Investing is hard. Trying to time the market is harder. Timing return factors at the right time? Forget about it.

The past few years have seen some of the industry’s brightest minds publish papers concerning the feasibility of timing return factors. The conclusions have varied slightly, but most generally agree that when investing in factors, trying to determine which ones to invest in at a given time is an incredibly difficult undertaking.

However, most of these papers analyze factor timing from the lens of the valuations of these factors. What if we take a different approach and see if we can estimate which factors could outperform from the context of where we are in the market cycle?

Where are we now?

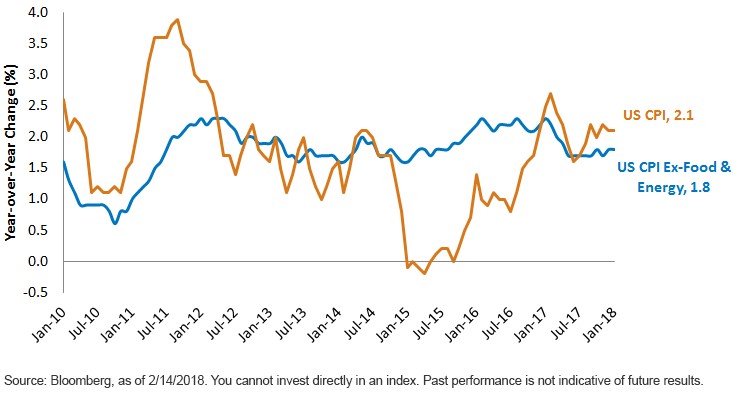

The U.S. equity bull market started on March 9, 2009. In the almost nine years since then, the S&P 500 has rallied nearly 400%.1 We are certainly not calling for an end to the bull run — in fact, the market environment still appears benign, and corporate earnings have remained strong — but it is certainly not a stretch to claim that we are closer to the end of the cycle than we are to the beginning of it.

As of this writing [mid-February], we are in the midst of the longest period without a 3% pullback in the history of the S&P 500.2 With implied and realized volatility hovering near their all-time lows, it seems reasonable to expect more choppiness — if not an outright correction — coming in the next few months. Based on what we know from history, what factors tend to outperform in the late stages of market cycles?

Factor performance prior to market corrections

Late-Stage Outperformers: Momentum, Quality

Dating back to 1990, there have been ten distinct 10% corrections in the S&P 500,3 with bifurcated results in the months preceding the correction. In the lead-up to the downturns, momentum and quality stocks have seen consistent excess performance compared to the market, whereas the size and value factors have generally underperformed.

These results provide an interesting backdrop for today’s market. If we are indeed late in the cycle, and the market dropped 10% tomorrow, this trend would hold true once again. The MSCI Momentum Index and MSCI Quality Index have outperformed the S&P 500 over the last 12 months (by 1,700 and 320 basis points (bps), respectively), whereas the Russell 2000 Index and Russell 1000 Value Index (well-known small-cap and value indexes) have both lagged by more than 700 bps.4

While it is interesting to look at what factors worked well, we think it is also important to analyze what didn’t. If size and value lagged, one can conclude that their complements — large caps and growth companies — outperformed as a result.

Factor performance during market corrections

Quality: The best of Factors in the worst of times

Shifting our focus to the market corrections themselves, when the S&P 500 fell at least 10%, it is clear that quality was the most desirable factor by a relatively wide margin. Intuitively, that makes sense—when there is stress in the markets, high-quality companies should help protect investors during market downturns. Encouragingly, the factor excess performance was largest in the most severe market sell-offs (with the quality factor having captured only 74% of the market downside during the tech bubble and 81% during the financial crisis).

Again, value underperforms here, with size and momentum each having relatively more mixed results during market corrections.

What are Size and Value good for? Continue Reading…