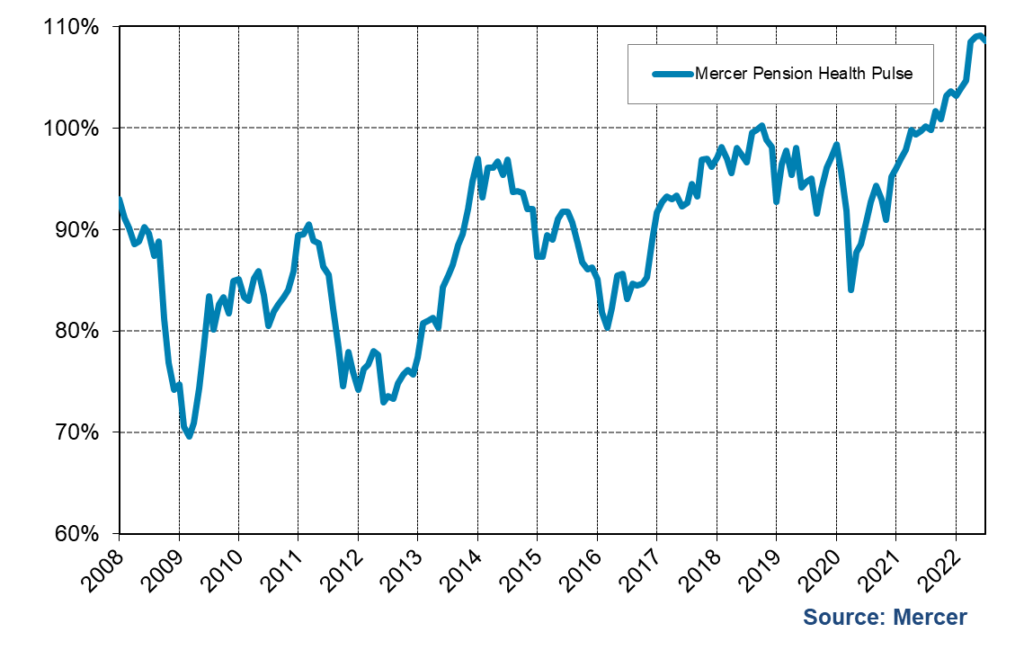

Unlike the first half of 2022, the financial position of most defined benefit (DB) pension plans “decreased slightly” in the third quarter, as they were buffeted by inflation and volatile stock markets. Investment returns were mostly negative in the quarter, and yields on long-term bonds were lower at the end of the quarter than they were at the beginning, according to The Mercer Pension Health Pulse (MPHP), released on Monday.

The MPHP tracks the median solvency ratio of the DB pension plans in Mercer’s pension database, which decreased from 109% as at June 30, 2022, to 108% as at September 30, 2022.

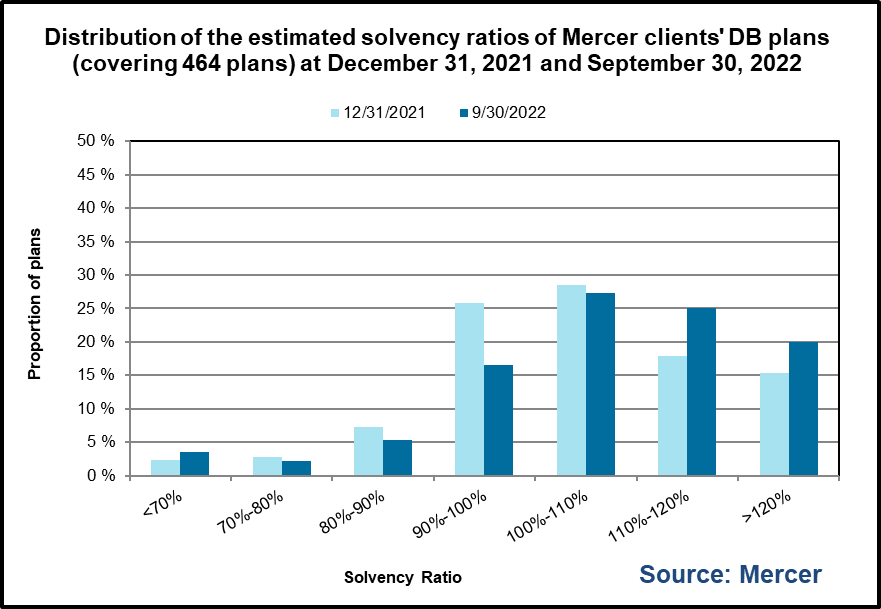

Of the plans in Mercer’s pension database, at the end of Q3:

