By Sean Cooper

Special to the Financial Independence Hub

Are you in the market for a home and finding it tough to afford a decent-sized place? You’re not alone. The new mortgage rules certainly haven’t made it any easier. Homebuyers have seen their purchasing power reduced by about 20 per cent due to the mortgage stress test that came into effect January 1, 2018.

Under the new rules, homebuyers are required to qualify at a mortgage rate 2 per cent higher. If you’re looking to buy a home in big cities like Calgary, Ottawa, Toronto or Vancouver, your options can be quite limited, especially when you’re a first-time homebuyer.

So, you go out into the real estate market, look for the home you’d like to purchase, but can’t afford it. What’s a homebuyer to do? Don’t throw in the towel: there’s still hope! Two popular options are driving until you qualify and condo living. Let’s look at them both now.

Driving Until You Qualify

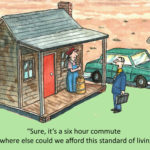

If you don’t like what you can afford in the big city, your first option is suburban living or what I like to call “driving until you qualify.”

Living in the suburbs does have its advantages. You can typically stretch your home-buying dollar further. Quite often in the suburbs you get more square footage for less than you otherwise would get in the city. Instead of only being able to afford a condo in the city, you might be able to afford a more spacious single-family detached home.

If you’re planning to start a family or have a dog, it’s hard to beat a big yard with a fence. Also, if you’re raising children, the city typically offers better schools. The suburbs also usually have a lower crime rate than the city centre.

Although you probably won’t have shopping at your doorstep, the ‘burbs make shopping easy with big box retailers. If you’re an outdoor enthusiast, you’ll often enjoy the suburbs a lot more. The suburbs usually have a lot more community centres, parks and swimming pools.

But living in the suburbs isn’t without its drawbacks. Perhaps the single biggest downside is the time it takes to commute if you work in the city. You could find yourself travelling for two hours or more a day. Make sure you’re ok with this before buying the property.

A good exercise is to try driving to work in the neighbourhood you’re thinking of buying in on a typical day to make sure the commute is tolerable. If you work from home this won’t be an issue, but don’t forget to factor in the added cost of not only buying a vehicle, but maintaining it as well.

Besides a longer commute, the other big downside is that you’ll be further from downtown. If you’re a millennial and enjoy the nightlife, make sure you’re ok with living further away from most of your friends. If you’re constantly downtown late after work, you may find it a real pain in the neck to commute back to the suburbs.

Condo Living

Who wants to be stuck in traffic for hours when you can be within walking distance of work and shopping? That’s just one of the many perks of living in a condo near the city centre. Not only do you save on transportation, you’ll help the environment by reducing your carbon footprint.

For most families, transportation is the second most costly household expenses after mortgage or rent. But if you can get by without owning a vehicle at all, you could use those extra savings to burn your mortgage even faster or start saving towards retirement.

While the suburbs may be a work in progress, urban centres typically have everything you’d expect in a city: streets lined with trees, local shopping and restaurants, and heritage buildings. If you’re looking for a night out on the town, the entertainment district is often at your doorstep: it doesn’t get any better than that!

Besides fantastic amenities, getting from point A to point B is often easier in the city. When you do need to take transit, it’s usually a lot easier hopping on the subway or LRT in the city than waiting 20 minutes for the bus in the suburbs.

Living in a condo in the city does have its drawbacks. You’ll often have to compromise when it comes to size. You may only be able to afford a crammed 500 square foot condo.

Also, some people just aren’t suited for the condo lifestyle. If you grew up on spacious home, it can be a rude awakening to go to living in a smaller condo. Perhaps try renting in a condo first for a year to make sure you’re suited before buying a property.

Don’t like either of these options?

A third option is becoming a landlord. Operating a rental unit in your principal residence is often referred to as a “mortgage helper.” Not only does it help you pay down your mortgage sooner, it can help you qualify for a bigger mortgage since rental income may be able to be included as part of your income when qualifying for a mortgage. If you’re thinking of doing this, speak with your mortgage broker so he or she can crunch the numbers and see if it makes sense for you.

Sean Cooper is the author of Burn Your Mortgage and managing editor of mortgagepal.ca.

Sean Cooper is the author of Burn Your Mortgage and managing editor of mortgagepal.ca.

Interested in this line from the article: “Also, if you’re raising children, the city typically offers better schools.” Do you have any numbers to back that claim up? Just curious…

Thank you for your comment, Robert. You’ll note that I put “typically” since it depends on the city you’re living in. Toronto Life wrote this interesting article where schools in neighbours like Rosedale rank high: https://torontolife.com/neighbourhoods/