It’s easy to stick to your long-term investing plan when times are good. Indeed, if your investment portfolio had any U.S. market exposure at all over the past 12 years you’ve likely enjoyed nearly uninterrupted growth.

It’s easy to stick to your long-term investing plan when times are good. Indeed, if your investment portfolio had any U.S. market exposure at all over the past 12 years you’ve likely enjoyed nearly uninterrupted growth.

Of course, there are always bumps in the road. Stocks fell sharply in a short period between February and March 2020, the swiftest decline in history. The world was shutting down in response to the COVID-19 pandemic and investors panicked. But stocks came roaring back and the S&P 500 ended the year with a gain of 18.4%. Things were good again. Until they weren’t.

Investors have been worried about a prolonged stock market crash for years. Those fears are heightened each year that stocks continue to rise. Surely this can’t last forever. Meanwhile, as we come out of the pandemic, there’s anxiety over inflation and rising interest rates, which has put downward pressure on bond prices. Long-term government bonds are down 12% on the year. U.S. treasuries, the ultimate safe haven, are down 3.3%.

In uncertain times we look to economic forecasts and predictions of what’s to come. There’s no shortage of opinions, so it’s easy to find one that fits your narrative. It’s hard not to listen when legendary investors like Jeremy Grantham call this the greatest bubble since 1929.

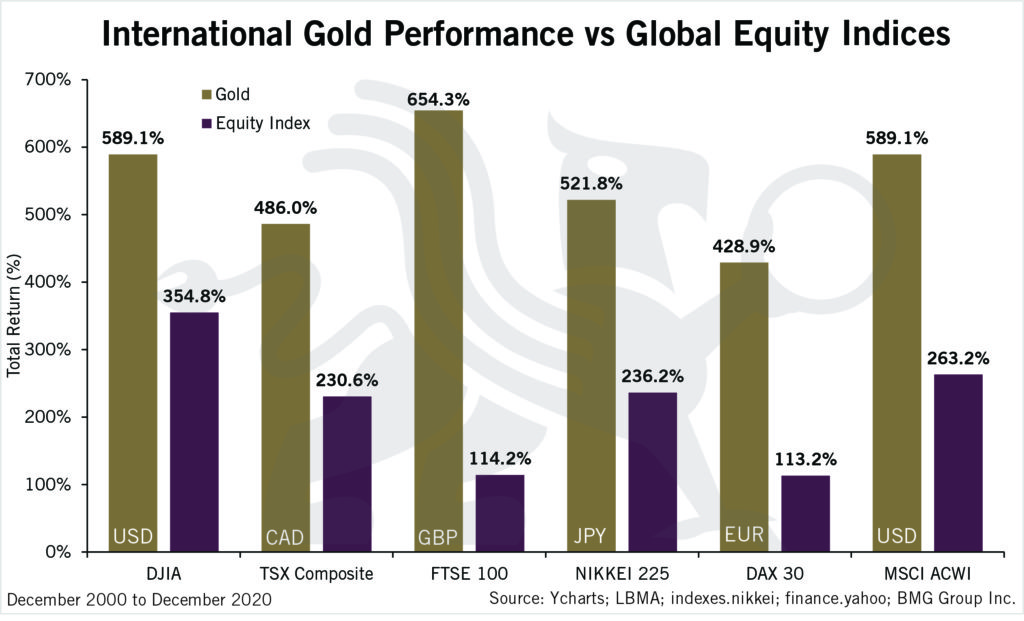

So, what’s an investor to do when stocks are poised to crash, bonds are in a free-fall, and cash pays next to nothing? Even gold, often pegged as an inflation hedge and portfolio diversifier, is down nearly 10% year-to-date.

Are you properly diversified?

Is your portfolio as diversified as it should be? Does it have a mix of Canadian, U.S., International, and Emerging Market stocks? A mix of short-term and long-term corporate and government bonds?

Are you judging your portfolio as a whole or by its individual parts? It’s never easy to see a specific holding fall in value. It makes you wonder why you hold it at all. Bond holders must be feeling that way right now.

If you hold Vanguard’s Canadian Aggregate Bond Index (VAB), you’re likely not pleased to see this performance:

When you add U.S. and Global bonds to the mix, the results are similar but slightly more favourable:

Now let’s add Canadian, U.S., International, and Emerging Market stocks to the portfolio using Vanguard’s FTSE Canada All Cap Index (VCN), Vanguard’s U.S. Total Market Index (VUN), Vanguard’s FTSE Developed All Cap ex North America Index (VIU), and Vanguard’s FTSE Emerging Markets All Cap Index (VEE):

When you put all seven of these ETFs together you get Vanguard’s Balanced ETF portfolio (VBAL). Each part following its own unique path, but blended together using a rules-based approach that maintains the original target asset mix through regular rebalancing.

Here’s how that looks over a three year period (since VBAL’s inception):

This is what diversification looks like. While some individual parts lag behind, others lead the charge and drive the overall returns. Regular rebalancing helps ensure you always buy low and sell high while managing your risk and return. The result is a compound annual growth rate of 7.3% since 2018.