- 72% of plans were estimated to be in a surplus position on a solvency basis,(vs. 73% at the end of Q2)

- 17% of plans were estimated to have solvency ratios between 90% and 100%,(vs. 16% at the end of Q2)

- 5% have solvency ratios between 80% and 90% (unchanged from Q2), and

- 6% have solvency ratios less than 80%. (also unchanged from Q2).

In a press release, the Calgary-based Principal and leader of Mercer’s Wealth business, Ben Ukonga, said that “In spite of the significant market volatility, the financial health of most DB plans would have experienced only a slight decline in the third quarter of 2022. As for what can be expected for the remainder of the year, plan sponsors should continue to expect significant volatility.”

Mercer says experts “urge caution and encourage plan sponsors to be prepared for anything, with more volatility on the horizon. Markets will most likely remain volatile in the short to medium term due to numerous risks such as the continued war in Ukraine, the upcoming US midterm elections, the potential confrontation between the US and China over the status of Taiwan, risks of a global energy supply shortfall, and of course, the ongoing inflationary environment.”

Continued short- and medium- term volatility

Markets will most likely continue to remain volatile in the short to medium term due to numerous global risks, including the war in Ukraine (and the Russian Government’s actions in response to Ukraine’s recent successes on the battlefront, such as the recent annexation of parts of Ukraine in violation of International Law, and the geo-political fallouts from these actions). Mercer is also cautious about the upcoming US mid-term elections, the increasing political gridlock and polarization in the US, and the potential for a confrontation between the US and China over the status of Taiwan. The recent volatility in the UK currency and bond markets and the risk of contagion to other markets.

Mercer also sees risks from a global energy supply shortfall, and the effect such a shortfall would have on the global economy: “… plan sponsors should pay attention to the risks associated with energy insecurity in Europe – such as the risk of the Russian Government using Russian gas supplies against Europe in retaliation to sanctions on Russia, and the effects on European economies if their energy supplies are curtailed.”

Inflation at levels not seen in 30 years

With inflation running at levels not seen in over 30 years, central banks globally are “on an aggressive monetary tightening mission in order to get inflation under control. Will they succeed without triggering a hard-landing global recession? Will higher interest rates make governments, corporations and households unable to meet the interest payments on debts they accumulated during the very long period of low interest rates? This could lead to an increase in bankruptcies and crowding out spending and investments, further exacerbating the risks of a hard landing global recession.”

As workers see a decline in the purchasing power of their wages, there will be increased pressures on employers for higher wages, Mercer says. “Sponsors of indexed DB plans will see increases in the cost of these arrangements, and sponsors of non-indexed DB plans may face pressure from their pensioner groups to provide ad hoc cost of living adjustments. Coupled with labour shortages, some employers may have no choice but to increase their labour costs. And companies that are unable to pass these increased costs to their customers will face profit margin pressures and reduced profitability, hurting their future economic outlook.”

Covid still poses macro risk

The global health landscape also poses a macro risk, Mercer says. “As the western hemisphere is entering the winter months, will a new vaccine-resistant strain of the COVID-19 virus appear? And how will governments and citizens deal with such a resurgence? Will the Chinese government continue with its zero-COVID policy? And how much of a negative impact will this policy, along with what some would call draconian lock down measures, have on the Chinese economy? And how deep will the negative knock-on effects be on China’s trading partners?”

Because market volatility will persist for some time, “we cannot stress enough the need for appropriate governance and risk management systems to be in place. They are necessary for the proper management of any pension arrangement,” Ukonga said.

DB Plan sponsors will need to have a good understanding of how their plans’ assets and liabilities will behave under different economic environments, and especially in a hard-landing global recession. Plan sponsors should be taking appropriate actions now to ensure (and improve) the sustainability of their plans, and reduce the risks the plans pose to the sponsor: “In this environment, our advice to plan sponsors is to prepare for the worst but hope for the best,” Ukonga said.

