By Lorne Marr, CFP

The entire insurance business is based on risks and the ability to evaluate them. At the same time, life insurance companies do not like situations where they do not have enough information and statistics about risks related to their potential customers. People who have or had Coronavirus (also called COVID-19) represent this case.

The current outbreak of Coronavirus has already infected over 70,000 worldwide resulting, so far, in over 1,800 deaths. The majority of cases are taking place in China. Nevertheless, it has already spread across more than 25 other countries and is growing. The world’s knowledge about this virus is still fairly limited, including very approximate data about its death rate and the ways it spreads. Currently there is no vaccine. The current estimations put COVID-19’s death rate at approximately 3% as per GlobalNews. Comparatively, the death rate of SARS (outbreak in 2003) was placed at 9.6% and the death rate of Ebola (also known as EVD – Ebola Virus Disease) varied from 25% to 90% with the average values at 50% as per the World Health Organization.

All this leaves life insurance companies with a lot of uncertainty on how to deal with current and past Coronavirus patients. We reached out to a number of Canadian insurers to understand how they would treat such cases.

Insurance companies are all about managing risk

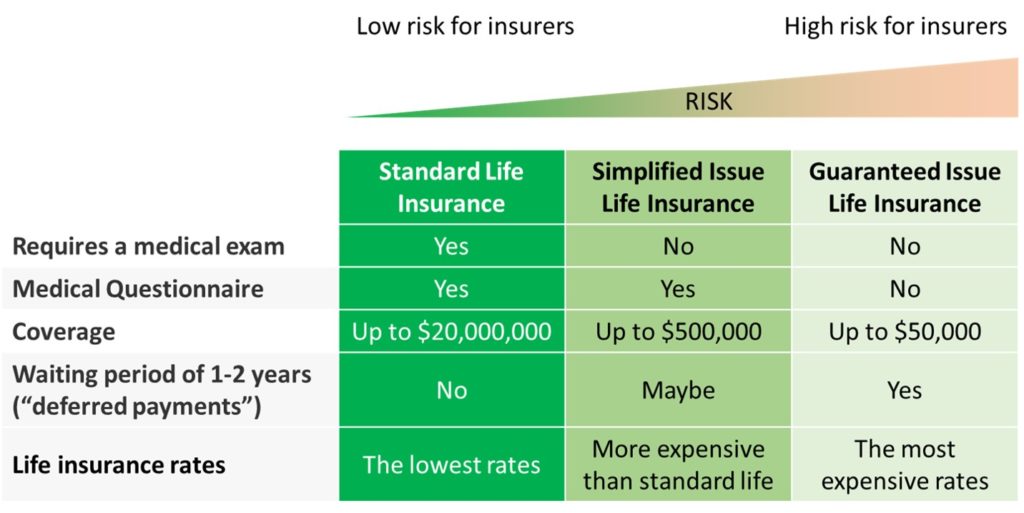

Insurance companies are all about managing risks and ensuring that they collect revenue in order to run their business and pay for claims. Insurers do this through defining various levels of life insurance products associated with different levels of risk. An overview below shows key products with their key characteristics.

- In a nutshell, standard life insurance is associated with low risks, comes with the highest coverage limits, but REQUIRES both a detailed medical exam and completion of a medical questionnaire.

- Simplified life insurance comes WITHOUT medical exams (which makes it very attractive for some people) but WITH a short, medical questionnaire. It comes at a cost and coverage limits are lower than standard life insurance.

- Guaranteed life insurance DOES NOT require medical exams NOR a medical questionnaire. It is a life insurance product that you can always buy, but it comes at much higher costs, with limited coverage, and extra clauses not providing any coverage if an applicant passes away in the first two years after purchasing the policy.

Two last life insurance types are also called no medical life insurance since they do not require a medical exam. They are increasingly popular among seniors and people with health conditions.

How do insurance companies treat people with Coronavirus?

Our inquiries to various insurance specialists showed that there are two groups of insurers:

- Those who do not have a defined approach of dealing with Coronavirus and

- Those who are able to share the exact conditions under which people with Coronavirus will be able to get life insurance.

The first group of insurers would either decline your application or delay it until a clear course of action is defined or offer you only guaranteed issue life insurance.

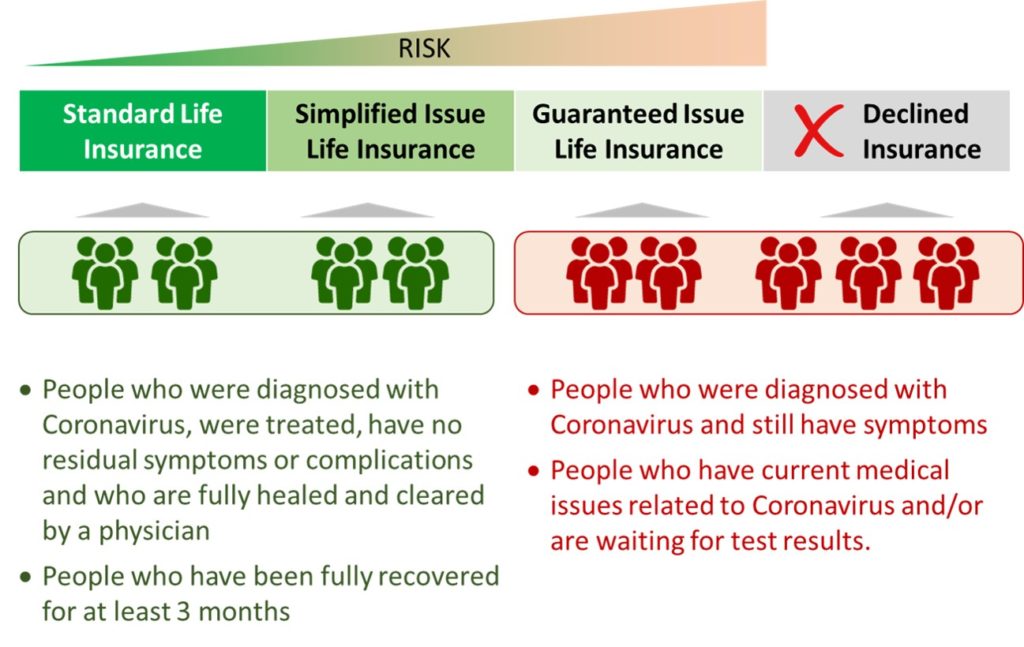

The second group of insurers will be able to offer you a standard life insurance policy, but only once you are within defined parameters which are:

• 3 months have passed since full recovery OR

• Fully healed and cleared by a physician after being diagnosed with Coronavirus

An overview below illustrates this concept:

What exactly do the insurers say if they are not ready to provide insurance?

The first group of insurers who are not open to providing life insurance for Coronavirus patients say:

- “We would not consider someone with this virus…” Continue Reading…