Special to the Financial Independence Hub

Like many Canadians, early in my investing career, I was investing in high fee mutual funds and the high fees were eating into my returns. I started dabbling in DIY investing but I didn’t get very serious about it until around 2010.

When it comes to DIY investing, I would group DIY investors into two categories. Investors in the first category are people that rely completely on low cost index ETFs. They purchase ETFs on their own and re-balance them regularly. In the past few years, the emergence of all-in-one ETFs like VGRO and XGRO and all-equity ETFs like VEQT and XEQT have significantly simplified the investing process for these investors.

DIY investors in the second category are people that invest in individual stocks and possibly index ETFs as well. These investors study and research individual stocks and make the requisite buying and selling decisions.

As you’d expect, we fall in the second category. We manage our own portfolio and invest in both index ETFs and individual stocks. We have adopted this approach because we want to be more involved with our money and have more control over it. I also enjoy learning about investment-related topics and how to analyze stocks.

I will admit that I have made A LOT of investment mistakes throughout the years. However, investing mistakes are inevitable. The important thing is that we learn from them. That is the absolutely crucial thing as we all make mistakes; it is the learning from those mistakes that distinguishes the good/great investor from the mediocre/poor one.

So, I thought I’d share my learning from my investment mistakes and hopefully help readers to avoid the same mistakes.

Here are some investment mistakes I have made since I started managing our investment portfolio. They are not specific to only dividend growth stock investing.

Note: These mistakes aren’t in any particular order.

Mistake #1: Not doing proper research

When we first started with dividend investing, I knew very little about how to analyze dividend growth stocks. Like many new dividend investors, I was very much focused on only one metric – high yield. I was not paying any attention to other key metrics like payout ratio, dividend streak, or dividend growth rate. I certainly wasn’t keeping a dividend scorecard.

I stumbled onto a high yield dividend stock called Liquor Store in 2012. At first, I was overjoyed to find a dividend stock in the alcohol industry. Without doing my own research, I assumed that Liquor Store owned and operated all the liquor stores in Canada. I bought $1,500 worth of Liquor Store thinking I had hit the jackpot.

The business certainly wasn’t as rosy as I originally anticipated. The stock price then took a beating when BC introduced legislation to allow licensed grocery stores to sell BC wine.

Due to the deteriorating business environment, Liquor Store cut its dividend in 2016 and we exited this position shortly after, taking around 50% loss, not counting dividends collected.

Although I was deploying the be an owner strategy, I didn’t do my due diligence and learn more about the company. I failed to understand that the company was operating privately owned stores. I also failed to realize the Liquor Store only had a small fraction of the market share and was competing against Crown-owned liquor stores in Canadian provinces.

The biggest mistake? I foolishly assumed that since people would regularly buy alcohol, therefore the company would always be highly profitable, and the dividends would be safe.

I was simply too naive.

What did I learn from this mistake? I learned to always do research about the company regardless of whether I know the company very well or not. Never assume that I know something and never let my ego take over. At a minimum, learn about the company by going over investor presentations that most companies have under their investor relations. It is also important to go over quarterly and annual reports or consult websites such as Morningstar, Yahoo Finance, Marketbeat, Digrin, Seeking Alpha, Simply Wall St, etc.

In case you’re wondering, Liquor Store eventually was de-listed. It is now part of Alcanna (CLIQ.TO).

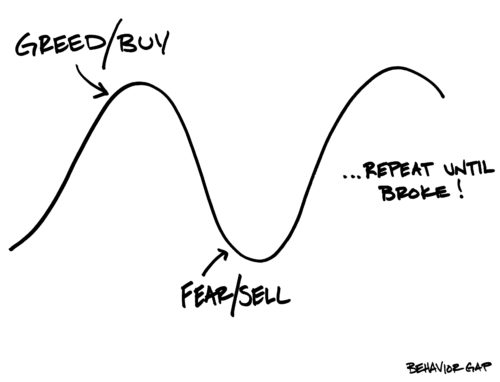

Mistake #2: Being greedy, not following my own rules

When I graduated in 2006 and entered the workforce, my company’s stock was trading around $15 per share. After my three-month probation period, I enrolled myself in the share purchase program and purchased company stocks with a portion of my pay-cheque every two weeks (the company matched 15% of my contribution).

Then the financial crisis happened and the company stock went down the drain. My company stopped the share purchase program and I owned a few hundred shares at a cost basis in the low teens.

Early in 2009, the company stock went all the way down to just below $4 a share. It sat around that price for a few months. Being young and with some money saved up, I decided to purchase 300 shares at $3.93. I then purchased a few hundred shares more as the stock price climbed its way up to around $10.

Altogether, I owned less than 2,000 of my company shares. Knowing that the company was not profitable at the time and that I could be easily replaced in a blink of an eye, I decided that it was not a good idea to put all my money in one basket, so I invested my money elsewhere (i.e. high fee mutual funds).

My company turned itself around in 2012 and the stock price started climbing. At one point, I told myself that I’d sell everything when the stock hit $20.

Throughout 2013, the stock price kept climbing, reaching a high of $25. The company was firing on all cylinders – we had won many multi-million deals with key customers and we were gaining market shares. I sold a few hundred shares to take in some profit. But I was not satisfied. I believed that the stock price would keep climbing.

I was being greedy and wanted to make more money.

So I kept most of my shares.

The stock price continued to climb. First, it was $30 per share. I told myself I’d wait for a little bit longer and sell when the price hit $35.

The stock price hit $35. Once again, I told myself I’d wait for $40.

Then the stock price hit $40 and I told myself I’d wait for $45 before selling everything.

The stock price went higher and higher. It was exhilarating. Everyone in the company was excited and happy about the stock price.

In early 2015, the stock price hit a high of just below $55. I thought about selling all my shares at the time but decided to reset my selling target to $60.

I was crunching numbers and imagining how much money I’d profit if I sold all my shares at $60.

But the stock price never got anywhere close to $60. In about three months’ time, the share price quickly tumbled from a high of around $55 to just below $20.

I was kicking myself for not selling my shares at higher prices. A year later the stock price eventually climbed back up. Seeing that I missed the boat the first time and didn’t want to miss my chance again, I sold a few hundred shares at a time as the stock price climbed its way up to $35.

Investing has a lot to do with being patient, setting and executing strategies as flawlessly as possible, and not letting your ego get in the way. In this instance, I totally got my ego in the way. I needed to learn to have an exit plan and execute this exit plan according to it, rather than continuously deviating from it.

Mistake #3: Not thinking long term

I purchased a number of Google shares in October 2012, a few days after Google announced a terrible quarterly result and the stock price went for a slide. At around $340 a share, I thought the per-share price was high but when I looked at the PE ratio and how much cash Google had, I thought I purchased Google shares at a discount (remember, you can’t just look at the stock price alone and claim it’s expensive).

I’ve always wanted to own Google shares, ever since I started using Google for internet searches in the late 1990s. I was amazed at how good and efficient Google was compared to other search engines like Yahoo, Altavista, and Excite (remember them?). As a teenager, I was convinced that Google would be extremely profitable. In the early 2000s, on several occasions, I told my dad to invest in Google if the company was to go public. Continue Reading…