Due to COVID-19, 57% of adult Americans are worried about their job security, while 63% are concerned about both their retirement savings and ability to make monthly student loan payments. Plus, many other insights from LendEDU’s newest survey.

At the time of this writing, Johns Hopkins’ Coronavirus Resource Center has reported 353,692 cases of Coronavirus around the world and 15,430 deaths. In the United States, there have been 35,345, while the total number of deaths is 473 by most estimates.

Then there’s the economic fallout in the U.S. as the stock market has gone into a tailspin, and a recession, or worse, seems likely. With the nation necessarily self-quarantining itself, countless small businesses are shuddering their doors and laying people off.

In the wake of this global pandemic, LendEDU has surveyed 1,000 adult Americans to better gauge the micro-level economic impact that COVID-19 will have on our country.

We found that a substantial proportion of people are worried about their job security, retirement savings, mortgage or student loan payments, and taking on too much credit card debt.

Click here to jump to the full survey results

If you would like to see a specific breakdown of the data other than those provided (ex. state-by-state, gender, age), please email me at brown@lendedu.com.

Observations & Analysis: How is Coronavirus Impacting the Finances & Employment of Americans?

All data is based on a survey of 1,000 adult Americans commissioned by LendEDU and conducted by research firm Pollfish. The survey was conducted on March 18, 2020. For some questions, the answer percentages may not add up to 100% exactly due to rounding.

Job Security

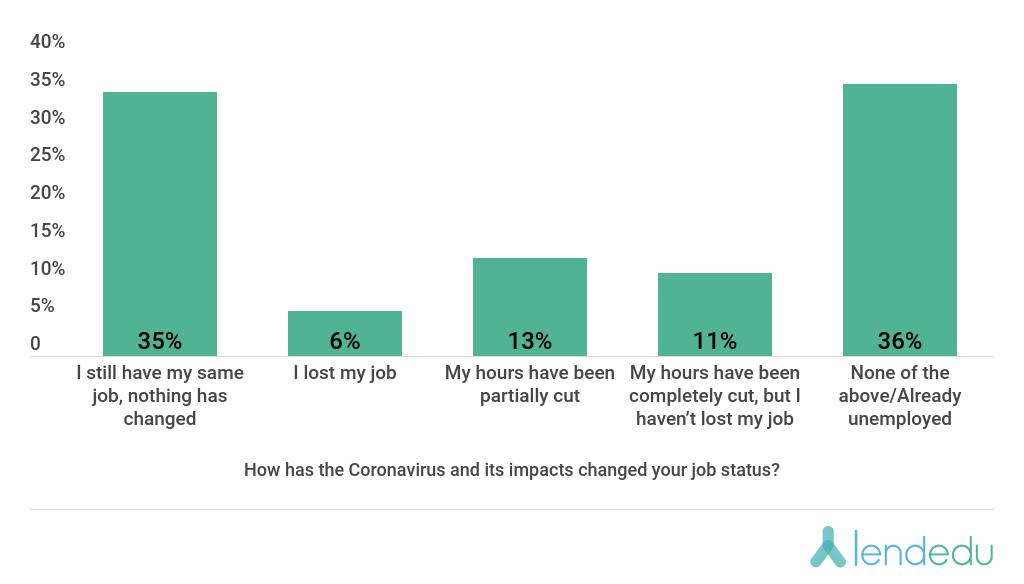

We first asked respondents how Coronavirus has already impacted their job since the virus’ impacts started being felt by the U.S.

35% of adult Americans have been fortunate enough to see no changes to their job due to COVID-19, while a combined 24% have not lost their job, but have seen their hours either reduced or eliminated. Unfortunately, 6% of respondents have lost their job in the Coronavirus fallout.

But, just because the majority of respondents have kept their job in some manner does not mean they aren’t still concerned about losing it. This rings especially true amongst those who have seen hour reductions.

Amongst those that maintained their job in some manner, the majority, 57%, were still concerned about job security moving forward as the impact of Coronavirus widens.

Amongst those that maintained their job in some manner, the majority, 57%, were still concerned about job security moving forward as the impact of Coronavirus widens.

67% of those who have seen reduced hours are worried about keeping their job, while 73% of respondents who had their hours completely cut but kept their job are concerned over job security.

Compare these numbers to the 48% of those who have seen no change in their job, but are still worried about their losing it.

No matter the position employees find themselves in as COVID-19 takes hold, it is clear that stressing over job security will almost be impossible to avoid during this time. Maintaining morale will be a challenge for employees, employers, and the economy as a whole.