Perhaps the best way to visualize how diversification works is by looking at the periodic table of investment returns over the past 20 years (source: www.callan.com):

Last year’s winner is often next year’s loser. Every asset class has had its turn at or near the top, including large cap stocks, small cap stocks, emerging markets, real estate, bonds, and yes, even cash (once).

Do you think you can predict which assets will lead the way in 2021 and beyond? Unlikely. That’s why it’s best to diversify broadly so you can capture market returns without trying to guess where to park your money.

What about pulling out all of your investments and moving to cash? Well, cash was the worst performing asset class in eight of the 20 years. Even in 2008-09 bonds were the better bet.

Have you rebalanced?

I’ve written before about investors getting distracted by shiny objects like cryptocurrency, technology stocks, and high-flying fund managers. Even seasoned investors were moving more of their money into U.S. stocks, technology stocks, and Bitcoin to capitalize on rising markets.

Indeed, why hold bonds at all when every other asset class has been soaring?

The result is a portfolio and asset mix that is likely out of step with your original goals.

Rebalancing is counterintuitive because it forces you to sell what’s going up in value and buy more of what’s going down. It’s tough to wrap your head around selling U.S. stocks to buy more Canadian stocks. Or worse, to buy more bonds.

It’s even more difficult in uncertain times. It’s easy to look back at March 2020 or March 2009 as buying opportunities of a lifetime for stocks. But in the moment it probably felt terrifying to even be holding stocks at all.

Today, nervous investors are worried about holding bonds. What should be the stable portion of their portfolio is suddenly underwater and signs of future upside are nowhere to be found.

Damir Alnsour, a portfolio manager at Wealthsimple, has heard from many of these anxious investors in recent days. They’re asking questions like, will bonds keep going down?

“The answer is that no one really knows if it is likely to continue, but we always look at our portfolios with a long-term lens because we don’t allocate our investments based on short-term market performance. We expect that in the future there will be times where stocks are doing well, and bonds are underperforming but also the opposite. We can’t predict these times, and we don’t think anyone else can either,” said Alnsour.

He encourages his clients to take a 30,000-foot view and remember the reason their portfolio includes bonds. Bonds are a long term source of return that improve the stability of your portfolio because they often react to changes in the economic environment differently than stocks.

“During most of the major stock market downturns historically, bonds have increased in value and helped cushion losses,” said Alnsour.

Just like the three-year chart of VBAL’s returns, a well-balanced and diversified portfolio is expected to rise over time: after all, that’s why we invest in the first place. But it’s normal for the same portfolio to suffer minor short-term losses along the way that can sometimes take weeks or months to recover.

Back to Wealthsimple’s Alnsour:

“Also, keep in mind, we would rebalance the portfolio if bonds were to continue to sell-off. What this means is that should the bond allocation drop below our rebalancing threshold, we would sell some equities to add to bonds and therefore pick up more fixed income at a cheaper price and better yields (just as we would have sold bonds to add to your equity position in March of 2020!).”

Don’t Just Do Something, Stand There!

Your portfolio is like a bar of soap. The more you touch it, the smaller it gets. Yet in times of uncertainty we can’t help but feel like we need to do something to curb losses or increase gains.

The better choice, assuming you have a well-diversified and automatically rebalancing portfolio, is to log out of your investing platform, close your internet browser, and do nothing. Focus on your family, friends, hobbies: anything that will prevent you from logging back on and seeing your investments in the red.

As PWL Capital portfolio manager Benjamin Felix says, “your investment strategy shouldn’t change based on market conditions.”

That’s right. You identified your risk tolerance and time horizon, and chose your original asset mix for a reason. You understood that markets fluctuate, often negatively, for periods of time and that is out of your control. Yet when markets are going through their downswing, you feel compelled to change your approach.

Let’s go back to the term, “uncertainty.” Isn’t the future always uncertain? When are we investing in certain times?

Pundits and market forecasters often paint a bleak future, like Grantham’s 1929-style crash or Dr. Doom Nouriel Roubini calling for hyperinflation. The truth is nobody knows how this will play out.

What if you make a tactical shift to your investment strategy and you’re wrong? There are plenty of investors who moved to cash after the global financial crisis and never found their way back into the stock market. Once you convince yourself of a particular narrative it’s nearly impossible to admit that you were wrong and change course.

Final Thoughts

It’s reality check time for investors. We’ve been in a bull market for 12 years (minus a few blips). Almost everything has worked, which can lead to overconfidence in your investing skills. Meanwhile, many investors have strayed away from their original goals to chase even higher returns from U.S. stocks, technology stocks, and the like.

It’s time to check in on your portfolio and make sure it’s broadly diversified and risk appropriate for your age and stage of life. It’s time to rebalance, if you hold multiple funds, and get back to your original target asset mix. Finally, if you’re already invested in an appropriate asset allocation ETF or robo-advised portfolio, it’s time to do nothing. Don’t change your investing strategy based on market conditions.

Take a long-term view of your investments rather than looking at the daily changes (which can be maddening). That’s how to invest in uncertain times.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on March 5, 2021 and is republished here with his permission.

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on March 5, 2021 and is republished here with his permission.