understand the TFSA or know if it’s the right type of account for them. More room is great but according to the CRA in 2015, only 10% of Canadians are currently maximizing their TFSA limits1. Also, the CRA has looked to collect over $75 million in past audit penalties over improper use of the TFSA2.

The history

Starting in January 2019, annual TFSA room of $6,000 will be provided to each Canadian resident over the age of 18. Since 2009, Canadian residents have been able to contribute a small portion of their after-tax savings into this tax-free account. If you still are paying taxes on interest, dividends or capital gains on your investments in a non-registered account, it’s time to review the TFSA. If no contributions had been previously made, your TFSA room accumulates over time and a full $63,500 contribution could be made January 1, 2019.

The contribution you make today can grow without any tax implications in the future. If you over contribute, the CRA will penalize you 1% per month on any amount over the approved threshold. A best practice is to check first with the CRA to determine your personal TFSA limit for the calendar year.

The contribution you make today can grow without any tax implications in the future. If you over contribute, the CRA will penalize you 1% per month on any amount over the approved threshold. A best practice is to check first with the CRA to determine your personal TFSA limit for the calendar year.

Improper use

If you accidently, or purposefully, over-contribute to your TFSA, the CRA will impose a 1% per month penalty on the overage. This may be overstating the obvious, but over-contributing is a bad idea. You would have to reasonably expect your investments to grow higher than 12%/year (assuming simple math with a January 1stcontribution) to break even. Having TFSAs at two or more institutions may be a way you lose track of your contribution room. Ensure you check with the CRA to understand your annual TFSA contribution limit.

Another example of improper use could be frequently trading stocks within the TFSA, aka ‘day trading.’This may be considered a ‘business activity,’ as perceived by the CRA and you could be taxed personally on all the income, dividends and capital gains.

Spousal successor

An important but often overlooked benefit to utilizing a TFSA is as an estate planning feature: the spousal successor declaration. Continue Reading…