General Finances

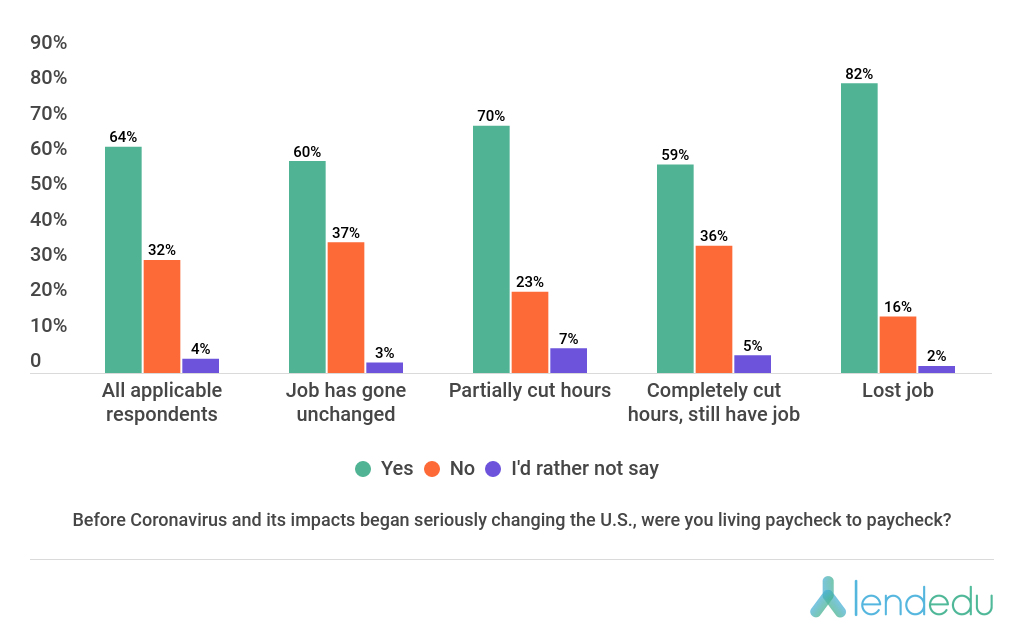

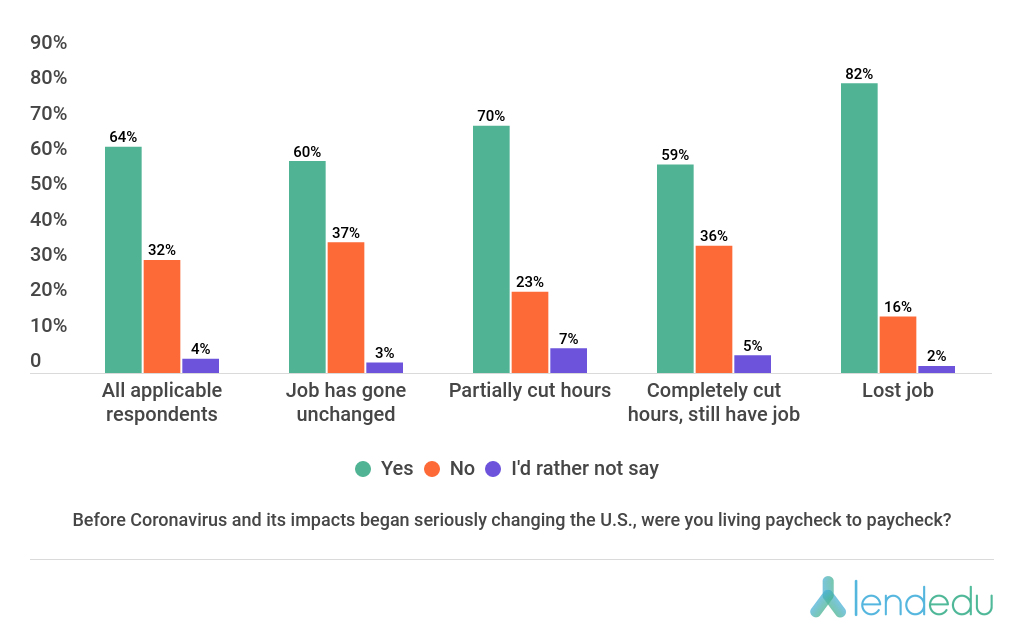

Before Coronavirus and its impacts hit home here in the U.S., how many Americans were living paycheck to paycheck?

No matter how the data is broken down, the majority of respondents were living paycheck to paycheck before COVID-19 became a large-scale issue in the U.S. This has been reported in other studies as well.

So, while the Coronavirus outbreak in the U.S. may not drastically change the financial lives of those who have seen no changes to their jobs, it could cause severe trouble for those who have seen reduced hours or lost their jobs completely.

For example, 70% of those who have seen their hours partially cut due to COVID-19 were already living paycheck to paycheck, while 82% who have lost their jobs because of the pandemic were doing the same.

