By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

October ushered in slightly stronger home sales across the nation leading to tighter buyer conditions, but losses in Canada’s largest markets continue to “overwhelmingly” drag the average well below last year’s activity levels, reports the Canadian Real Estate Association (CREA).

Sales remain weak Year over Year

According to CREA’s October report, overall sales rose 0.9 per cent month over month, but remain 4.3 per cent under 2016’s number. Compared to peak activity experienced in March, sales are down an even steeper 11 per cent. It was the seventh month in a row that sales have underperformed on an annual basis. And, with the majority of the downturn experienced in the Greater Toronto Area and surrounding Golden Horseshoe markets, it’s clear detached houses, townhomes, and condos in Hamilton and Toronto are proving less of a draw.

However, fewer homes listed for sale in October made the market more seller-friendly, down 0.8 per cent over the month. This could indicate the flood of Toronto real estate listings that followed the Ontario Fair Housing Plan may be subsiding, as well as typical seasonal factors: fewer people want to deal with selling their home as the holiday season approaches.

Buyers rush to beat Mortgage Rule deadline

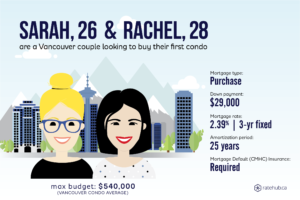

The slight improvement could also be due to new mortgage qualification rules, which will make it tougher for all borrowers of new mortgages — regardless of their down payment size — to qualify, and will reduce the amount of home they can afford. CREA President Andrew Peck says that as the changes will take effect in January, buyers now are rushing to get into the market in order to avoid the new requirements.

“Newly introduced mortgage regulations mean that starting January 1st, all home buyers applying for a new mortgage will need to pass a stress test to qualify for mortgage financing,” he stated. “This will likely influence some home buyers to purchase before the stress test comes into effect, especially in Canada’s pricier housing markets.”

CREA’s Chief Economist Gregory Klump agrees, saying short-term improvement may be temporary.

“National sales momentum is positive heading toward year-end. It remains to be seen whether than momentum can continue once the recently announced stress test takes effect beginning on New Year’s Day,” he stated. “The stress test is designed to curtain growth in mortgage debt. If it works as intended, Canadian economic growth may slow by more than currently expected.”

Home prices continue to rise across Canada

Real estate continues to get more expensive throughout Canada, with the national average price rising 5 per cent to $506,000, and the national MLS Home Price Index benchmark up 9.7 per cent year over year. However, the pace of price growth appears to be slowing: that’s the smallest increase seen since March 2016. Not factoring in Toronto and Vancouver, the average price would be $383,000 – $120,000 lower.

Toronto: following Vancouver’s footsteps?