By Ian Riach, Portfolio Manager,

Franklin Templeton Investment Solutions

(Sponsor Content)

It’s been a volatile first half of the year for the world’s capital markets. In many countries, both equities and fixed income have declined, which has led to the second-worst performance for balanced portfolios in 30 years. Typically, bonds outperform stocks in down markets, but not this time. In fact, this has been the worst start to the year for fixed income in the past 40 years, thanks to higher inflation and the resultant rise in interest rates.

Supply-side inflation harder to tame

Central banks use rate hikes as a tool to curb demand for goods and services; but the current inflation is being driven more by supply-side issues stemming largely from the COVID-19 pandemic and exacerbated by the Russia/Ukraine war. Unfortunately, central banks have little influence over supply. All they can do is try to dampen demand with an aggressive interest-rate adjustment process, but they must be careful not to overshoot. Raising rates too quickly runs the risk of tipping weak economies over the edge into recession territory.

Canada’s most recent inflation imprint, released in June, showed an increase to 7.7% year-over-year. One negative consequence is that real incomes are being squeezed as inflation continues to accelerate.

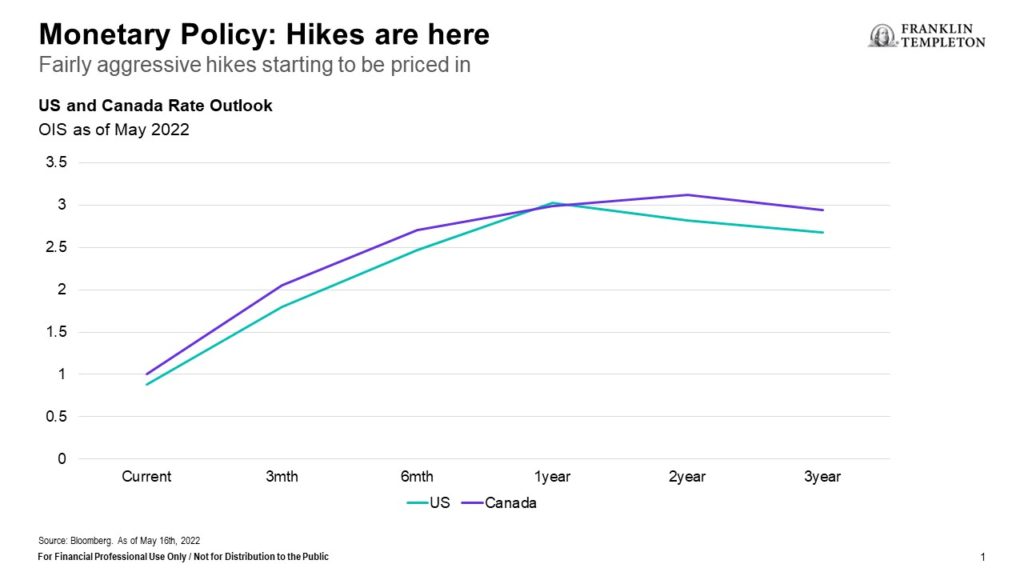

Rates are rising quickly

Both the U.S. Federal Reserve (Fed) and Bank of Canada (BoC) have increased their overnight lending rates from essentially 0% prior to March of this year to 1.5%-plus in June. The Canadian futures market had priced another 75-basis point (bp) increase at BoC meeting in July, which ended up an even higher 100-bps with indications of more to come in September.

Rising interest rates are hurting several sectors of Canada’s economy, notably real estate — especially risky for the economy as housing and renovations have been leading Gross Domestic Product (GDP) growth for the past few years. A significant correction in that sector could lead to a recession.

If there is any silver lining in the current situation, it may be in the Canadian dollar versus its U.S. counterpart. Short-term rates in Canada have moved higher than in the United States. This differential, along with the direction of oil prices, affects the value of the Canadian dollar against the U.S. dollar. If the differential widens and stays higher in Canada, the loonie will likely benefit.

Recession risks are growing

The likelihood of recession is hotly debated within our investment team. Recession in North America is not our base case, but a soft landing will be very difficult. We are currently in a stagflationary environment and recession risks are increasing daily. Europe may already be in recession.

The stock market is a good leading economic indicator, and its recent decline indicates the risk of recession is rising. In addition, the yield curve is very flat, which typically portends an economic slowdown. These market signals have somewhat altered our team’s thinking. Given the current environment, we are reducing risk in our portfolios. In fact, we recently went slightly underweight equities.

Regionally, we are reducing the Europe weighting as that region is more exposed to the negative headwinds associated with war. We are slightly overweight the U.S. but acknowledge that valuations are subject to disappointment with declining earnings growth. We are overweight Canada, which continues to benefit from rising resource prices. Continue Reading…