Over the next few weeks or even months, these folks will be stretched thin like never before when it comes to their finances. This is why a plan to send Americans checks due to COVID-19 is being discussed in Washington D.C.

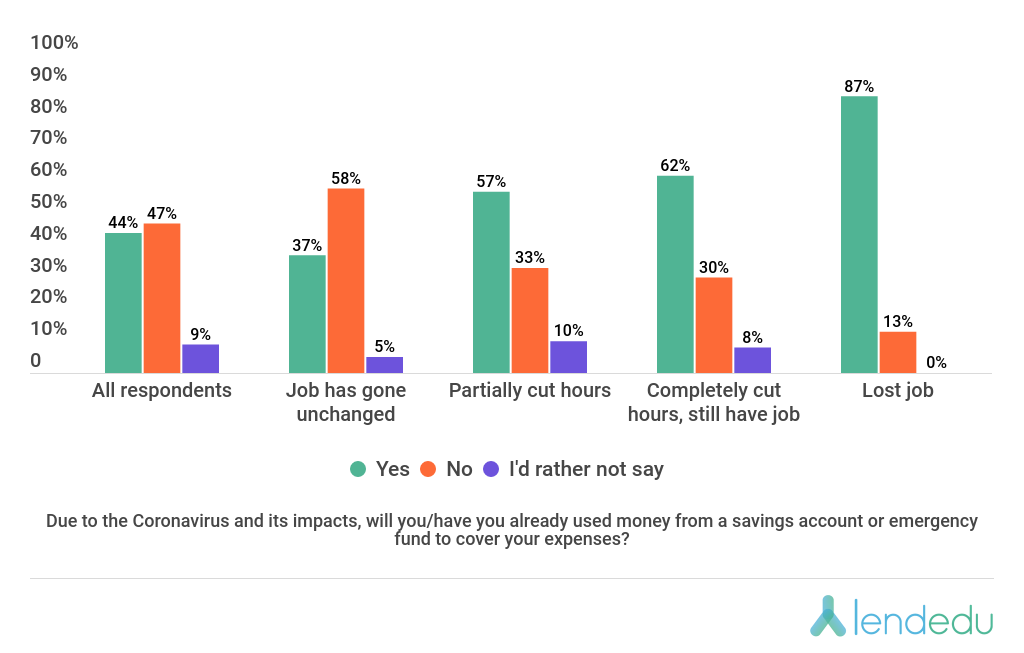

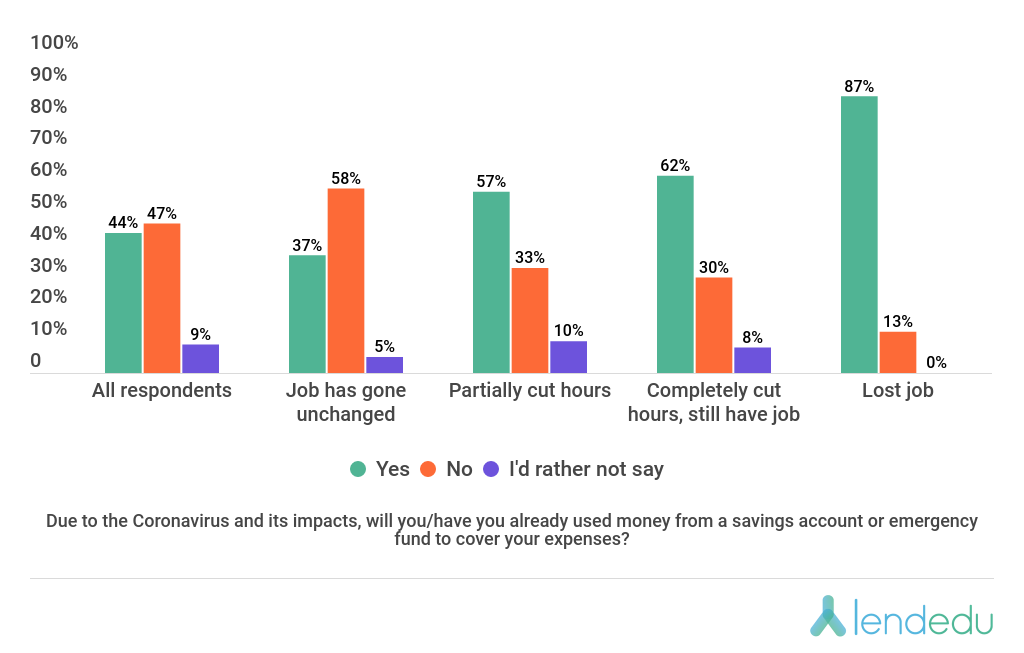

With financial woes forthcoming or already here for many Americans, some will be drawing from an emergency fund or savings account to cover expenses.