Investment Returns of Asset Classes

Mercer also released the following third-quarter investment returns, sourcing Refinitiv. As you can see at a glance, year-to-date returns are showing a torrent of red ink:

Mercer says a typical balanced fund portfolio would have posted a return of positive 0.2% over the third quarter of 2022. “Global equity markets rallied briefly at the start of the quarter, driven by strong economic activity, declining energy prices and positive sentiment on controlling inflation. However, by the end of the quarter, markets adjusted lower as inflationary pressures in core goods remained sticky and global central banks remained united in enforcing tighter monetary policy for periods longer than expected.”

All developed markets ended Q3 with negative returns (in local currency) as rising interest rates and recessionary fears were factored into equity valuations. Emerging markets underperformed versus other developed markets, it said. In China, geopolitical tensions, and the continued uncertainty related to re-opening from COVID restrictions after the latest wave of lockdowns, weighed on performance. In the UK, the last weeks of the quarter were very volatile with fiscal policy announcements having significant impact on equity, bond and currency markets. “The US dollar soared against major developed market currencies, supported by hawkish Federal Reserve rhetoric as well as energy importing countries needing US dollars for increasingly expensive energy purchases. Commodity prices moderately declined, except for natural gas, which reached multi-decade high due to increasing demand from Europe, which is building reserves before the winter season. From a style perspective, growth outperformed value due to its significant outperformance in July as investors expected that the Fed would not have to tighten policy as much to control inflation. Interest rate sensitive sectors such as real estate, information technology and healthcare continued to underperform.”

Canada outperformed global peers

One bright spot for Canadians is that Canada outperformed its global peers (in local currency terms) in Q3, with modest declines in inflation while benefiting from elevated energy prices. “Health care, real estate and communication services sectors saw continued declines with current economic conditions negatively affecting valuations. In real estate, private residential sales activity and new listings stagnated throughout the quarter causing price pressures.” The loonie depreciated against the U.S. dollar.

Canadian bond prices recovered moderately over the period after a significant decline during the first half of the year. Canada’s inflation controls flattened the yield curve with the universe bond yields rising 23 basis points while long-term bond yields declined by 4 basis points. Long-term bonds outperformed both universe and corporate bonds during the period. The Canadian yield curve inverted for a period over the past quarter, and at the end of September short-term rates were only 3 basis points lower than long term rates and mid term rates were lower relative to both.

“Inflation continues to be the core focus over the quarter, dominating the market narrative with increasing fear of a central bank induced recession” said Venelina Arduini, Principal at Mercer Canada. “We expect inflation to remain above target, but reduced from current levels over the next few quarters. Despite some asset classes starting to look undervalued, the elevated risk and uncertainty over short term economic conditions call for restraint.”

Both the U.S. Federal Reserve and Bank of Canada increased their target rates twice over the quarter, but at different increments. The Bank of Canada increased rates 100 and 75 basis points respectively while the U.S. Federal Reserve raised rates twice at 75 basis points each. The Federal Reserve and Bank of Canada have both committed to controlling inflation through strict monitoring and review.

The Mercer Pension Health Pulse

The Mercer Pension Health Pulse tracks the median ratio of solvency assets to solvency liabilities of the pension plans in the Mercer pension database, a database of the financial, demographic and other information of the pension plans of Mercer clients in Canada. The database contains information on almost 500 pension plans across Canada, in every industry, including public, private and not-for-profit sectors. The information for each pension plan in the database is updated every time a new actuarial funding valuation is performed for the plan.

The financial position of each plan is projected from its most recent valuation date, reflecting the estimated accrual of benefits by active members, estimated payments of benefits to pensioners and beneficiaries, an allowance for interest, an estimate of the impact of interest rate changes, estimates of employer and employee contributions (where applicable), and expected investment returns based on the individual plan’s target investment mix, where the target mix for each plan is assumed to be unchanged during the projection period. The investment returns used in the projections are based on index returns of the asset classes specified as (or closely matching) the target asset classes of the individual plans.