Harvest ETFs CIO explains that as markets take a breather, the healthcare sector continues to show defensive characteristics with exposure to growth prospects

By Paul MacDonald, CIO, Harvest ETFs

(Sponsor Content)

US large-cap healthcare has been a bastion for investors in an otherwise rough market. While not fully insulated from the broad sell-off we’ve seen in recent months, the sector has outperformed due to stable demand, high margins and relatively low commodity price exposure. The Harvest Healthcare Leaders Income ETF (HHL:TSX) combines a portfolio of diversified large-cap healthcare companies with an active covered call strategy to generate consistent monthly cash distributions. The portfolio’s defensive positions, plus its income payments, has resulted in significant outperformance of broader markets.

In the wake of July earnings data, however, we saw some relief come to the broader markets as companies across sectors reported largely in line with expectations, providing much-needed visibility. As markets breathed a sigh of relief, growth-oriented sectors like tech started to pare back losses from earlier in the year. While the healthcare sector has shown its reputation for defensiveness in recent months, we are also seeing that the sector’s growth tailwinds are making a greater impact.

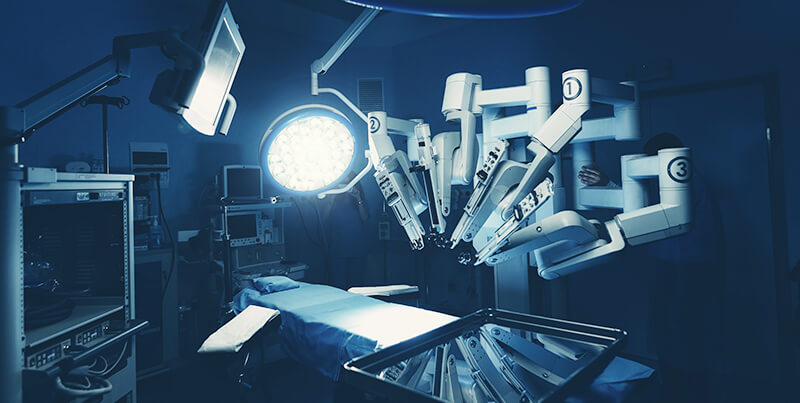

This whole space is innovative: whether that’s a company leading the way on robotic-assisted surgery, or a huge established player like Eli Lily making strides in obesity medication. Healthcare companies have significant growth tailwinds and, in our most recent rebalance of HHL we’ve taken some steps to capture more of those growth prospects.

Positioning HHL for growth prospects

We would stress that the recent rebalance in HHL maintained the ETF’s commitment to subsector and style diversification within the healthcare sector. However, some of the new additions to HHL have positioned the portfolio for greater growth opportunity.

The first move was replacing Agilent Technologies with Danaher in the portfolio holdings. Both companies focus on life sciences, tools & diagnostics, but Danaher has a more diverse line of businesses and a larger market share, which in our experience better positions Danaher for any potential market recovery.

The second move in the rebalance was to remove HCA Healthcare Inc, a value position which had shown worsening earnings visibility and rising costs due to labour issues and add Intuitive Surgical. Intuitive Surgical is the market leader in robotic-assisted surgery, with technology almost a decade ahead of its closest competitor. The robotic-assisted surgery market is currently underpenetrated, and a number of companies are making strides in the space: including Stryker, another HHL portfolio holding. The addition of Intuitive Surgical positions HHL to better participate in that subsector’s growth prospects.

While moves like these are designed to position HHL for improved growth prospects, we should emphasize that the whole portfolio is designed for diversified exposure to the growth opportunities and defensive characteristics inherent in the healthcare sector.

Maintaining defense while capturing growth opportunity

It’s ironic. We can easily think of specific investment sectors as a value-growth binary, trading off one for the other. But the healthcare sector isn’t so simple. Some of the largest companies in this sector have incredible growth prospects due to innovations in treatments, pharmaceuticals, and patient service. At the same time, given the large-cap focus we take in HHL, even our more growth-oriented names have market shares and barriers to entry that can be seen as highly defensive.

Those characteristics have shown themselves throughout 2022, as low commodity price exposures and high margins kept the sector in a state of outperformance. HHL is also one of the 6 Harvest ETFs held in the Harvest Diversified Monthly Income ETF (HDIF:TSX), where it contributes to the overall defensive position of that core portfolio.

There are also two aspects of HHL that beef up its defensive traits: diversification and covered calls.

HHL is constructed and maintained to deliver broad sub-sector diversification. From med-tech and biotech to big pharma to service providers among others, the portfolio delivers a broad-based diversity to safeguard against uncertainty. With the macro environment still rocky, and recessionary fears mounting, that diversification is key.

The active and flexible covered call strategy in HHL adds an additional layer of short-term defense and returns in a volatile market. The ETF currently pays a monthly distribution of $0.0583 per unit and has done so since its inception. In a market where total return is hard to find, that distribution is a key component of overall performance.

That distribution is also earned through the selling of call options for premiums combined with any dividends paid by portfolio holdings. Because HHL uses an active covered call strategy, the portfolio management team can write calls at different levels to take advantage of market volatility, which raises the price of options. Therefore the ETF can be positioned for growth opportunities while maintaining its monthly cash payments to unitholders.

It’s our view that a diversified portfolio of leading companies combined with a covered call strategy is always a strong position. The recent rebalance has brought us to a place that balances growth and defense in the portfolio. But the nature of large-cap healthcare is that in these companies you have your ‘offense’ and your ‘defense’ on the same shift.

Related Articles Links

https://harvestportfolios.com/the-three-investment-strategies-inside-one-etf-hdif/

Harvest ETFs Mentioned

Paul MacDonald is the Chief Investment Officer and Portfolio Manager with Harvest Portfolios Group Inc. This article is adapted from this August 8, 2022 piece and is re-published with permission from Harvest Portfolios Group Inc.

Paul MacDonald is the Chief Investment Officer and Portfolio Manager with Harvest Portfolios Group Inc. This article is adapted from this August 8, 2022 piece and is re-published with permission from Harvest Portfolios Group Inc.

Commissions, management fees and expenses all may be associated with investing in HARVEST Exchange Traded Funds (managed by Harvest Portfolios Group Inc.) Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently and past performance may not be repeated. All comments, opinions and views are of a general nature and should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.