And when it came to the expenses that Coronavirus has brought on, whether it be toilet paper or T-bone steaks, we found that our respondents have spent an average of $335.65 on COVID-19-related expenses since the pandemic began to seriously impact the U.S.

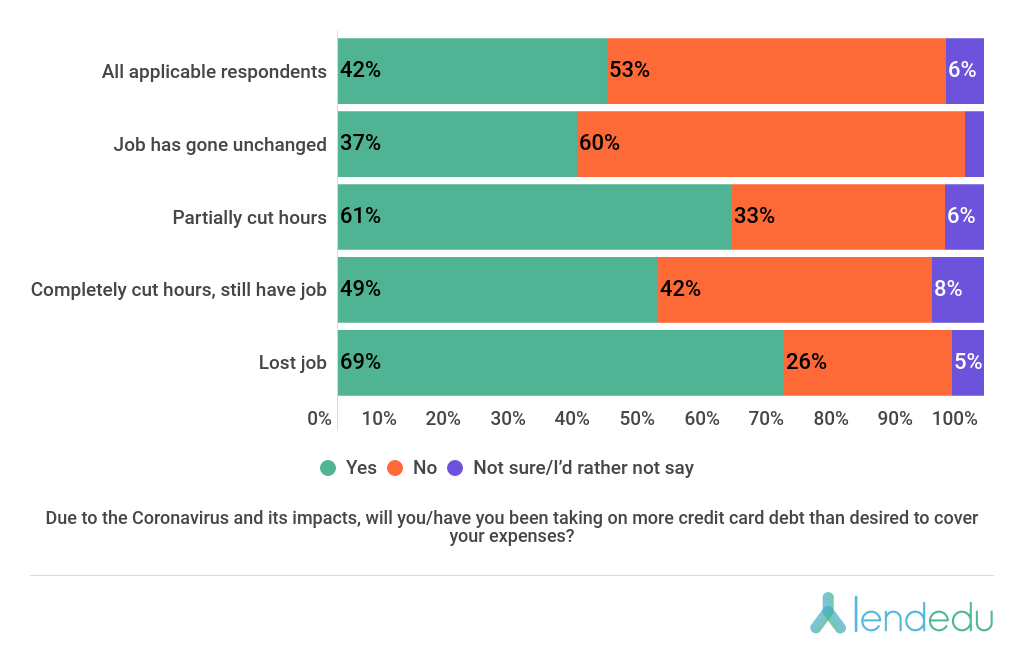

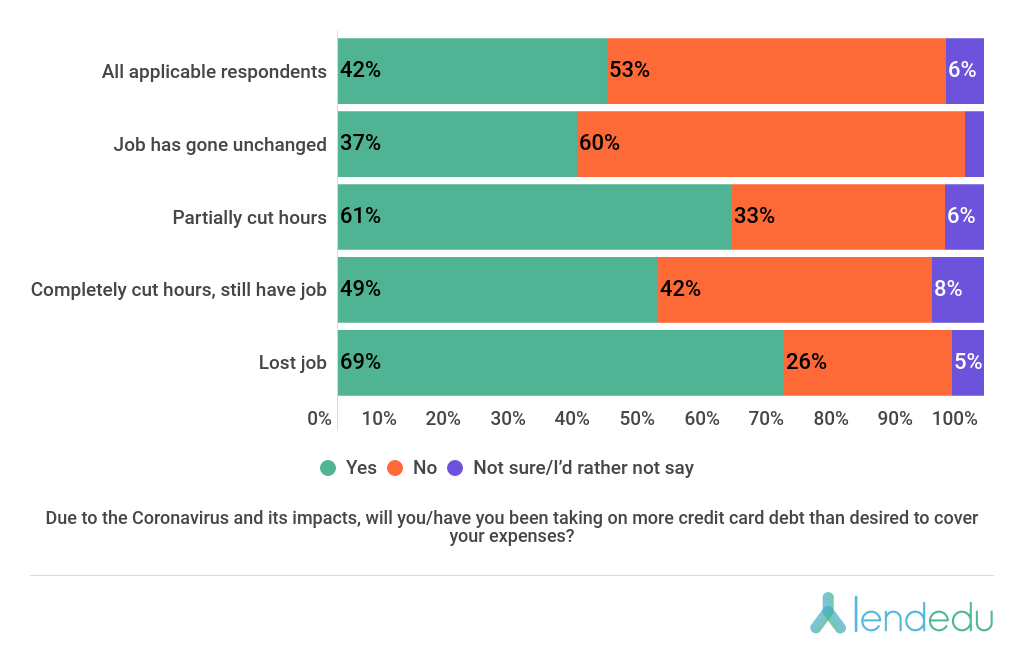

When expenses run high, many consumers need to access debt, typically via credit card, to finance their purchases. We asked poll participants with at least one credit card if they will be taking on more credit card debt than they would like due to Coronavirus.

