By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

Think breaking into the Toronto real estate market is tough? Try making a lateral move; there’s a whole new crop of challenges facing those looking to cash in on their home’s equity, according to a recent bank report.

While much has been made over the plight of first-time buyers, they’re not the only ones feeling the pinch. Home owners with a long-term position in the market and who have become considerably house-rich — namely baby boomers — are also put off by the market’s challenges.

And while this generation has received criticism for hunkering down in their family homes rather than adding them back to the supply of low-rise, detached housing, the fact is many would love to cash out: but they face the same hurdles as their millennial counterparts.

According to a recent poll conducted by CIBC, two in five Canadian homeowners planning to sell their homes are poised to profit on their home sale — but 62% are reluctant to put it on the market due to the high cost of buying another home.

“In today’s market, homeowners are facing a conundrum as to whether to buy, sell or stay put,” says David Nicholson, vice-president of CIBC Imperial Service. “Buying or selling your home is one of the biggest decisions you’ll make. That’s why it’s important to make the decision for the right personal and financial reasons and see past the noise in the marketplace. Evaluating the pros and cons as part of an overall financial plan can help you decide what’s best for you.”

Sixty-seven per cent of boomers (aged 55 and up) indicated they wished to downsize to a smaller home, condo or nursing / retirement home.

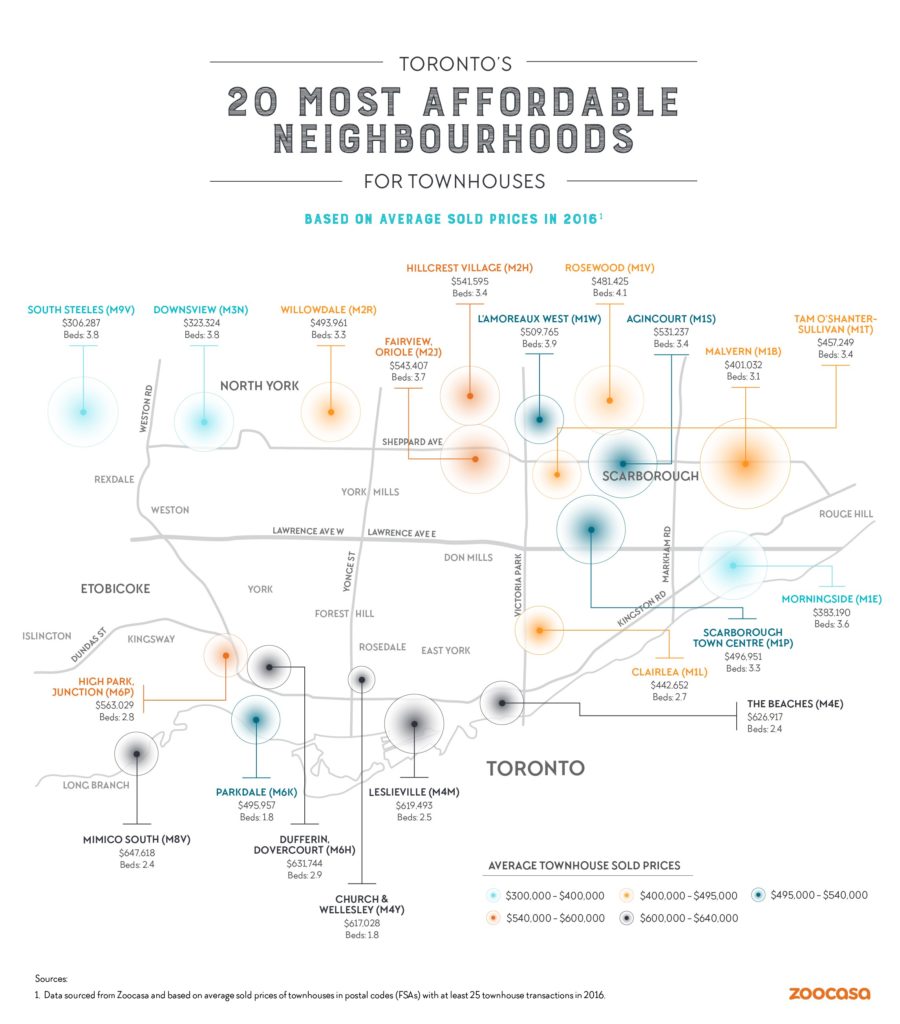

The search for affordable options

Most downsizing boomers aren’t looking to acquire another million-dollar detached property, but recent price surges within the condo market may leave them feeling as though their options are limited. The Greater Toronto Area market has infamously experienced a 33% year-over-year price increase, and much of that double-digit growth has spilled over into the condo segment.