Retirement Savings

Coronavirus has already had a crippling impact on the stock market, and it’s likely to get worse. For older Americans especially, there’s a pervasive fear that retirement nest eggs might get completely decimated as a result.

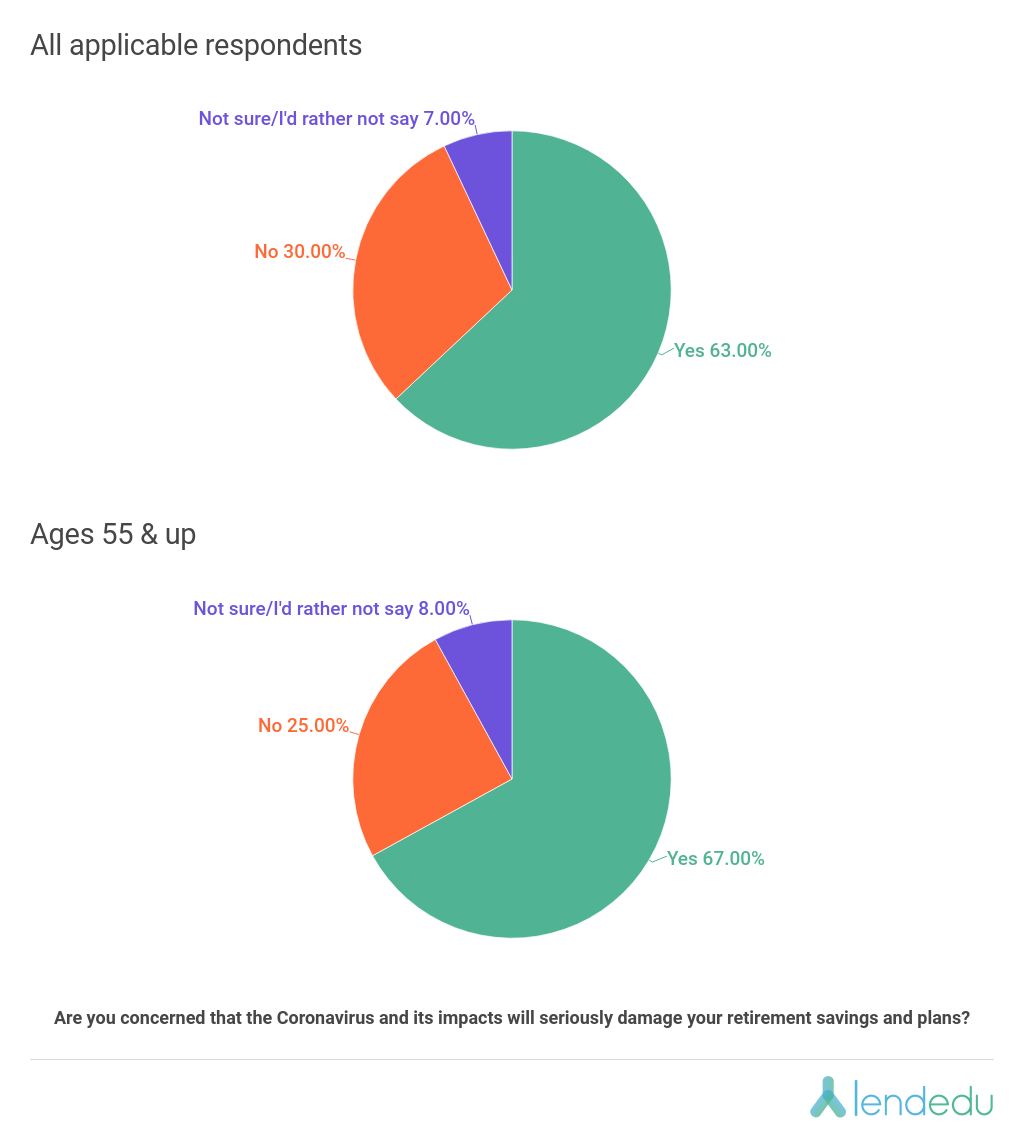

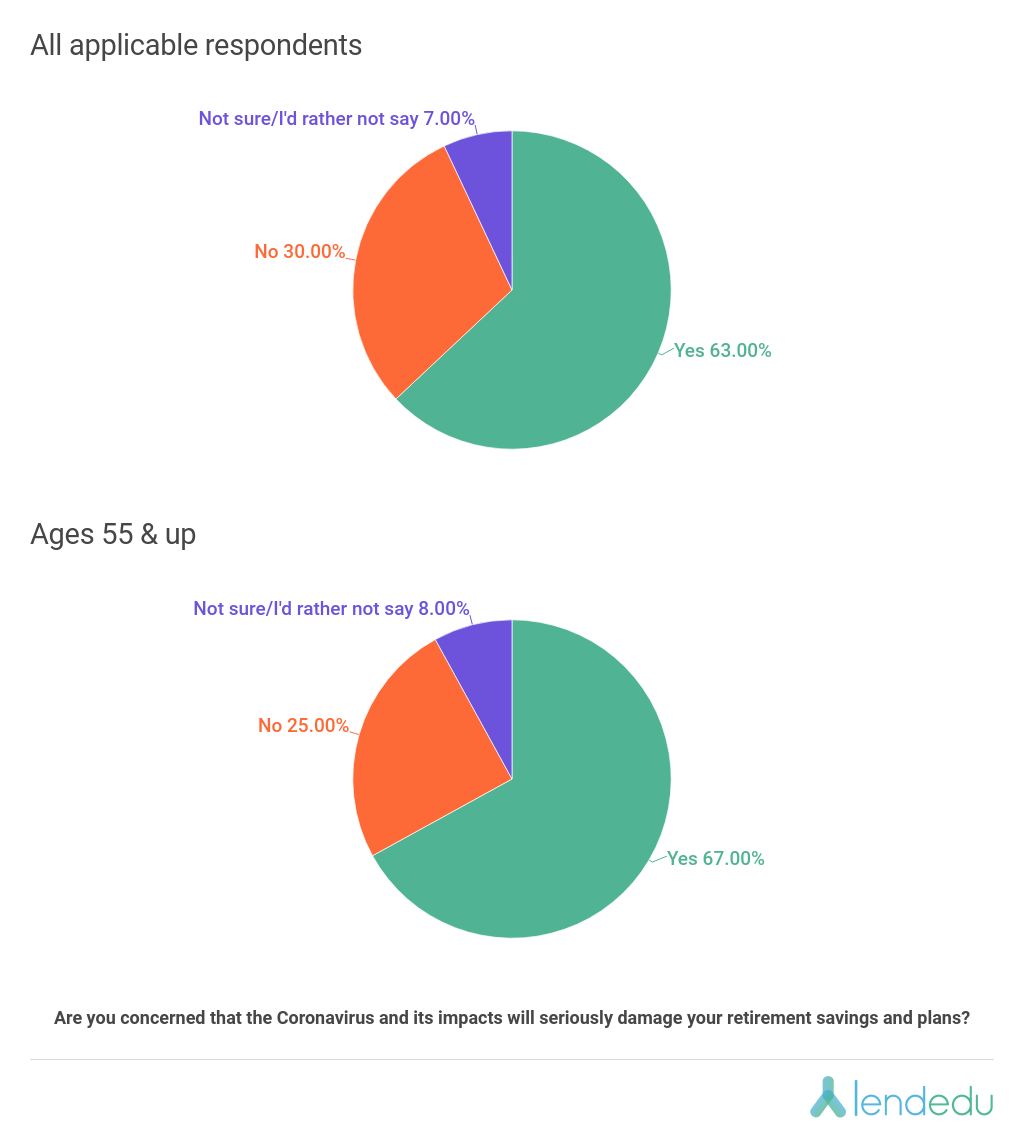

38% of our respondents indicated they are currently saving for retirement through something like a 401(k), Roth IRA, or high-yield savings account. We asked these folks about their concerns over their retirement savings due to COVID-19.

Within each age breakdown, the majority of Americans indicated that they are worried about their retirement savings due to COVID-19 and the ramifications it will have on the market.

Not surprisingly, this is especially true for older Americans ages 55 and up who are in the retirement red zone. 67% of this cohort are concerned about their retirement nest eggs.

Monthly Finance Payments (Mortgages, Student Loans, & Credit Cards)

With financial worries widespread and budgets tightening, we wanted to ask a few questions related to common financial obligations that Americans have, like payments for student loans, credit cards, or a mortgage.

The following graphics are based on questions only asked to those respondents that stated they had a mortgage (35%), outstanding student loan debt (23%), and/or at least one open credit card account (63%).

Many respondents are quite concerned about meeting their monthly financial obligations, whether they be related to a mortgage, student loans, credit cards, or all three.

Many respondents are quite concerned about meeting their monthly financial obligations, whether they be related to a mortgage, student loans, credit cards, or all three.

Most alarming was how those adult Americans that lost their jobs due to Coronavirus answered these few questions. 96% of this group was worried about meeting mortgage payments, 88% about student loan payments, and 93% about credit card payments.

Widespread delinquency or default would have severe implications on the economy at large. In an attempt to combat this, we have seen the Trump Administration waive further accruing interest on student loans and suspend all evictions and foreclosures until April for FHA-insured mortgages.

Investments

While we did touch on investments as they pertained to retirement savings earlier, we wanted to dedicate a section to more active, personal investments that consumers make through personal brokerage accounts.

To describe the stock market in the last couple of weeks as turbulent would be an understatement. There have been sharp rises and drops (mostly the latter), and trading has actually been halted a few times in recent weeks on both the New York Stock Exchange and Nasdaq. The 15-minute halts happen when an initial steep drop in the market triggers “circuit breakers” that shut down trading.

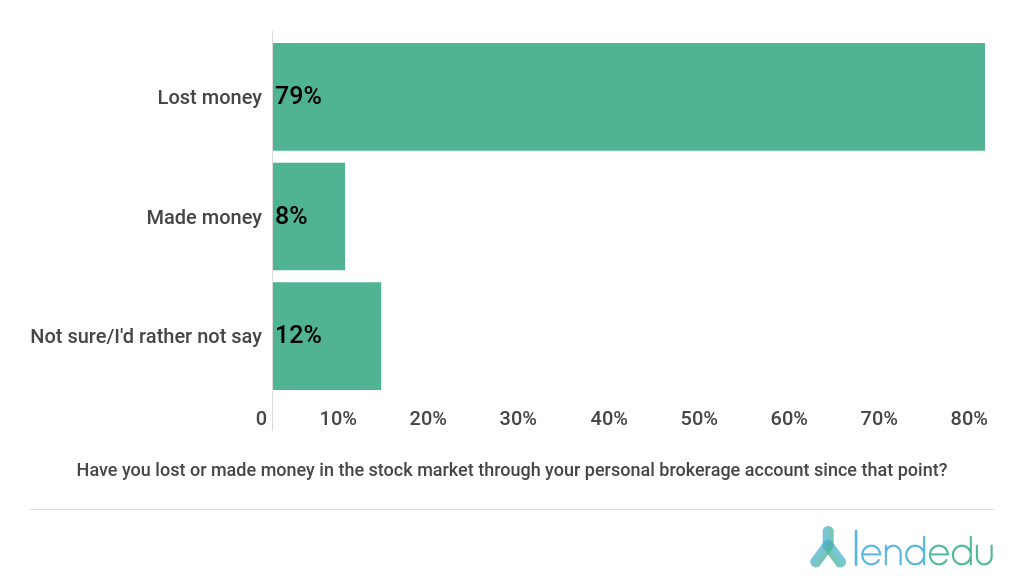

27% of our poll participants indicated that they were actively invested in the market through a personal brokerage account when COVID-19 started impacting the U.S.

We asked this group a couple of questions in regards to playing the market.

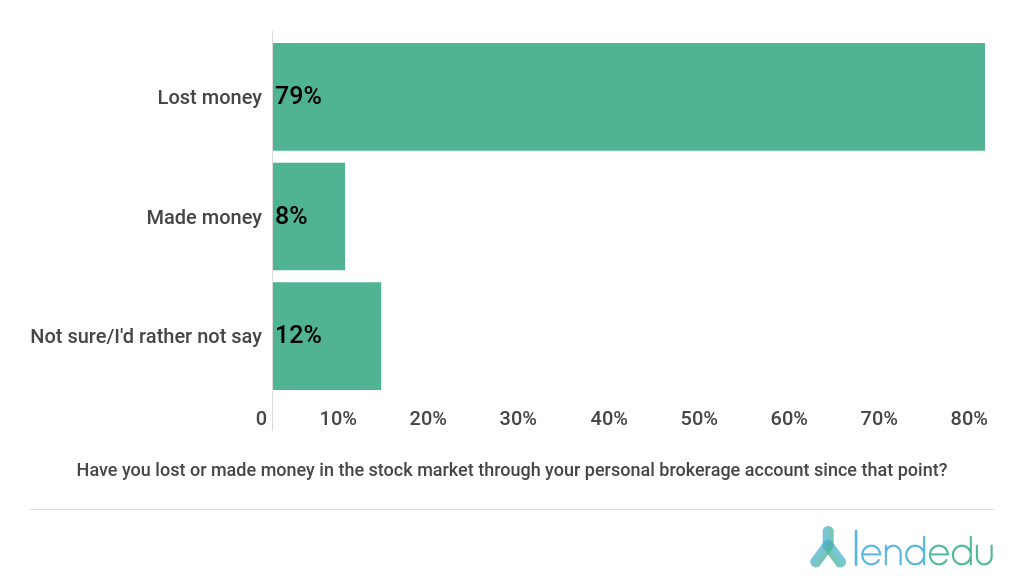

As expected, the vast majority of Americans who were making personal investments in the market when Coronavirus escalated got clobbered. 79% of respondents indicated they lost money, while just 8% made a profit.

As expected, the vast majority of Americans who were making personal investments in the market when Coronavirus escalated got clobbered. 79% of respondents indicated they lost money, while just 8% made a profit.

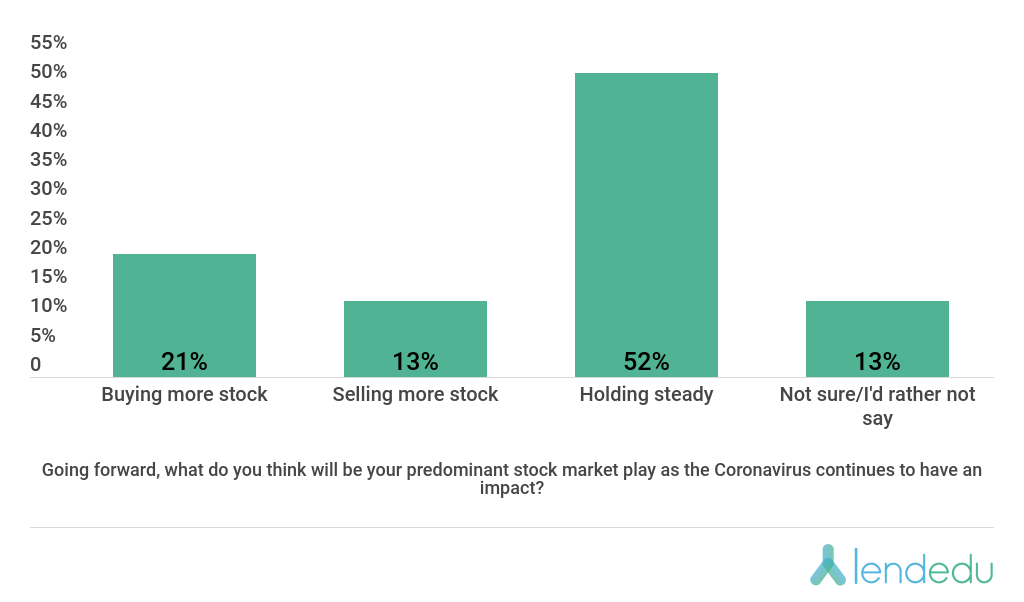

And, how will these respondents invest moving forward as the pandemic continues to disrupt daily life?

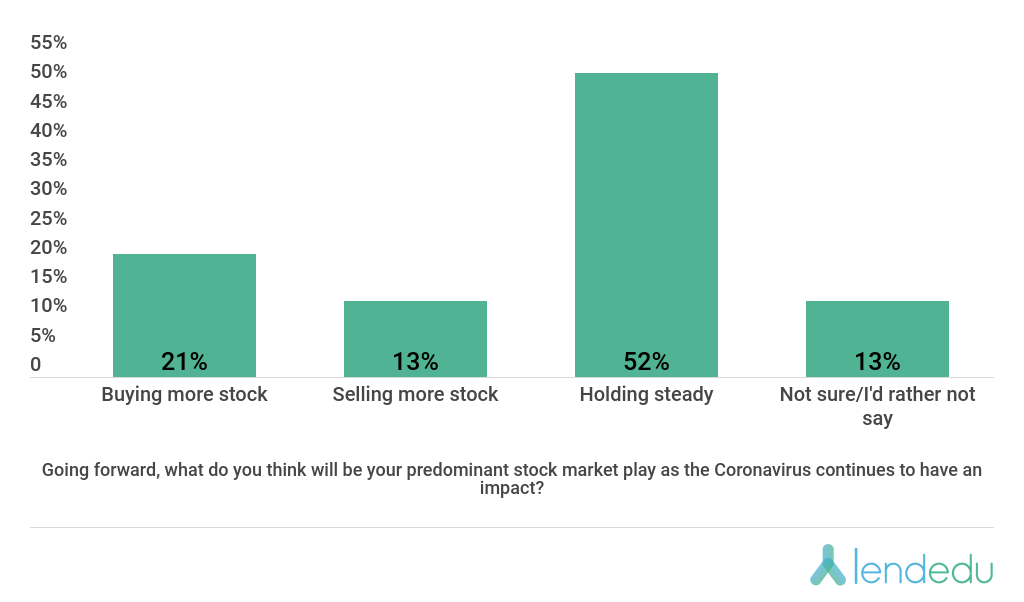

As it turns out, the majority of investors plan on riding out the storm and holding steady on their stock plays. Meanwhile, 21% plan on buying more during this crisis, while 13% will be looking to dump shares.

As it turns out, the majority of investors plan on riding out the storm and holding steady on their stock plays. Meanwhile, 21% plan on buying more during this crisis, while 13% will be looking to dump shares.

Full Survey Results

Continue Reading…